|

| By Kenny Polcari |

Earnings season is off and running.

It’s a time when speculative traders tend to embrace all the excitement and uncertainty surrounding corporate financials and hunt for quick, ginormous gains.

However, others look at earnings season as an opportunity to confirm the fundamental health of their current holdings or put new ones on their radar.

Regardless of how you approach it, just be careful navigating this landscape.

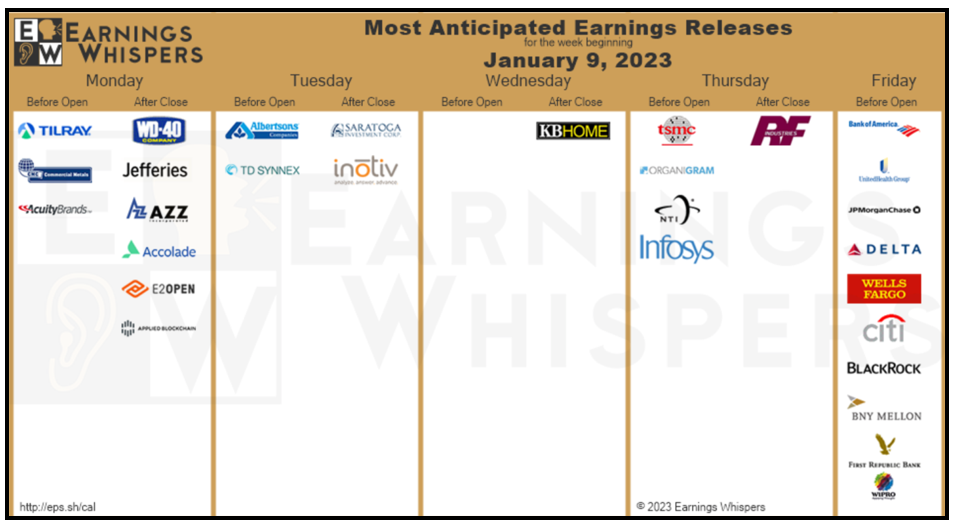

Click here to see full-sized image.

I look at earnings season as a big beauty pageant where corporations parade their financial figures — playing up strengths and de-emphasizing weaknesses — hoping for acceptance and praise from shareholders after they report the good, the bad and the ugly.

Of course, just as beauty is in the eye of the beholder (and judges) during Miss America contests, so is a company’s health in the minds of investors. Financial statements, though filled with actual numbers telling actual stories, are wide open to interpretation.

Anything that invites subjectivity, personal bias, outside influences and perception is particularly challenging.

I mean, meeting, beating or missing expectations clearly impacts investors’ reactions, but they often don’t make much sense. Here’s why …

The Full Financial Picture

I’m sure you’ve seen a company deliver an awful report and miss Wall Street estimates by a wide margin. You start scrolling through all the financials and confirm the bad news.

But once you look up the stock’s real-time price, it’s not getting pummeled. In fact, it’s up by a lot.

What’s going on? Well, it could be because the market takes any and all information into consideration. In other words, what the freshly reported numbers say about the prior three months may be totally out of sync about the coming three to six months.

In other words, you have to be sure to read the small print and in between the lines of any financial statement to get the full financial picture.

Here is another challenging scenario ...

A company reports earnings that meet or exceed analyst estimates. In the conference call, management raises forward-looking revenue and profit estimates while portraying confidence in its business outlook.

However, when the stock opens for trading, it sells off. What happened?

Most likely, it was due to “buy the rumor, sell the news” action. It’s quite common, especially in very strong companies, where investor enthusiasm pushes the stock so high heading into earnings that even a better-than-expected report usually results in profit-taking or some type of pullback.

What can be useful in getting the true picture of what is really going on is to watch the price action either in the pre-market or after the close, depending on the release time.

While most investors were keeping their eyes and ears focused on Wednesday’s Consumer Price Index report, attention will no doubt shift to earnings today as results shed some light on corporate health and near-term stock market direction.

