Dollar’s Doom Can’t Stop the ‘New American Wanderlust’

|

| By Michael A. Robinson |

To hear the media say it … going to Europe right now is a trip for fools.

After all, with the dollar down about 11% since the start of 2025, it’s now more costly than ever to head overseas.

As a guy with an honor’s economic degree, I get the math. And so does my MBA wife.

And yet, our recent chat on maybe changing plans was pretty brief.

I asked if maybe we should scale back and do something in the U.S. instead.

She didn’t hesitate: “Absolutely not — we’re going to Europe.”

That sums up the $1.7 trillion global travel boom better than any survey ever could.

Despite all the noise, Americans are spending more than ever on vacations abroad.

Intent to travel is soaring.

Wallets are opening wider.

And that’s creating one of the biggest profit waves we’ve seen in years.

Today I’ll show you one stock at the center of it all, one that’s on pace to double earnings in less than two years …

The New American Wanderlust

Now then, as a guy with chronic low back pain, I’m no fan of long flights.

Flying from San Francisco to Venice is sure to cause some aches and strains.

But I have to say I’m really looking forward to this one. After all, it’s our thirtieth wedding anniversary.

We are starting off in Italy, where we will also visit Florence and Rome.

Then we fly to Athens.

Once there, we board a cruise ship that will tour the coast of Greece and Croatia before docking in Italy.

I’m sharing this with you because there is a larger issue here.

If you think Americans are scaling back on travel, think again.

Fresh surveys show that more than half of us plan to travel more this year than we did in 2024.

About 44% are already booked for trips that involve a flight or hotel stay.

Even better, they’re opening their wallets.

The average household plans to spend nearly $5,900 on travel in 2025 — roughly $1,400 more than last year. That’s a 31% jump in just 12 months.

And the drive runs across all age groups.

Like me, boomers “of a certain age,” are traveling to honor milestones. Gen Xers and Millennials are blending vacations with remote work.

Even Gen Z is driving demand. As a group they spend early earnings on experiences rather than stuff.

This paints a clear picture: What I call the “New American Wanderlust” is alive and well.

More people are flying.

More people are staying in hotels.

And more people are willing to pay up for the experience.

Planes, Planes & More Planes

On the supply side, the story is just as bullish.

Boeing issues one of the most respected outlooks in aviation.

Its latest forecast sees the current travel boom lasting until at least 2041.

That means a need for tens of thousands of new aircraft over the next two decades.

By then, global airplane sales will be up by about 80% compared with 2019’s pre-Covid baseline.

In other words, the total market for new planes is worth an astounding $7.2 trillion.

Airbus is equally upbeat.

Its backlog now stretches years into the future.

Both firms know airlines need more fuel-efficient fleets to handle surging demand while also hitting targets for cleaner air.

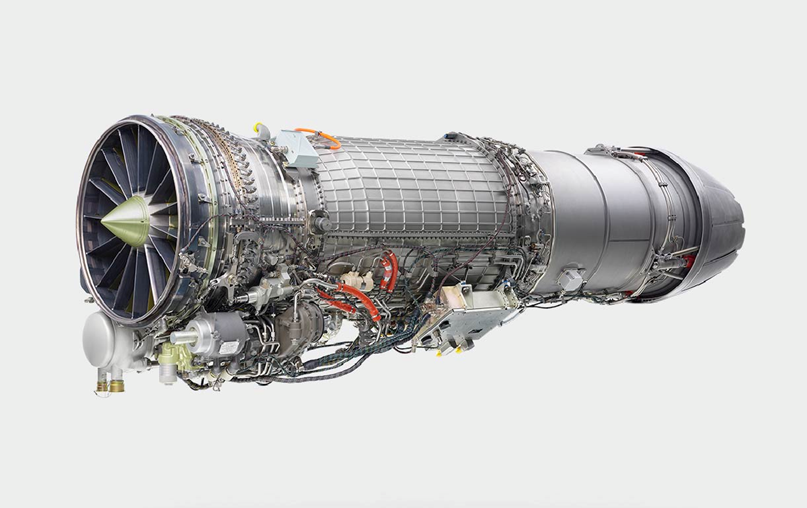

And here’s the catch: The real profits don’t flow to Boeing or Airbus alone.

The real money shows up in the firms that supply the engines and technology that make these aircraft fly.

A Legendary Name with New Life

That brings me to GE Aerospace (GE).

I talked about this historic American icon on Tuesday.

You’ll recall that GE is partnered with NASA on the future of space exploration.

But the company’s main business still goes back to its roots more than a century ago.

This firm has been in aviation since before the Wright Brothers lifted off at Kitty Hawk. But its future looks brighter than ever.

You may recall that General Electric split into three companies in 2023: GE HealthCare, GE Vernova and GE Aerospace.

The idea was to strip down the old conglomerate and make each unit leaner and more focused.

GE Aerospace got the famous ticker “GE” for a reason. It’s now the crown jewel.

Here’s why. The firm has a 55% global market share in commercial jet engines, according to Statista.

That lead spans from regional jets to wide bodies flying routes all around the world.

It’s also a key defense contractor.

