|

| By Chris Graebe |

When investing in startups, there are a lot of items to consider:

What industry do I like right now? What kind of product or service might become the next big thing? What kind of management team best suits my investment timeframe?

In fact, this list could go on for days. There is one question I get about startup investing that seems like it should have an easy answer:

"Do you like business-to-consumer startups or business-to-business startups?"

Just pick one or the other, right? Well, actually, no.

It actually just depends …

I like startups that look like they are going to hand me a large return on my investment.

And both can do that. Of course, how they go about that is different and needs to be put into perspective.

First, let’s define what we’re talking about.

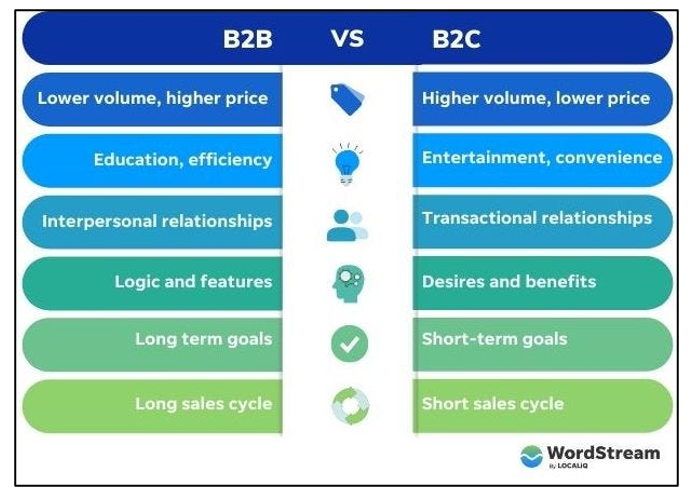

- Business-to-consumer, or B2C, is a startup focused on reaching and selling to individual consumers.

- Business-to-business, or B2B, is a startup focused on serving other businesses.

Now, I've invested in both business-to-consumer startups and business-to-business startups. I don't see one as necessarily better than the other. But there are some key things I think about when looking at startups in either arena …

B2C Startups

These startups typically have a quicker path to revenue, meaning they can test a product pretty quickly and see if consumers want to buy what they’re offering.

This requires less capital to get off the ground, unless it's B2C software. But if they have an idea to solve a problem through a CPG, or consumer packaged goods, then they can get a protype, a minimum number of widgets made and start quickly testing in the market.

Now, the speed to concept is definitely an advantage for B2C startups, but usually the biggest issue is adoption and scalability.

This means figuring out whether their TAM, or total addressable market, is large enough to really scale and be acquired by a larger player like Amazon.com (AMZN), for example.

They also have to figure out if they have the cash to market, purchase large quantities of inventory and whether their manufacturing is beholden to contractors.

Plus, if the company is in tech or SaaS, it’s important to know if they have the cash or runway to constantly pivot until things are dialed in.

If a B2C startup can overcome all these barriers and achieve mass adoption, then it’s more than likely that they will have major acquisition offers come their way.

To sum it up, B2C startups have a fast path to cash and real-time feedback. But they must also have a strong leadership team that can then navigate the challenges of scale that are a direct result of being successful.

B2B Startups

These startups are usually focused on much higher ticket sales. They are going after businesses that have a problem and need a solution.

I like B2B startups because once they've found their fit in the market and businesses start signing up with them, those clients typically stick with that startup for a while and pay much larger fees than a customer might pay.

The biggest challenge B2B businesses face is having the ability to gain traction and raise the amount of capital that will allow them to wait for those first adopters to jump on their service.

I've heard stories about founders who have had to pitch and build relationships with leadership teams for years before they actually landed a client.

It’s a common fact that most businesses, especially larger corporations, do NOT make hasty decisions. There are committees who must review that year's budget and talk over their strategy before deciding.

But on the other hand, if a startup can make it through that period of the due diligence process, then that's usually a good sign that they have a product that is strong and one that will have staying power.

The other interesting fact about B2B is that if the solution is strong enough, their potential acquirer is oftentimes one of their clients.

This means that if a startup develops software on the Salesforce (CRM) platform and Salesforce sees that startup take off and decides it makes sense for them to acquire it, they will.

This is all to say …

It All Depends

In short, both types of businesses are viable paths to a strong return on capital.

Lastly, it all comes down to a number of important factors no matter if the startup is B2C or B2B, such as:

- Strong leadership.

- Market timing.

- A strong business model and plan.

- Clear vision.

- And a little bit of luck.

So, that's the longer answer to the question: B2C or B2B?

The short answer: It all depends.

Plus, it’s important to mention that artificial intelligence is being used in both B2C and B2B startups at a faster rate than ever.

My colleague Jon D. Markman recently announced his #1 AI Stock of 2023. In fact, if you watch his recent Artificial Intelligence Town Hall, you can get all the info on that AND another AI discovery he found this weekend.

That’s it for today. I’ll be back with more soon.

All the best,

Chris Graebe