|

| By Michael A. Robinson |

While Wall Street stays fixated on tariffs and other macro noise, a seismic shift is taking place thousands of miles to the north — and most investors aren’t even looking.

The visit by Vice President JD Vance to Greenland, planned for today, isn’t just for optics. It’s part of a bigger strategy to secure America’s long-term dominance in the Arctic — the last great untapped frontier of strategic and economic power.

This isn’t about headlines or bluster. It’s about controlling resources, rare earths and shipping lanes before China or Russia can.

Some see it as bold. Others see it as far-fetched.

But here’s the truth: If the U.S. folds Greenland — and eventually Canada — into a broader North American bloc, it would become the largest nation on Earth by land mass and one of the richest in energy and tech-critical minerals.

And while the world argues over the politics, I’ve already found a way to play the opportunity — one that’s quietly beaten the S&P 500 by 30% …

Cut Spending, Buy Greenland

Let’s clear up one thing: This isn’t about politics or “sides.”

As I’ve said many times, our job as investors is to stay objective — and to find profits regardless of who’s in the White House.

Even if this deal never happens, the thesis still holds:

The greatest investment frontier today isn’t in Asia or Europe — it’s right here in North America.

Let’s zoom out for a second. Think of this less as a political gambit and more as what it truly resembles — a leveraged buyout (LBO) of historic proportions.

Cutting just $100 billion from the federal budget — a rounding error in a $6 trillion ledger — could be enough to put a Greenland deal on the table.

That kind of budget shift would allow the U.S. to make a compelling offer that Greenland’s government — or Denmark — might eventually find hard to ignore.

A Massive Financial Payoff

Greenland’s population is just 56,000 people. If $100 billion were directed toward the purchase, each resident could receive approximately $1.79 million.

That’s an astronomical figure by any standard — especially in a country with a GDP of only $3.5 billion, or per capita of just $57,000.

Now layer on the resource upside.

