|

| By Michael A. Robinson |

Here’s a not-so-bold prediction for 2025: Big Tech will play an outsized role in the market.

Of course, it’s a pretty simple concept — the American economy now completely depends on technology across the board.

But I’m drawing a sharp contrast between big tech firms writ large and the Magnificent 7.

See, gains for a couple of those stocks have slowed lately after a blistering two-year run. Apple (AAPL) and Microsoft (MSFT) gained about 10% in the last three months, roughly on par with the S&P 500.

But other names are just crushing it …

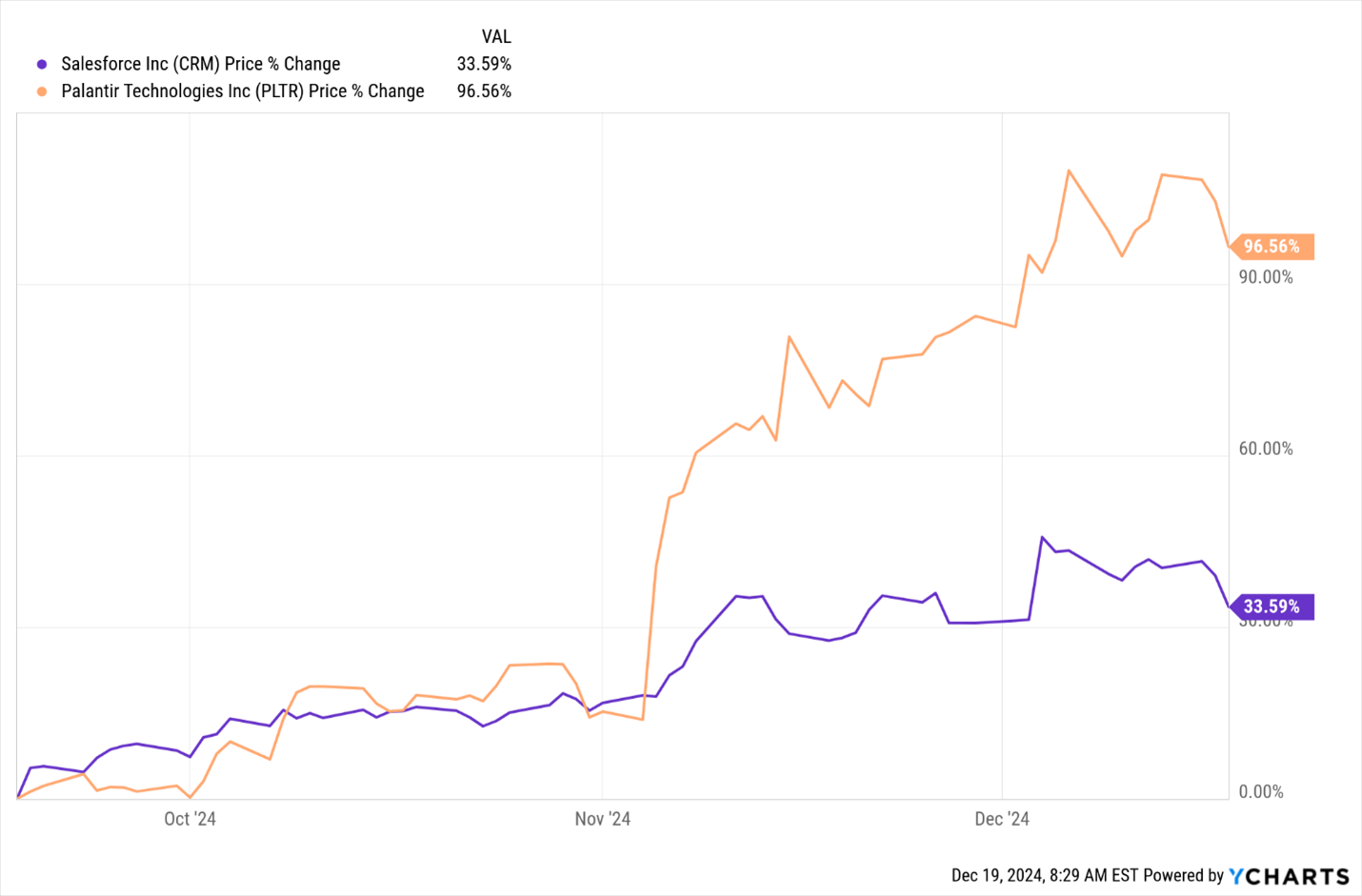

Consider that shares of Salesforce (CRM) saw three-month gains of 34%. Over that same period, shares of Palantir Technologies (PLTR) are up a stunning 97%.

That brings up a question for investors.

If we know Big Tech, in general, will do well next year, how do we board that train before it leaves the station?

Fortunately, I have an answer at hand. And in a moment, I will reveal a great way to play the field with an investment I believe all investors should make.

But first, allow me to set the scene.

Don’t Bet Against Tech

Let me start with a reminder that these days every business is a tech business.

Even something as simple as ordering food at a restaurant has gone high tech.

My wife and I recently went to a local restaurant where the server took our order on a handheld computer connected wirelessly to the kitchen.

We recently stayed at a hotel where we got wristbands that unlocked the doors for us. Other hotels do that by connecting to your mobile phone.

It’s convenient … but not without risk.

After all, every time you tap or swipe your room key or bankcard … or even enter it online or at a physical terminal … scammers are always looking to get in on the action.

And so, AI and cyber agents — the “good guys” — must be on standby to scan for fraud.

In other words, fancy new tech requires even more tech!

