China’s Navy Buildup Opens a Profit Opportunity

|

| By Michael A. Robinson |

President Trump’s bold move to capture Venezuelan strongman Nicolas Maduro has grabbed the nation’s attention.

It’s also put a bright spotlight on America’s role in Latin America.

Don’t get me wrong — this matters. But like many headline stories, it will probably fade in the weeks ahead.

Half a world away, though, something bigger is happening.

Just weeks ago, China launched its third — and largest — aircraft carrier.

This wasn’t for show. It was a message.

China wants to be the world’s top naval power.

Beijing is pushing toward a 400-ship navy this year and plans to reach 435 ships by 2030.

For perspective, the U.S. Navy currently operates 241, with plans to get to 381.

And China isn’t stopping there. Its fourth aircraft carrier, already under construction, will be its first modern, nuclear-powered ship.

While President Trump may be focused on Venezuela (and Iran) right now, you can be sure China hasn’t slipped off the radar. Rebuilding America’s Navy is already a top priority.

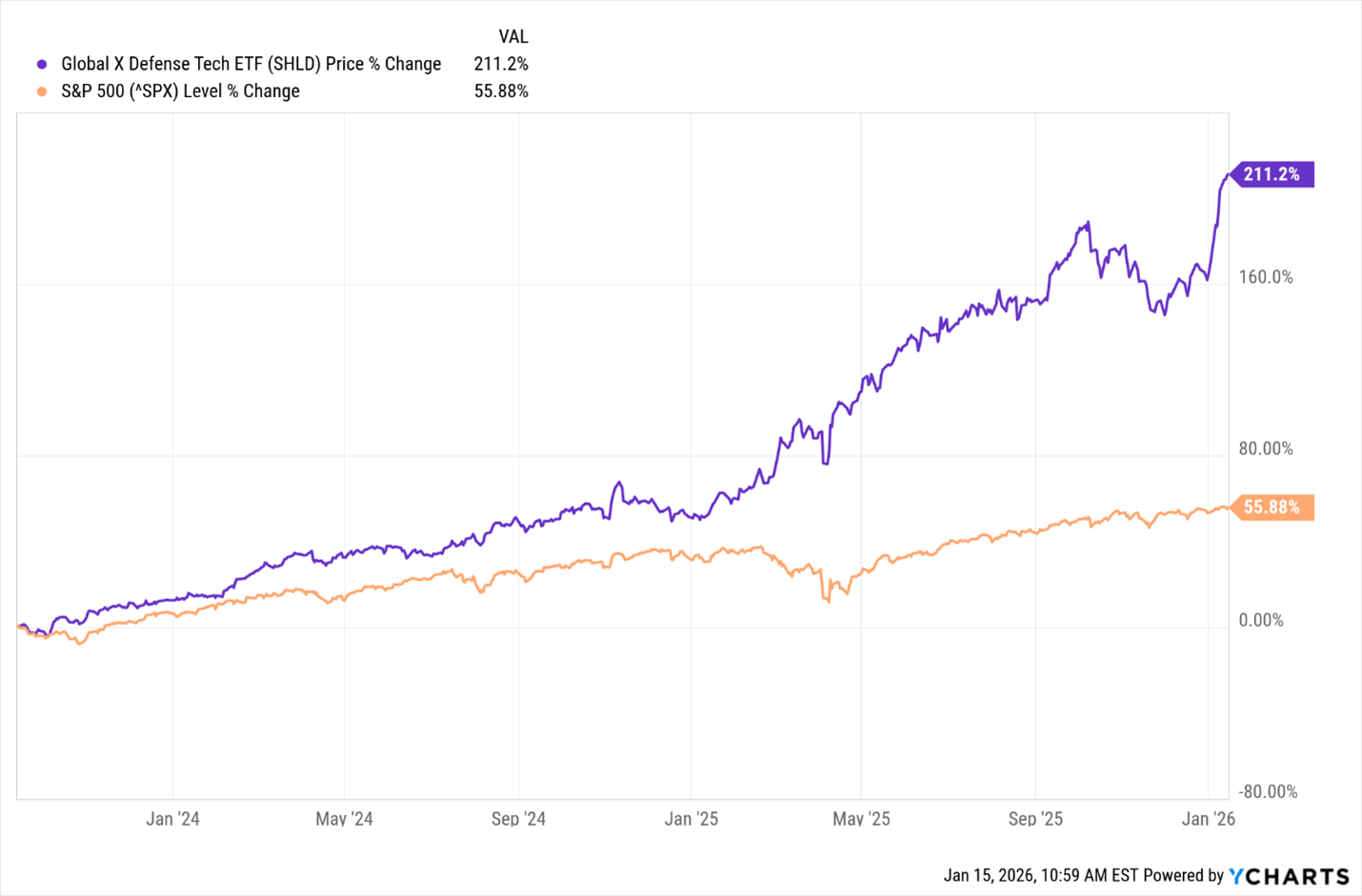

And I’ve found a way to invest across the broad spectrum of U.S. defense — one that has already beaten the broad market by nearly 4x …

Why China’s Navy Really Matters

Trump has a very good reason to pay so much attention to China.

