|

| By Tony Sagami |

“Uncle Tony, can I borrow one of your cars for a couple weeks?”

My nephew’s a brilliant kid with a fresh accounting degree from the University of Washington.

He’s been driving his mother’s hand-me-down 2003 Nissan Altima with over 200,000 miles to work … but it’s starting to fall apart.

Like a lot of twentysomethings entering the workforce, my nephew is long on ambition but short on money.

He’s reluctant — and I don’t blame him — to pour what little money he has into a 20-year-old car.

But he, like millions of other Americans, is shocked by the prices of used cars.

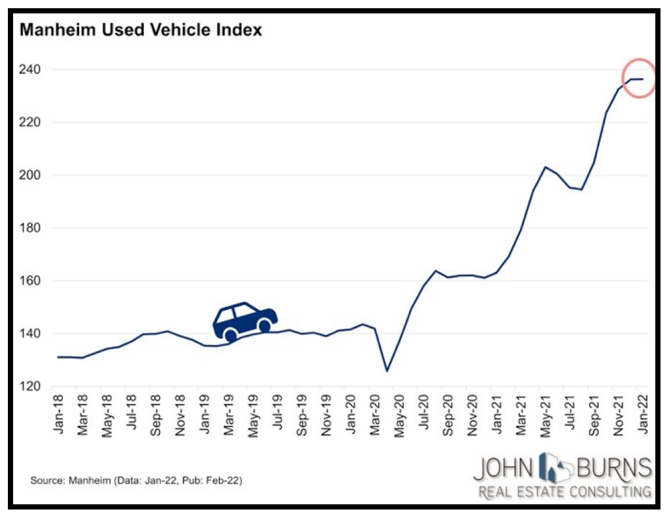

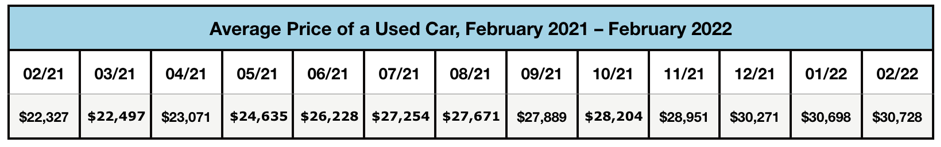

The price of used cars has skyrocketed — the average price of a used car has jumped by 38% in the past 12 months:

A couple years ago, the easy answer for my nephew would have been to dump that money pit of a car and buy a newer, more reliable one.

However, the sky-high price of used cars is forcing many Americans to fix up their aging cars instead of buying new ones.

- Guess what? The auto parts industry is enjoying a tsunami of business.

The auto parts industry is one that has been largely unaffected by online competition, and auto parts are still largely purchased at brick-and-mortar stores.

The reason is that when your car needs repairs, you need parts ASAP. Otherwise, you:

1. Miss work and don’t get paid.

2. Take public transport, bike or walk.

3. Pay for a taxi or rideshare.

4. Rent a car until the vehicle is repaired.

Or, like my nephew, borrow a car from a family member.

There are approximately 280 million cars on the road today and that translates into a whole lot of potential customers and a landslide of business for the auto parts suppliers.

The auto parts industry is dominated by four companies: AutoZone (AZO), Advance Auto Parts (AAP), Genuine Parts (GPC) and O’Reilly Automotive (ORLY).

But there’s another hidden gem in the auto parts food chain that you may not have heard of: Copart (CPRT).

Copart isn’t a household name, but it’s a fantastically profitably business that operates online vehicle auctions for damaged vehicles, primarily sourced from the insurance industry.

When vehicles are so severely damaged that they are considered a total loss by insurance companies …

- Copart helps insurance companies turn those wrecks into fast, liquid cash.

The number of totaled cars is soaring along with the rising cost of auto repairs.

What might look repairable to us is often considered a total loss to the insurance industry because of skyrocketing repair prices.

- According to the U.S. Bureau of Labor Statistics (BLS), auto repair prices are 61% higher today than in 2000.

That’s music to Copart’s ears because the number of vehicles classified as “totaled” has been growing at a double-digit pace, because the high-tech nature of new autos makes them more costly to repair than in the past.

- Copart is the dominant company in a very niche market … and it is growing like mad.

Like my nephew, don’t rush and make sure to do your homework. But make no mistake, the auto parts business is booming and definitely worth your consideration.

That is why I recently recommended one of the above auto parts stocks to my Weiss Ultimate Portfolio subscribers, and they’re already sitting on gains.

If you’d like to find out which one, consider a no-risk trial of my Weiss Ultimate Portfolio service. I think you’ll be very pleased with the results.

Best wishes,

Tony