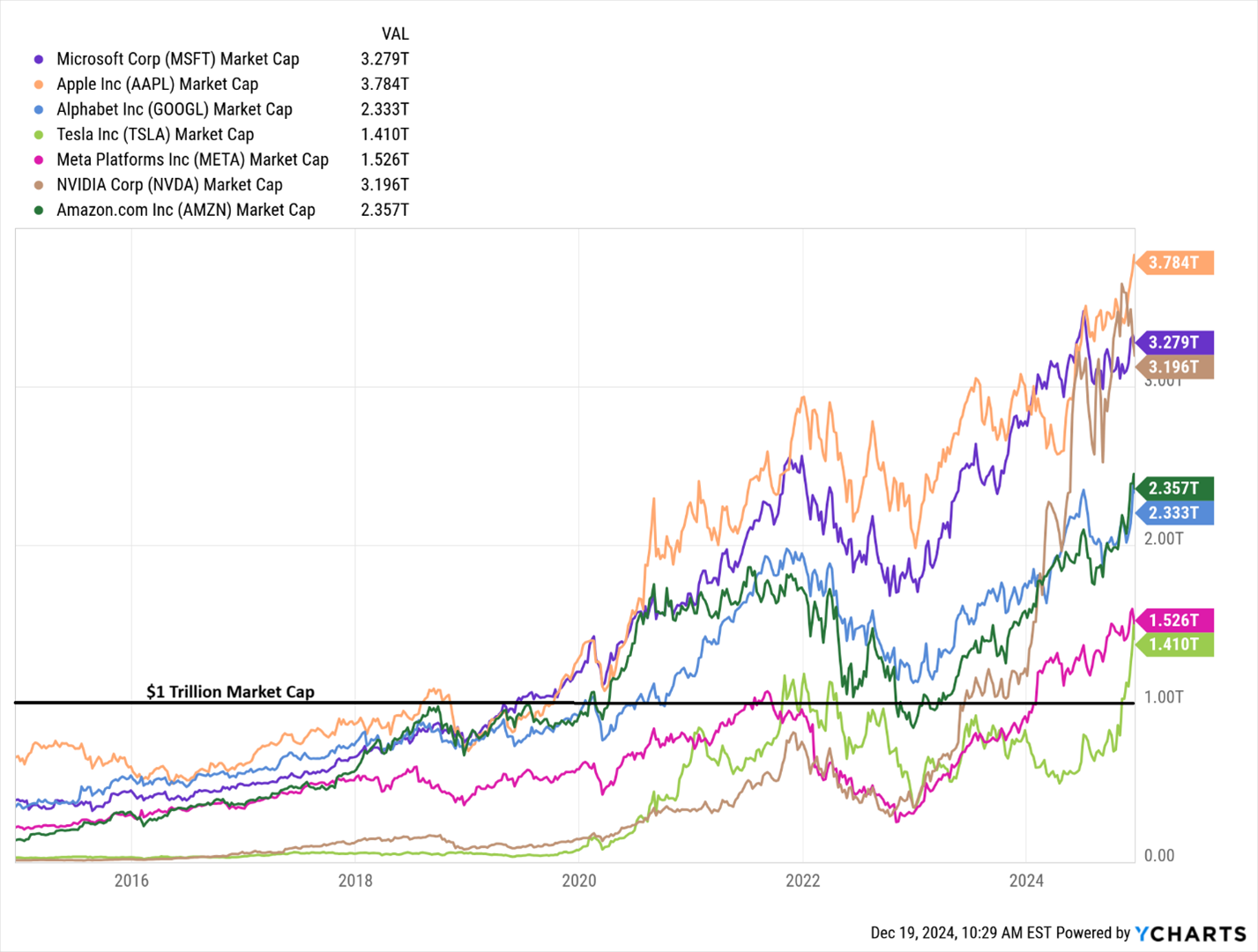

Fun fact: Just six years ago, there were no $1 trillion tech firms. Today, there are seven.

Clearly, betting against tech is a fool’s errand.

But don’t get me wrong. Some names will fall out of favor or stumble by missing earnings estimates. That’s the nature of the market.

Naturally enough, I expect Big Tech to do well again this year even if some of the Mag 7 slow or falter.

That’s because there are always new breakthroughs like cloud computing, the mobile revolution and more recently, AI, a field that is set to create trillions in wealth in the years ahead.

And as we come to the end of what turned out to be a scorching year for tech, I have in mind a way for you to capture the waterfront of great tech winners.

All-in-One Core 2025 Investment

With this one investment, you can cash in on AI, big data, the cloud, semiconductors, fintech, mobile phones and apps, cyber security and genomics, just to name a few.

