As the Banking Crisis Continues, Here’s How to Find Safety

|

| By Tony Sagami |

Trust is a fragile thing and once damaged, it’s almost impossible to regain. I learned that painful lesson during the last years of my 17-year marriage.

The same is true of our banking system.

We give banks our hard-earned money, and they give us some electronic digits in exchange. That’s a big leap of faith, wouldn’t you say?

We trust the banks to give back our money on demand. That trust is built on decades of safety, which is backed up the Federal Deposit Insurance Corporation.

That trust is now being undermined by the wave of recent bank failures — namely Silicon Valley Bank, Signature Bank, Credit Suisse and the latest to join the banking crisis, First Republic Bank.

Mark my words, there will be …

More Bank Failures

This week, we got another glimpse of that as First Republic Bank— an organization whose shares plummeted $147 on Feb. 2 to $3.51 at the time of writing … a loss of over 97% — was taken over by JPMorgan Chase (JPM).

Click here to see full-sized image.

First Republic admitted to a gruesome flight of capital, which has led to rapid deterioration in its balance sheet.

In just one week, First Republic saw an astonishing 58% of its deposits disappear.

The bank was forced to borrow $138 billion from the Federal Reserve and Federal Home Loan Banks and another $30 billion from a consortium of the 11 largest U.S. banks.

Here’s the ugly math: First Republic was forced to replace $102 billion of departed deposits at a weighted average cost of 1.24% with funds that have an average cost of 4.8%.

That’s a $3.6 billion hit to its books. Yikes!

If this banking crisis spreads — and I think it will — and you are a large depositor …

You Need to

Protect Your Money

If you have more than $250,000 in your bank, the limit to FDIC insurance, there are a few things you can do:

1. If you’re married, open a joint account with your spouse, which will protect up to $500,000 rather than $250,000. You could do this at multiple banks.

2. Open a new account at a different bank. The $250,000 FDIC insurance is per bank, not per person. Moving some of your money to other banks will multiply the $250,000 by the number of banks that hold your money.

3. Money market funds aren’t FDIC-insured, but they don’t need to be. Any capital in a money fund is backed by 100% of its assets. As of March 15, 2020, money market accounts — unlike banks — are not required to keep any reserves whatsoever.

The Safety of

Non-Banking Assets

You could also move some of your money into non-banking assets, like Bitcoin (BTC).

Have you noticed the price of Bitcoin recently? Fears of the current banking crisis have triggered a wave of crypto adoption.

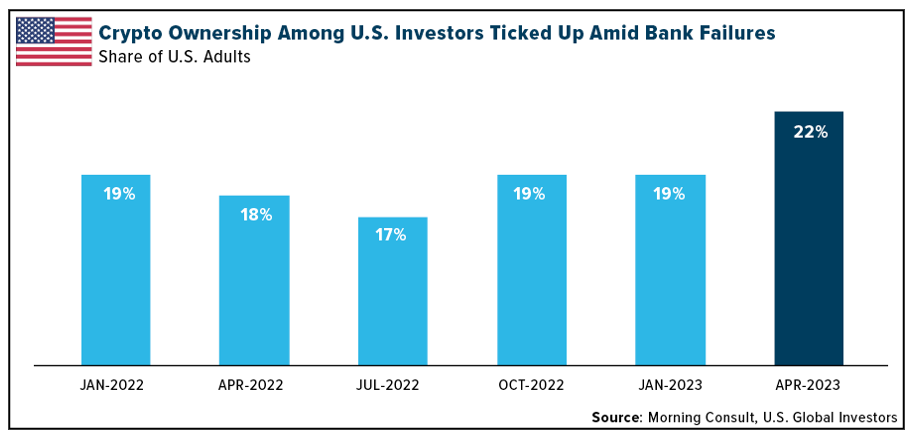

According to Morning Consult, 22% of Americans now own at least one form of crypto, a 4% increase in just one month.

Click here to see full-sized image.

In fact, Bitcoin is the most widely held digital asset among 16% of respondents. That’s up from 13% a year earlier. According to the Morning Consult poll, over a quarter of Americans (27%) said they were planning to add to their Bitcoin holdings in the next month.

The increase in crypto ownership is no doubt tied to market jitters around the banking industry.

If you’re part of the 78% of Americans who don’t own any cryptocurrency assets, I recommend that you reevaluate your investment strategy and find some non-banking assets that you’re comfortable investing in.

In the event that the trust in the banking system is broken, trillions of dollars will seek a new, safe home. Make sure you’re prepared in case that happens.

All the best,

Tony

P.S. Back in December 2018, talking heads were calling “the death of crypto.” At the same time, Weiss Crypto Analyst Juan Villaverde was calling the start of the largest bull market of any asset class on the planet.

Spoiler alert: The talking heads were full of hot air. Juan was right. Investors who understood that risk and were glad to buy at bargain prices could’ve seen our list of high-rated coins surge dramatically — 20x, 54x, 102x and even as high as 234x!

How did Juan know to call the start of the next big bull? He’s a student of the cycles, and using his Crypto Timing Model, Juan monitors the cycles to determine when to act. As the next leg of the crypto bull market heats up, you can learn more and join him by clicking here.