Beijing has made it clear that Taiwan is a top priority — and not just politically.

Taiwan sits at the heart of the global tech supply chain. Roughly 60% of the world’s advanced computer chips are made there.

If China were to blockade or seize Taiwan, it wouldn’t just be a regional conflict. It would hit the U.S. economy hard — especially AI, cloud computing, defense systems and anything that relies on advanced semiconductors.

In short, the AI boom we’re all investing in would be at serious risk.

That’s why China’s expanding navy is such a big deal.

Aircraft carriers project power, control shipping lanes and enforce blockades.

A larger Chinese navy gives Beijing leverage — even without firing a shot.

Pacific tensions are already spilling over.

Just weeks ago, Japan’s new prime minister said Japan would support Taiwan if China invaded.

China responded by cutting trade and diplomatic ties. That tells you how close to the surface this issue already is.

Right now, the best defense isn’t a war. It’s deterrence.

Pacific Strength in Numbers

One of the smartest moves the U.S. has made isn’t just rebuilding its own Navy — it’s locking arms with allies.

That’s where AUKUS comes in.

The acronym refers to the pact that includes Australia, the U.K and the U.S.

It’s designed to push back against China’s ambitions in the Pacific.

Together, these countries are building a modern naval force that can operate far from home, stay in place longer and respond faster if tensions rise.

Here’s how it works.

U.S. and U.K. defense companies will help modernize and expand Australia’s Navy. This includes advanced ships and nuclear-powered submarines.

In return, Australia provides strategic reach and support across the Pacific — exactly where it’s needed most.

This isn’t just about Australia. It’s about creating a network that makes any move against Taiwan far more costly for China.

And it’s a big win for defense companies in all three nations.

At the same time, Europe is stepping up its own defense spending, while countries like Japan and South Korea are also boosting military budgets.

This is a long-term shift that should pay huge rewards for defense investors.

A Broad Defense Play

With this much change underway, trying to guess which single defense contractor will be the biggest winner can be a daunting challenge.

That’s where the Global X Defense Tech ETF (SHLD) comes into play.

The ETF holds top defense firms in the U.S. and Europe, with exposure to key Pacific allies, like Japan, South Korea and Australia.

About 61% of the holdings are U.S. companies, giving it a strong domestic base with global reach.

What makes SHLD especially interesting is its mix.

It owns the well-known defense giants — the “primes” — but it also holds smaller, fast-growing defense tech firms.

These are the companies working on AI security, advanced sensors, communications and next-gen systems.

Sea, Space & Everything in Between

Modern defense isn’t just about ships, planes and troops anymore.

What happens at sea is tied directly to what’s happening in space.

Satellites manage communications, intelligence, navigation and command systems.

Every aircraft carrier group depends on eyes in the sky.

That’s why alliances like AUKUS focus on far more than shipbuilding. They support entire defense networks.

Take Lockheed Martin (LMT), the fund’s top holding.

More carriers mean more aircraft. Lockheed just landed new F-35 orders overseas and a massive $24 billion deal for 296 F-35s for the U.S.

SHLD’s No. 4 holding is General Dynamics (GD).

If the U.S. and its allies are building ships and submarines for decades, GD is central.

It owns Bath Iron Works and Electric Boat, two crucial shipbuilders.

You’ll also find L3Harris (LHX), a leader in secure communications and a key player in future missile defense systems.

And there’s also BAE Systems (BAESY), a major U.K. defense firm with deep U.S. ties and one of the world’s top naval shipbuilders.

4x the Market

Irony abounds. This amounts to a stealth defense play.

SHLD launched in September 2023 with very little fanfare and has gotten little media attention.

But the returns have been off the hook.

Since inception, it has gained 211%. Over the same period, the S&P 500 gained about 56%.

That means SHLD has beaten the broad market by almost 4x.

And given the long-term shifts now underway — in naval power, alliances, AI and defense spending — I believe this ETF still has plenty of room to run.

Best,

Michael A. Robinson

P.S. This is all part of a larger supercycle in technology. For the specific ways to take advantage of only the fifth supercycle in 150 years, you’ll want to get your name on this list.