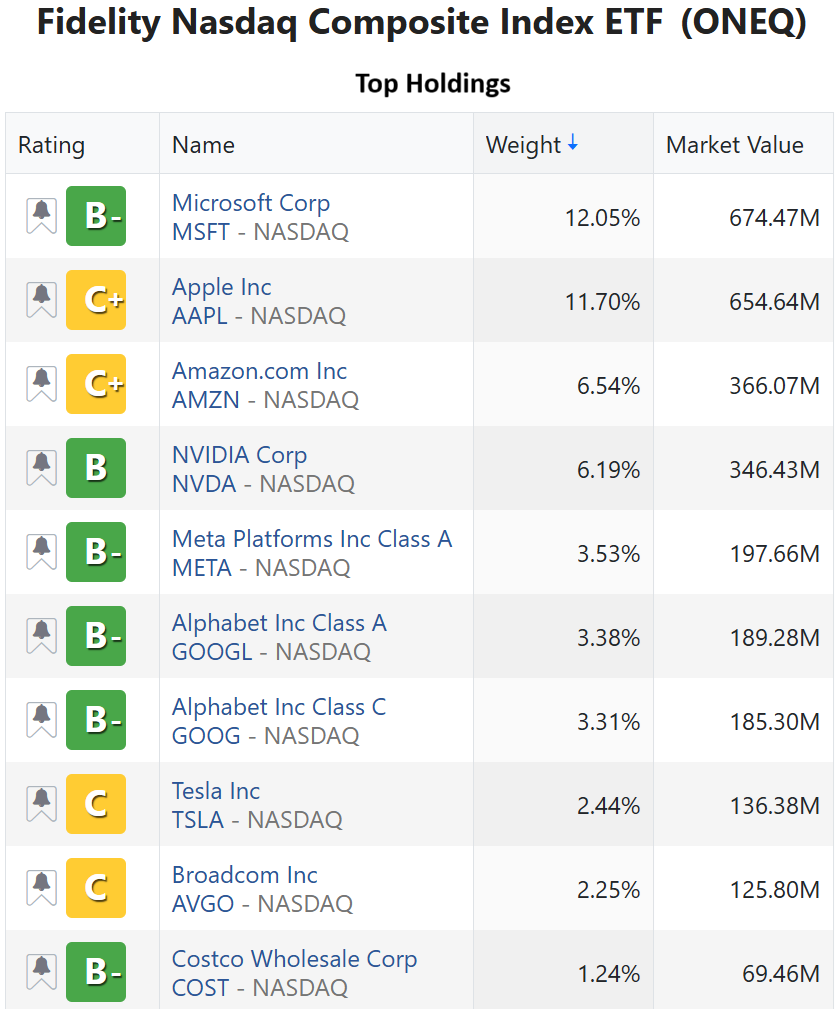

That’s where the Fidelity Nasdaq Composite Index ETF (ONEQ) comes in.

I consider this a core investment, and if you don’t own it, you should make it a priority for 2025.

It’s a great way to own all Magnificent 7 stocks plus a ton of hot AI leaders, as well as medical technology and other sectors in one fell swoop, along with small caps that might be too volatile for individual investors to hold in their portfolios.

By doing this, you get a market-crushing investment with an ETF in which the fund managers do all the heavy lifting. That way you don’t have to pick the winners from the losers.

See, I’ve found in my nearly 40 years of banging around Silicon Valley that one way to consistently beat the market is to have a portfolio steeped in high tech.

An ETF like this can work as a key holding that will beat the broader market. In other words, you get outsized returns with what amounts to a safety play.

Here’s why that works so well. It allows you to set a portion of your tech portfolio on auto pilot.

In essence, it means you get to have your ear to the ground for the big disruptive shifts in the market without worrying you’ll miss out on a hot new trend or pick the wrong stock.

By doing this, it frees up your time and psychic energy so you can really drill down on the details you need to know when picking individual winners.

And make no mistake, ONEQ covers the broad global tech ecosystem but still has its focus in the most important market — the U.S., which remains the world leader in tech advances. U.S. stocks make up nearly 97% of the ETF’s roughly 900 holdings.

No doubt, it’s rooted in the big caps but offers many small and mid-cap players as well. ONEQ’s top 10 holdings are a Who’s Who of tech leaders in mobile, the Web, computing, biotech and e-commerce.

Besides Magnificent 7 stocks like the aforementioned Apple and Microsoft, you’ll also find chip giant Broadcom (AVGO) and retail leaders Costco Wholesale (COST) and Starbucks (SBUX).

Though ONEQ is focused on technology by definition, it also provides a good deal of sector diversification.

Information technology accounts for 49% of the fund. Consumer discretionary, communications services and healthcare make up another 35% of ONEQ’s holdings.

This is also a great way to leverage off the exciting small and micro-cap stocks without all the volatility that comes with these plays.

Make no mistake. This is a great long-term holding. Reflecting the overall power of tech stocks, this ETF has gained nearly 126% over the last five years.

During the same period, the S&P 500 is up a very respectable 88%. That means ONEQ beat the benchmark by more than 40%.

Add it all up, and ONEQ is a great way to play the unstoppable tech boom and really help you build wealth.

Best,

Michael A. Robinson

P.S. While I’ve been saying that all companies are now tech companies for a while, I’ve also begun to say the same for AI. All companies are — or will soon be — AI companies.

There are more ways to play this than just buying ONEQ or a handful of AI leaders today. In fact, this is the heart of my new presentation: “Beyond AI.”