|

This week, I’m heading to the annual New Orleans Investment Conference. That means I’ll have plenty travel time to spend in contemplation.

These days, there’s no shortage of conflicting narratives and market moves to ponder! That includes those related to inflation, energy, gold, interest rates and more.

So I want to take a few moments to help you cut through that confusion ...

Inflation Nation

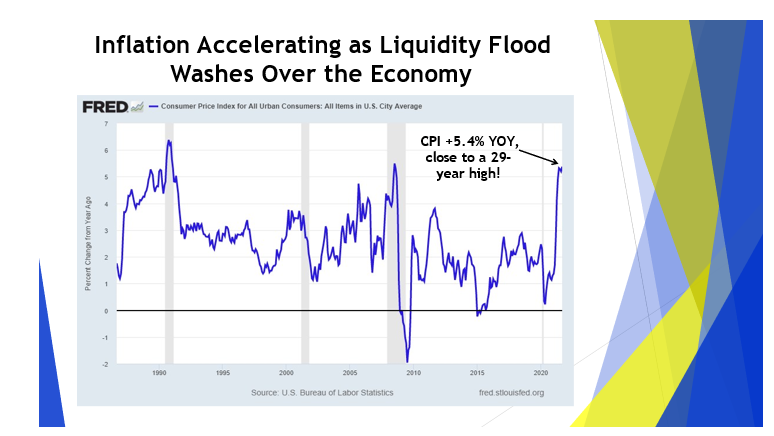

Policymakers keep talking about how inflation is “transitory” — or in the recent words of Atlanta Federal Reserve Bank President Raphael Bostic, “episodic.”

But look at this slide from my upcoming New Orleans presentation. Does this surge in the Consumer Price Index (CPI) look like a fleeting, nothing-to-worry-about move to you?

|

In times of turbulent markets — like when inflation rises — safe haven investments tend to perform well.

Yet traditional stores of value in inflationary times, like gold, silver and precious metals stocks, have underperformed.

The VanEck Gold Miners ETF (NYSE: GDX) has shed around 10% in value this year, while the SPDR Gold Shares (NYSE: GLD) has just flopped and chopped around since last summer.

Energy Eruption

The Biden administration and large swaths of corporate America are all-in on renewable energy and a future of net-zero carbon emissions.

Many believe that’s an admirable goal from a societal and environmental perspective.

• But from an INVESTMENT standpoint, guess what? Traditional energy plays are hitting the ball out of the park.

Crude oil just topped $83.50 per barrel in U.S. trading … the highest in nearly seven years! Natural gas prices have roughly quadrupled since last summer, too, prompting the U.S. government to warn of soaring heating costs this winter.

Sure enough, that means energy stocks are trouncing the returns of other competing S&P 500 sectors.

The Energy Select Sector SPDR Fund (NYSE: XLE) has returned more than 56% year-to-date, trouncing the 21% rise in the Technology Select Sector SPDR Fund (NYSE: XLK).

Treasuries Teetering

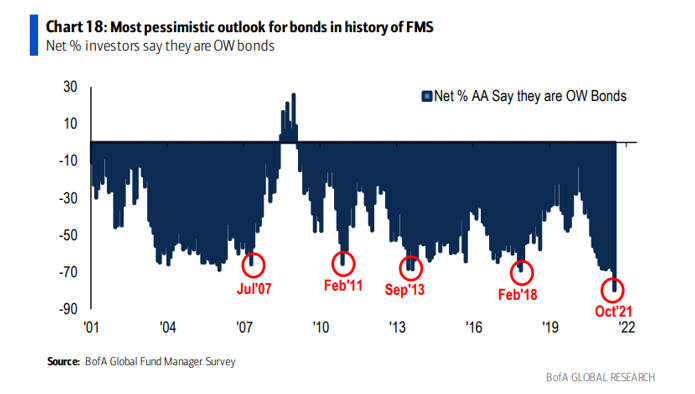

Investors hate bonds. Like really, REALLY hate them. The following chart shows the results of the ongoing BofA Global Fund Manager Survey of professional money managers:

|

As you can see, the percentage of managers “overweighting” bonds in their portfolios has plunged … to the lowest in the survey’s 21-year history.

And sure, the iShares 20+ Year Treasury Bond ETF (NYSE: TLT) hasn’t been a great investment. It’s down a bit less than 7% so far this year.

But interest rates haven’t exactly skyrocketed, either. The 10-year Treasury yield is around 1.6%. The 30-year Treasury yield is just over 2%.

That seems like a bit of a disconnect, given the aggressive anti-bond stance, right?

• Oh, and it’s also worth noting: Those previous sentiment lows all came around LOWS in bond prices and HIGHS in bond yields.

So, cutting to the chase, what does this all mean for YOU?

1. If you’re looking for UNDERVALUED investments in a market full of overvalued ones, I’d point to precious metals and related stocks. They may be out of favor for now. But given the underlying fundamentals ... and the inflation outlook ... I don’t think they’ll stay that way much longer.

2. There’s nothing wrong with investing in sectors that will benefit from government efforts to phase out fossil fuels. I’ve recommended some of my favorite sectors and stocks in the Safe Money Report.

But it’s too early to write off traditional energy companies. The clean energy transition will take years — and you can make plenty of money in the meantime!

The Weiss Ratings Stock Screener is a great place to start. You can use the “Add Criteria” tool to select specific industries, including energy. Then, you can sort in descending order by Weiss Rating to find the company names our system grades the highest.

3. I’m no fan of low-yielding Treasurys. I’d much rather you focus on income-generating stocks, exchange-traded funds (ETFs) and options strategies that can help you beat the pants off of the yields bonds offer. You can find some of my favorite ideas here.

But it probably isn’t a great time to be “shorting” bonds, either. Or shying away from so-called “bond-alternative” stocks, like Real Estate Investment Trusts (REITs). Some of my favorite, high-performing names can be found in that sector.

Bottom line? There are a lot of turbulent cross-currents and competing narratives in this market.

But by keeping these pointers in mind, your portfolio should have a much smoother flight.

And don’t forget to say “hello” if we cross paths in the Crescent City!

Until next time,

Mike Larson