Backdoor AI Winner of Fannie & Freddie’s Reprivatization

|

| By Michael A. Robinson |

President Trump has Wall Street on alert again.

This time with a bold idea that could revive not one, but two, legendary tickers.

He’s floated the notion of taking Fannie Mae and Freddie Mac public again.

Such a move could unlock billions in potential value from the mortgage giants still under federal control since the 2008 crash.

Now, financials are doing well this year. The Financial SPDR (XLF) is up 5.5% compared to the S&P 500’s current 2.4% gain.

That said, savvy investors like us know there’s a better way to profit from financials.

As someone who’s covered IPOs for decades, I’ll tell you flat out: Most are best avoided for at least six months.

Early on, volatility is high, and insiders cash out. The real upside takes time.

More importantly — the big money isn’t in housing finance anymore.

It’s in financial technology.

Because while politicians debate the next IPO, one fintech titan is already quietly transforming personal finance with cutting-edge AI — and turning that digital edge into massive earnings gains.

I believe it’s set to double the market’s returns without needing to own the whole sector.

Let me show you why …

This Proposal Could Unlock Billions

The administration’s proposal to take Fannie Mae and Freddie Mac public again isn’t just headline bait — it’s a multitrillion-dollar idea with profound implications.

Together, Fannie and Freddie own or guarantee nearly $7.5 trillion in U.S. mortgage debt. That’s more than half the entire American home loan market.

These aren’t just big companies — they’re foundational to the U.S. housing economy.

And after 17 years under federal conservatorship, Trump wants to give investors a chance to own the two mortgage giants on the public stock exchanges again.

The motivation?

It’s not just political. It’s financial.

A public offering could inject tens of billions of dollars into the U.S. Treasury — a fast, one-time windfall that supports government funding without new taxes.

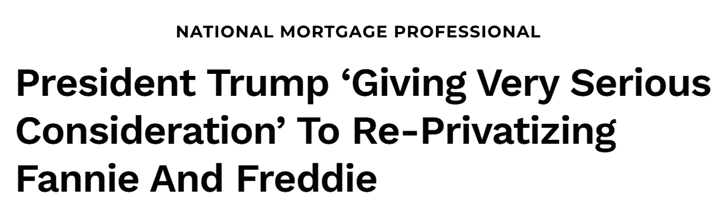

Technically speaking, both Fannie Mae and Freddie Mac already have common stock. But they’re traded over the counter.

Both are up sharply since the election. But neither are considered investment grade on the Weiss Ratings scale.

It’s unknown how Trump plans to put millions of shares in front of the public.

Either way, issuing stocks in these finance units could be good for America.

But good performers for your portfolio? Perhaps not. At least, not right away.

If you’re looking for high growth in financials, I wouldn’t chase a complex IPO.

Instead, I’d follow the money — to the fintech revolution already underway.

The Rise of Fintech & a Mountain of Cash

Over the past decade, a quiet revolution has transformed the financial world.

Fintech companies have carved out high-margin, digital niches across lending, payments, tax prep, credit monitoring, business software — even personalized financial coaching.

And they’re doing it without the burden of traditional banking infrastructure or the risk of underwriting billions in mortgage debt.

Unlike legacy mortgage lenders, these firms aren’t tethered to the housing market. They’re not waiting on rate cuts or supply rebounds.

Instead, they’re growing by deploying software — automating what used to take weeks and replacing paperwork with AI.

The result? Higher returns, lower costs and explosive scalability.

And now, with generative AI and predictive models entering the equation, the leaders in this space aren’t just surviving — they’re accelerating.

One fintech veteran is turning decades of financial data into a profit machine …

Its AI engine is already live.

Its margins are strong.

And it’s got a Weiss Rating it can be proud of.

Yet, its stock is still underpriced.

The Fintech Titan Quietly Dominating the Sector

The company I’m talking about is Intuit (INTU).

Most investors still think of it as “the TurboTax company.”

But that’s like calling Amazon an online bookstore.

Intuit has evolved into a fintech powerhouse, driving financial decisions for more than 100 million.

In recent years, Intuit has smartly expanded through acquisitions — Credit Karma, Mailchimp and others — each adding a new revenue stream.

These aren’t random bolt-ons.

They’re part of a deliberate strategy to build a full-service financial franchise,with AI layered across every product.

The result?

Broader reach, deeper engagement and increasingly robust sales growth — with users across TurboTax, Credit Karma, QuickBooks and Mailchimp.

And it’s doing something most fintechs can only dream of: Generating strong profits while deploying serious AI at scale.

This isn’t some fledgling startup.

Intuit is already posting gross margins north of 80% and generating billions in free cash flow.

It has a loyal user base, recurring revenue and something Wall Street is only starting to price in …

A proprietary AI engine that touches nearly every dollar it helps its customers earn, track, borrow — or save.

And that engine is already transforming the way millions handle taxes, budgets, credit and small business operations.

Intuit’s AI Edge Makes It a Market-Beating Machine

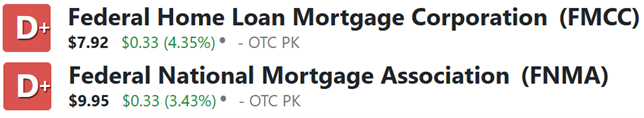

At the heart of Intuit’s advantage is a platform calledGenOS.

It’s the firm’s internal AI operating system.

It’s already powering more than 1.2 billion intelligent interactions per month, from helping freelancers file taxes faster … to flagging cash flow risks for small businesses … to suggesting credit-building strategies in real time for Credit Karma users.

GenOS is woven directly into the company’s core.

It pulls from decades of proprietary financial data and decision-making behavior — giving Intuit a strategic edge that’s nearly impossible to replicate.

Think of it as an AI-trained brain that helps consumers and business owners alike make better decisions automatically.

Meanwhile, the company’s Mailchimp acquisition adds another layer — smart marketing for small businesses, powered by AI-generated content and A/B testing tools.

Put simply: Intuit isn’t guessing where AI is headed. It’s already there — and cashing in.

I’ve gone through the financials and can project earnings growth at about 18% a year.

At that rate, per-share profits will double in about four years.

And with AI now fueling growth in every corner of the platform, this stock could easily double the market’s returns over the next three years.

Best,

Michael A. Robinson

P.S. Intuit isn’t alone in taking advantage of AI’s Second Wind.

In fact, we just put together a list of the next AI stocks set to soar.

Be sure to follow the simple instructions at the end to make sure you get the full list.