And keeping in mind the importance of analysts’ expectations, they paint …

A Not-so-Rosy Picture

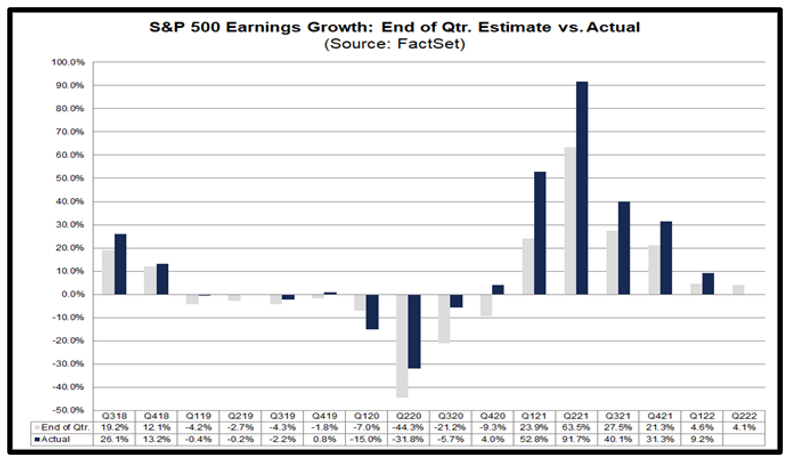

According to FactSet’s recently released Earnings Insight report, S&P 500 companies are expected to report a 4.1% year-over-year drop in Q4. Other analysts suggest we’ll see closer to an average 6.3% reduction in Q4 earnings between Sept. 30 and Dec. 31.

Click here to see full-sized image.

Regardless of which number you lean toward, both are above the five-year average of 2.5%, 10-year average of 3.3% and the 20-year average of 3.8%.

And as long as the average turns negative, it’ll be the first fall in year-over-year earnings since Q3 of 2020 when they slid 5.7%.

Early company guidance also suggests that declines will be part of the early 2023 narrative. Some 65 S&P 500 companies have issued negative guidance for earnings per share and another 35 expect theirs to come in below consensus.

While we’ve had a smattering of reports this week, on Friday we’ll find out how reality and expectations compare for many big banks and financial firms, including JPMorgan Chase (JPM), Bank of America (BAC) and Wells Fargo (WFC).

Analysts predict that earnings for S&P 500 companies in the finance sector have declined by 8.7% in Q4 from a year ago, the fourth-biggest projected drop among major sectors (tied with tech), according to data from Refinitiv.

However, that’s not how earnings for Q3 2022 played out, despite the Fed firmly in tightening mode and promising more hikes in interest rates.

Wells Fargo topped earnings per share estimates by 20%. Bank of America and JPMorgan followed suit, beating estimates by 5% and 8%, respectively.

Investors rewarded all three stocks between Oct. 14 (the reporting day) and Nov. 1. JPM rose around 15%, Wells Fargo shares shot up nearly 10% and BAC gained 11%.

What happens this time around is anyone’s guess.

Since last year’s Q3 reports, the pain from higher interest rates is …

Hitting Banks Where it Hurts

And that’s in their mortgage businesses, of course.

Those headwinds banks faced in mid-2022 were a breeze, but they’ve stiffened severely with the current housing slump and weaker consumer spending.

As a result, we’ve seen widespread layoffs and a reduction of exposure to mortgage loans for many firms.

Now, we’re about to hear what all that means for bottom lines over the past quarter and, more importantly, where they go from here.

Will there be any surprises? What will CEOs say to move the needles of their company stock and will announcements be more rah-rah than reality? Did they conveniently omit certain numbers or make overenthusiastic remarks about others?

That’s a lot to digest, and you may or may not be able to stomach all of it.

While many investors like to place trades around earnings announcements, it can be a crapshoot.

Bottom line: While earnings season can produce plenty of opportunities and offer investors lots of financial information, it’s also a time of uncertainty and elevated volatility.

I think what it comes down to is that investors crave stability and loathe uncertainty and volatility now more than ever.

As seasoned investors, we know that moderate volatility is actually a market-mover that can hand us opportunities and profits, but when it’s all we’ve seen for the past year, it’s time for some stability to even out the scales.

That’s why you should remain focused on your long-term plan and core holdings. Earnings announcements, similar to Federal Reserve meetings and economic data, can turn short-term stock prices on a dime.

The only problem is you don’t know if that dime will turn into a nickel or a quarter down the road, so it’s safer to sit tight and keep to our long-term plan for now.

To your wealth & wisdom,

Kenny Polcari

P.S. If you want to take advantage of earnings season and ongoing megatrends, consider joining my colleague Sean Brodrick’s trading service, Wealth Megatrends. Members are currently sitting on seven positions with double-digit gains, including over 50%, 33% and 21%. Click here to find out more.