Editor’s note:Juan Villaverde has been tracking the Fed’s likely actions when faced with out-of-control debt. (Catch his analysis here and here.)

Today, he has a specific forecast for how best to profit from what’s coming next out of the Fed.

He is also about to take part in a special All-Access Summit at 2 p.m. Eastern today.

You’ll want to read this after you grab your spot at today’s event …

|

| By Juan Villaverde |

For some time, I’ve said that a worldwide recession would likely arrive alongside crypto’s forthcoming four-year-cycle peak.

With crypto’s bull-market top penciled in for late 2025, the bulk of the ensuing correction should land in 2026.

As a macro analyst and crypto-cycle trader, whenever a four-year-cycle peak approaches, I do the same thing: Look for fundamental factors that would push crypto markets — and global assets — down into a cycle low.

In 2021, I sounded the alarm about Federal Reserve officials’ stealth policy shift to my Weiss Crypto Portfolio Members.

At the time, the Fed was creating new dollars … but quietly keeping them out of circulation by stashing them in the Fed’s “Reverse Repo Facility.”

In other words, it was quietly carrying out “quantitative tightening” but kept its work behind the scenes. In public, though, the Fed continued to print money relentlessly.

It was clear to me when I saw this that the Fed had grown concerned about inflation. Even though no one would say so publicly.

But I said so. And at the time, it was quite a controversial call.

That’s because the Fed’s post-COVID money-printing bonanza was still in full bloom. In almost every asset class, prices were rising sharply.

That included crypto.

It wasn’t until the fourth quarter of 2021 that the Fed finally admitted inflation was on its economic radar. And signaled rate hikes would start in early 2022.

This corresponded with crypto’s four-year cycle peak. After which, virtually every investment market — from stocks to bonds to crypto — fell into late 2022.

Fast forward to 2025. Another trigger of recession is manifesting: the ballooning U.S. federal debt.

I wrote about it last week. But here are the important takeaways …

- Total debt is $34 trillion. That’s an increase of $11 trillion in just four years, the fastest pace in history.

- At roughly $1 trillion a year, interest alone now accounts for half the federal deficit.

Unlike many observers, I am not predicting a U.S. default any time soon. Nor do I anticipate any sudden outbreak of fiscal discipline in Washington.

My view is this: The moment the Treasury market cracks under a mountain of new issuance, the Fed will ride to the rescue.

They will print with reckless abandon, debase the currency, launching crypto (and other assets) straight into the stratosphere.

In the end, all debt crises resolve the same way: trillions are printed, rates fall and liquidity-sensitive assets like Bitcoin (and gold) surge.

But while signs of stress have already begun to manifest, the Fed is unlikely to ride to the rescue anytime soon.

That’s because, even as federal finances deteriorate …

Inflation Is Flaring Again

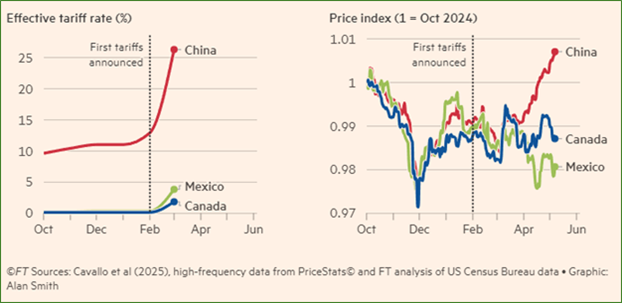

The left side of the above chart shows the effective tariff rate on China (pre-dating the 90-day pause announced by the Trump administration a few weeks ago).

And the right side shows U.S. prices of Mexican, Canadian and Chinese imports — before and after Trump’s tariff proclamation (marked by the vertical dashed line).

As you can see, prices of Chinese imports (the red line, above) are up roughly 2%, and rising sharply. Which means they’re already starting to fuel consumer price inflation in America.

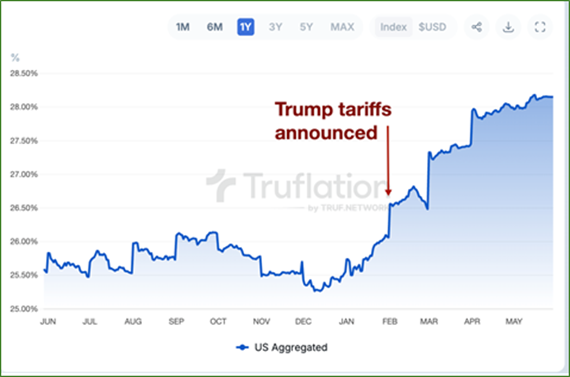

The Trueflation Index shows a similar sharp rise in post-tariff inflation in the U.S.

A Non-CPI Gauge of U.S. Inflation

Inflation heating up like this makes any near-term interest rate cuts very unlikely. Indeed, the odds of the Fed cutting rates are meagre — just 6% in June, and 21% in July.

In short …

- The Federal Reserve is unlikely to cut rates meaningfully in 2025 or print money to bail out Uncle Sam.

- Yet, the government is sleepwalking into a full-blown debt crisis, unable to roll over its gargantuan liabilities without central bank support.

And what happens when a financing crisis puts Washington on the brink of default … just as the economy plunges into recession?

The Fed will pivot 180 degrees so fast it will make your head spin. It’ll go from fighting inflation to preventing a financial meltdown like that.

Jerome Powell — or his successor as Fed Chair — will slash rates and fire up the presses to buy U.S. government debt.

That will only happen after the crisis hits … and scares the daylight out of most investors!

But you’ll know what’s really going on.

And you know that when the printing presses turn on and liquidity rushes back into the market, crypto will likely rise with the new tide.

Best,

Juan Villaverde

P.S. The time to prepare for market hardships isn’t when they hit. It’s well before. Especially in environments like this, where renewed momentum is fueling the broad market’s climb.

That’s why I’ll be taking part in a special Crypto All-Access Summit today at 2 p.m. Eastern.

It’s the first step to take advantage of the current market, which could offer the ideal opportunity to build a true foundation of wealth that can be passed on for generations.

But there are only 350 spots, so I suggest grabbing yours before it’s too late.