As Housing Prices & Mortgage Rates Fall, This Company Will Benefit

|

| By Tony Sagami |

This year is going to be all about the Federal Reserve.

The Fed has clearly telegraphed that it’s going to increase interest rates, but the more important issue is the expected path, which is heading toward a pause.

Most of the Fed followers expect the central bank to continue to raise rates by taking smaller baby steps in the first half of 2023, then pause for a while before lowering rates in the second half of 2023.

Of course, nobody knows for sure, but everything depends on what happens to inflation.

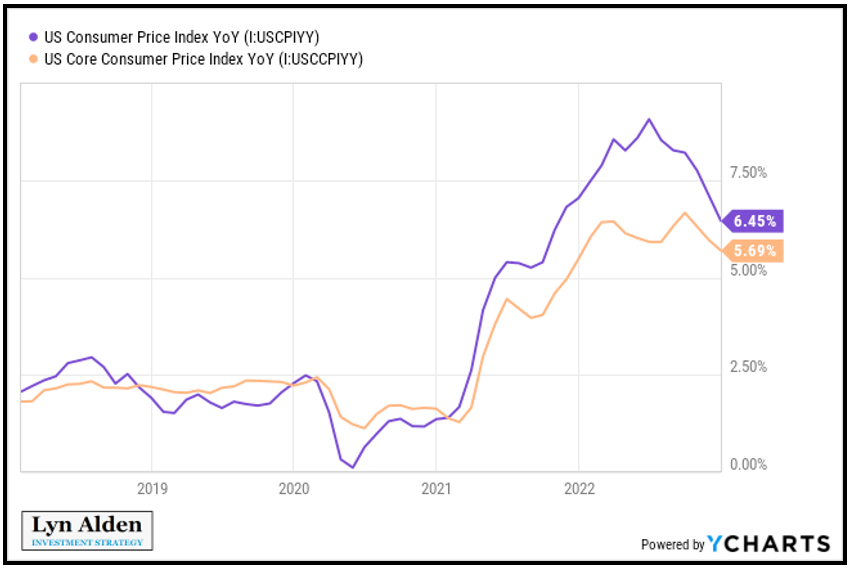

My expectation: Investors will be surprised by how fast inflation will fall.

Click here to see full-sized image.

The most recent Consumer Price Index numbers came in a little lower than expected, which continues its recent downtrend that began late last year.

But as always, the devil is in the details …

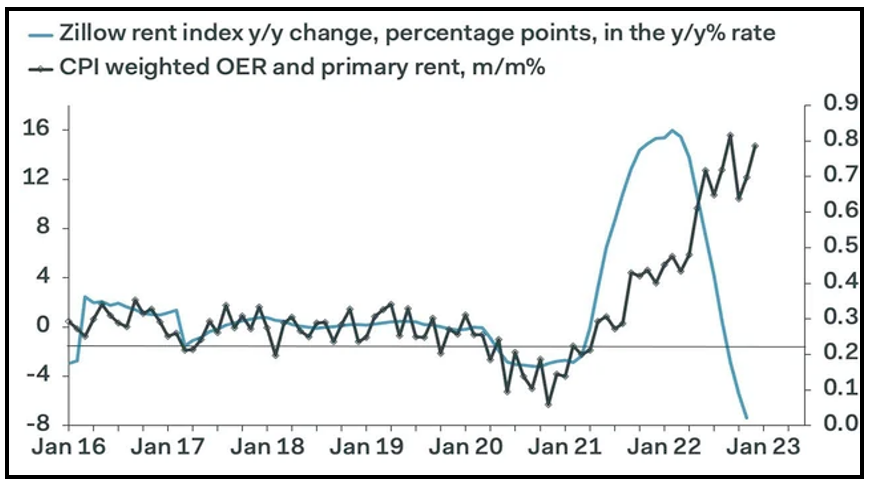

Nearly One-Third of CPI Is Shelter

Specifically, a measurement called “owners’ equivalent rent,” or OER. I don’t have to tell you that house prices — and mortgage rates — have been falling, but rental prices have been falling even faster.

Click here to see full-sized image.

According to Zillow, the most recent month is showing evidence of deflating.

That’s right: DEFLATION.

OER is measured over the past trailing 12 months, which means that the 12-month average grossly overstates the cost of rental shelter today.

In fact, if you remove the overstated shelter component from the CPI calculation, the rate of inflation would actually be negative.

So with inflation, housing costs, mortgage rates and rents all coming down, certain companies are posed to prosper. You can too by joining members of my trading service, Disruptors & Dominators. They’re enjoying open gains of over 46%, 40% and 35% and have two real estate investment trusts in their portfolios.

Today, however, I’d like to tell you about one company in the real estate space that’s continuing to forge ahead on the back of a strong 2022.

That’s because it provides financial services, and over the past three months, the financial sector of the S&P 500 has performed third best, up nearly 19.37% and trailing just behind second-place industrials (20.89%) and the first-place materials sector (22.45%).

I’m talking about …

Enact Holdings (ACT)

Enact Holdings — formerly Genworth Mortgage Holdings — is a private mortgage insurance company.

The company is engaged in the business of writing and assuming residential mortgage guaranty insurance.

And for anyone who’s owned a home that they put less than a 20% down payment on, you know exactly what private mortgage insurance is and how profitable a business it can be.

Enact is one of those businesses.

Since 1981, it’s been in the business of provided PMI. According to the company, which is headquartered in Raleigh, North Carolina:

“Building on a deep understanding of lenders' businesses and a legacy of financial strength, we partner with lenders to bring best-in-class service, leading underwriting expertise, and extensive risk and capital management to the mortgage process, helping to put more people in homes and keep them there. By empowering customers and their borrowers, Enact seeks to positively impact the lives of those in the communities in which it serves in a sustainable way.”

Over the past year, despite the broad market nosediving, ACT managed a very respectable gain of 10.87% and is up 15.16% over the past six months.

The company has a “B+” rating and pays an average-beating dividend yield of 2.32% — for the record, the S&P 500 paid 1.27% last year.

Click here to see full-sized image.

Icing the cake, the company’s price-to-earnings ratio is a ridiculously attractive 8.17, and last quarter it beat earnings per share expectations by 30 cents, coming in at $1.17/share.

InvestorsObserver rates Enact Holdings better than 92% of all stocks, and The Wall Street Journal gives ACT a one-year price target high of $30 and low of $24.50.

Even if it fails to achieve the high-end price target, that low still marks an increase from where the stock is trading at the time of writing: $24.12. And remember, the company will pay you a generous dividend yield in the meantime.

Best wishes,

Tony