Ditch the Diet Drug Darling for This Breakthrough Biotech

|

| By Michael A. Robinson |

Talk about a one-two punch that rattled investors.

Then again, this wasn’t your typical earnings miss.

Shares of Novo Nordisk (NVO) fell off a cliff, falling 22% in a single session.

That came after weak guidance and a poorly timed CEO announcement shattered confidence.

That kind of drop demands our attention.

And in this case, it earns a “Sell” rating in my book.

A new CEO can sometimes spark a rally. But the way this was handled makes me think the problems are just beginning.

And here’s the good news. We don’t need to wait around to find out.

Because I’ve got a smarter, AI-powered biotech stock.

It’s targeting markets on pace to be worth $2.2 trillion.

Even better, in the most recent quarter, it grew per-share profits by nearly 50%.

Let me show you why you should sell NVO and buy this one instead …

A Rookie Move

Novo Nordisk was the darling of the obesity drug boom last year.

Riding the success of its weight-loss drugs and a well-crafted story, the company became a Wall Street sweetheart.

But that momentum masked a deeper issue — execution.

The board ousted its longtime CEO back in May but delayed naming a successor.

Then, in a bizarre move, they dropped the news of the new CEO in the middle of a disappointing earnings release.

That’s not how you inspire confidence.

The move to install an insider might stabilize the ship internally.

But to outside investors, it felt like the board was trying to bury bad news inside worse news.

It’s a rookie mistake that raises questions about transparency, leadership vision and what might be going on behind the scenes.

The weight loss market still has long-term promise.

But Wall Street’s love affair with NVO looks to have run its course.

Last year, the stock was a rocket ship. This year, it’s acting like an unguided missile.

The reality is, pharma is too important — and too profitable — to be chasing last year’s headlines.

That’s why I’m pivoting to a company that’s doing something smarter.

And frankly, something much bigger.

The Gene Therapy Leader You Should Own Now

I want to introduce you to a company using AI to attack disease at the genetic level — and generating real results.

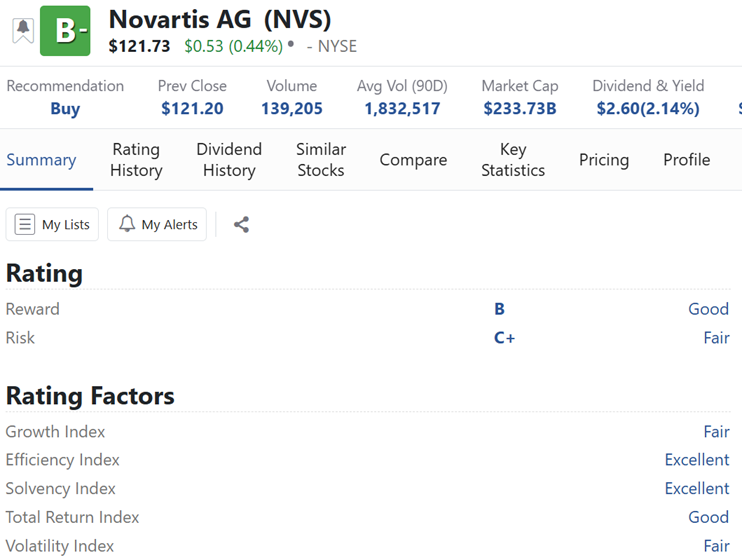

The company is Novartis (NVS).

Now let’s be clear: Novartis is no startup.

It’s a $200+ billion drug titan with operations spanning the globe.

But what separates it is how aggressively it’s embracing gene therapy and AI-based drug development.

This is the kind of company that builds platforms — not just products.

It already has eight gene therapy treatments on the market, including one that has extended the lifespan of babies with spinal muscular atrophy.

It operates a purpose-built gene therapy manufacturing plant in North Carolina.

It’s in clinical trials for Huntington’s disease and sickle cell anemia.

And it’s partnered with Microsoft (MSFT) to apply AI to drug discovery, targeting diseases with complex genetic links.

In short, this is the biotech AI story most investors are missing.

Profit From AI’s Life-Saving Powers

Most investors already know that AI is set to have a dramatic impact on the entire global tech ecosystem.

We’re talking everything from chips and graphics processors to data centers and software.

Add it all up and this disruptive technology could generate trillions for the global economy over the next 15 years or so, says the World Economic Forum.

But one part of the AI boom is flying under the radar — its impact on medical science.

AI could literally save your life.

In a recent study of genetic codes, human researchers identified about 80,000 mutations that might cause disease.

Sounds impressive … until you learn that they studied 4 million variations, identifying just 2% manually.

An AI model, by contrast, reviewed 216 million possible variations — and flagged 71 million genetic mutations potentially linked to disease.

That’s a quantum leap in both speed and depth.

The Market Is Massive & Growing

Gene therapy is not a fad. It’s the future of medicine.

The global market stood at $5.6 billion in 2023 and is forecast to hit $19.7 billion by 2028, according to Mordor Intelligence.

But that’s just a sliver of the opportunity at play year.

The firm’s total addressable market for gene- and protein-based therapies could reach $2.2 trillion by 2032, says Grand View Research.

That includes treatments for cancer, Alzheimer’s, heart disease and rare disorders — problems that are actually affecting hundreds of millions of people around the world.

And Novartis is positioning itself at the center of that revolution.

Crushing It on Earnings

Earlier this month, the firm posted another breakout quarter.

Per share earnings surged 23%, up from 17% the year-ago quarter. That’s a nearly 50% upswing in profit growth in just three months.

At that rate, the firm is on track to double earnings in just over four years.

Margins are expanding, sales are growing and its product pipeline is as deep as ever.

In a world where some big pharma firms are struggling with post-Covid declines, Novartis is doing the opposite — it’s building.

And remember, AI is not just a tech story.

It’s a productivity story. A geopolitical story. A major health story.

And it’s a big profit story.

NVS is surging into the future with AI-powered gene therapy and blockbuster drugs.

That makes it the type of biotech play you can count on for the long haul.

Best,

Michael A. Robinson

P.S. Drug development is a massive industry that’s undergoing an AI revolution. But it isn’t alone.

Investing is another. In fact, Weiss Ratings is at the forefront of this enormous change.

Earlier this week, Dr. Martin Weiss unveiled a brand-new AI trading system that beat the market 94-to-1.

This presentation won’t stay online for long. I urge you to watch it while you can.