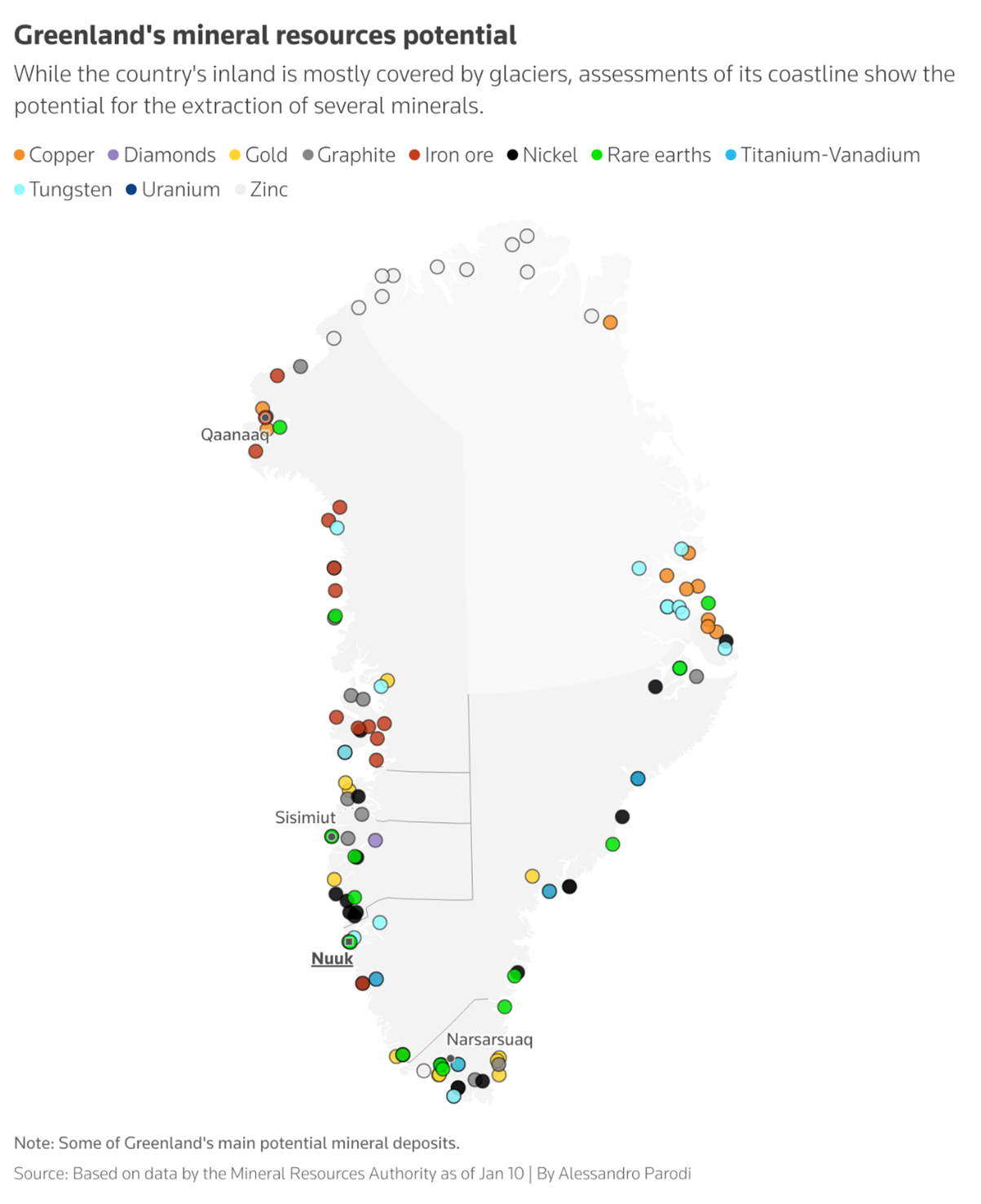

Greenland is estimated to sit on $185 billion in mineable resources — and potentially up to$4.2 trillion in long-term value.

But here’s the catch: The country doesn’t have the capital, infrastructure or geopolitical clout to extract that wealth at scale.

That’s where the U.S. comes in — with the technology, funding and incentive to secure access to rare earths that are essential for everything from smartphones to missile systems.

China controls nearly 60% of the global rare earths supply. That’s a national security issue, not just an economic one.

From an investor’s perspective, Greenland isn’t just a frozen expanse — it’s a call option on the future of global tech and defense.

Canada: The Final Piece of the Puzzle

Greenland might be the headline, but Canada is the real endgame.

Canada is rich in oil, timber, freshwater and rare metals — but geopolitically, it’s stretched thin and increasingly reliant on U.S. protection.

If Washington ever made a serious offer to fold Canada into a larger North American bloc, the strategic calculus for both countries could shift dramatically.

If this vision came true, America would become the largest country on Earth by land area — surpassing Russia by roughly 30%, with over 8.5 million square miles under its control.

It would also give the U.S. full Arctic access and total control of northern maritime routes. Russia and China would be effectively locked out.

Is it a long shot? Of course. But major realignments often look impossible until they aren’t — just ask Alaska or Louisiana.

Trump, Tariffs & the Long View

Yes, Trump’s policies can be hard to follow. One day it’s tariffs, the next it’s a spending freeze, the next it’s an AI moonshot.

But if you step back, the direction is clear:

Strengthen American sovereignty, control key tech and energy infrastructure and position the U.S. as the world’s dominant land and cyber power.

That brings us to what really matters for your portfolio: How to profit from the trend — not the politics.

There’s no Greenland ETF. No LBO ticker symbol. Not yet.

But there is a way to ride this wave:

Through the companies that will power and profit from the North American tech-industrial buildout.

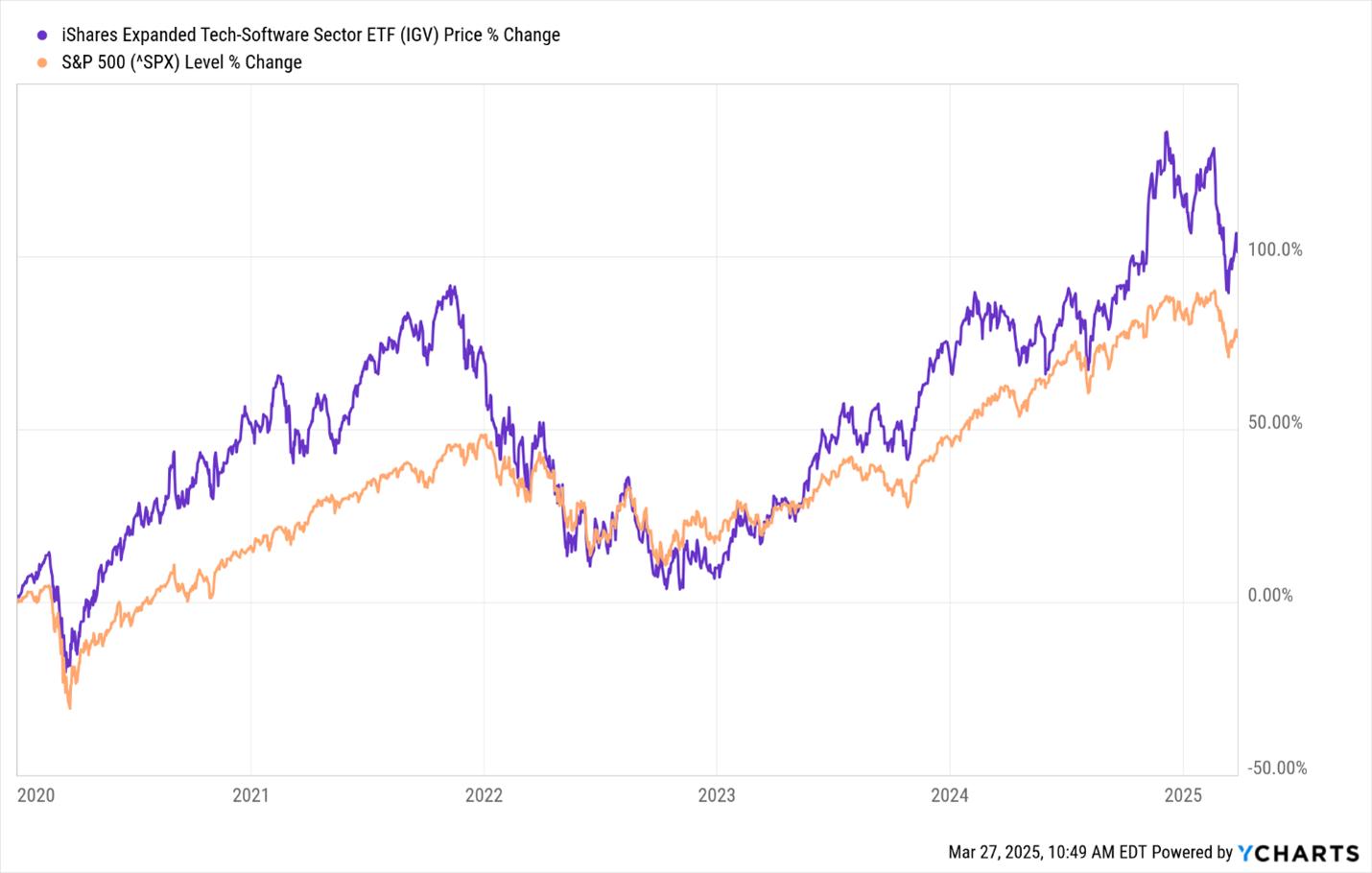

That’s why I continue to recommend the iShares Expanded Tech-Software Sector ETF (IGV).

This fund is loaded with top-tier U.S. software companies — the very firms helping to drive the $1 trillion AI expansion, defense contracts and next-gen infrastructure.

Software is capital-efficient, margin-rich and core to the long-term growth story. Just look at the names inside:

- Palantir Technologies (PLTR) — an AI-driven data analytics leader with deep federal ties.

- C3.ai (AI) — integrating AI into complex legacy systems across industries.

- Cadence Design Systems (CDNS) — dominant in electronic design automation.

These companies aren’t just riding the AI wave — they’re building the pipeline.

Over the last five years, IGV has outperformed the S&P 500 by 30%, even after the recent sell-off.

So, remember, this isn’t about picking sides in a political debate. It’s about understanding how power is shifting — not just geographically and technologically, but especially economically.

Whether or not Greenland becomes the 51st state, the opportunity is already here:

Own the tools, infrastructure and companies that make Arctic — and digital — dominance possible.

That’s how we continue to beat the market.

Best,

Michael A. Robinson

P.S. Betting market Kalshi says there’s a 26% chance of Trump buying at least a part of Greenland. Want to make money on something with much better odds?

Join us on Tuesday, April 1, at 2 p.m. Eastern for a big event: “60-Second Income.”

There, you will get access to the 97.4% accurate income strategy.