GE engines power U.S. fighter jets, transport aircraft and helicopters.

A new division, AiRXOS, is pushing into drones and unmanned flight systems — another frontier with enormous potential.

This isn’t just about legacy engines.

GE is deeply embedded in the next generation of flight technology, from fuel efficiency to autonomous air traffic control.

The Earnings Engine

What a turnaround we have here for a huge sector.

Just months ago, we saw tons of headlines suggesting that Trump’s tariffs would keep folks away from visiting the U.S.

I also lost track of the stories saying that with the dollar weaker, millions of us would just stay in the U.S. this year.

And yet, the exact reverse is true. Travel is back — and in a big way.

Americans want to fly, cruise and explore. Which is one reason why global demand for planes is soaring and will remain that way for at least 15 years.

And standing at the center of it all is GE Aerospace.

Plus, it gives us hooks in defense and drones, just to name a couple.

All that dominance translates into profits. And the numbers are eye-popping.

Over the past three years, GE has posted average per-share profit growth of 81%. To be conservative, let’s cut that in half.

Even then, we’d still see per-share profits on pace to double in less than two years.

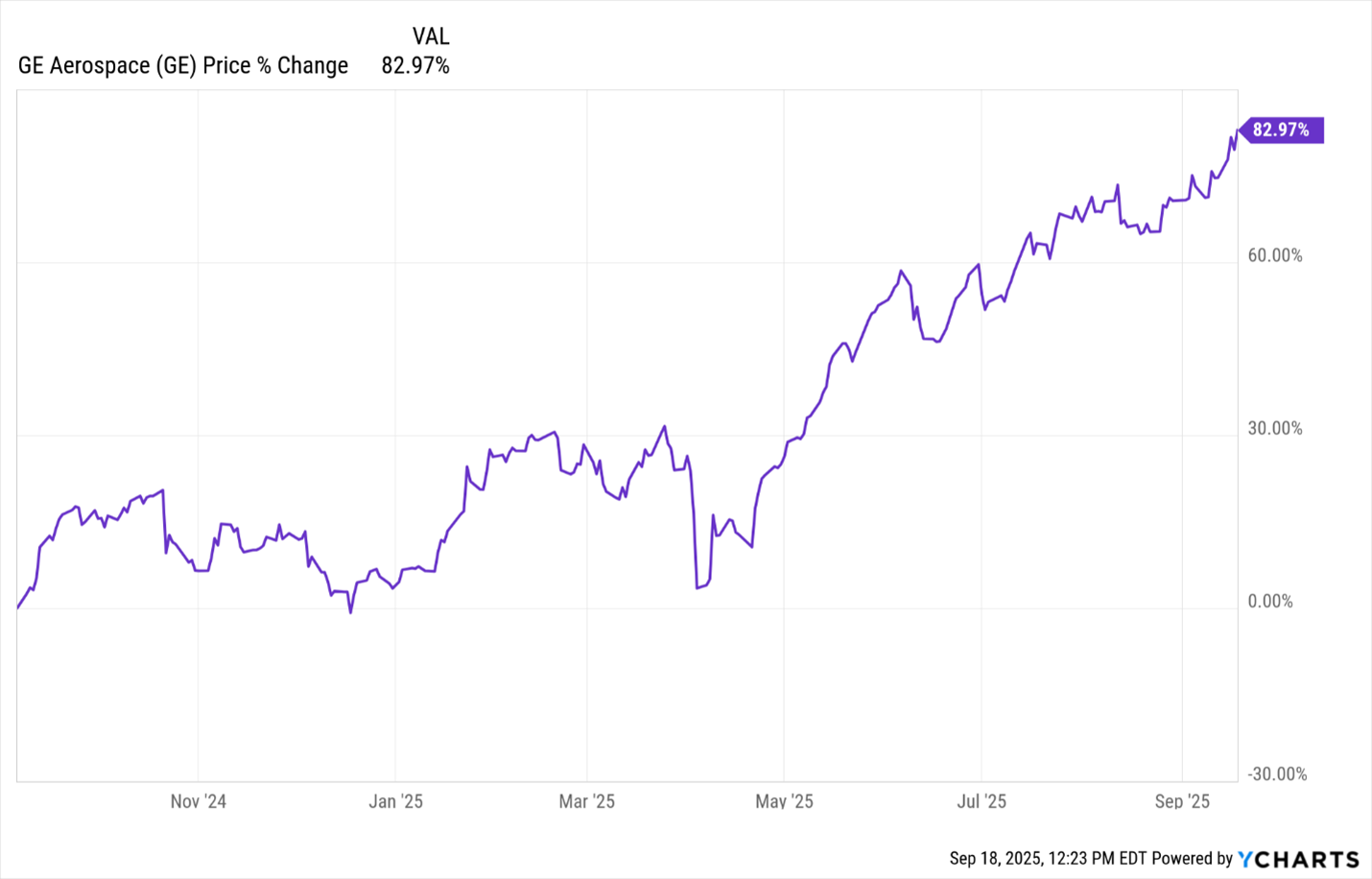

That’s why I don’t mind sharing this historic name here … after my subscribers got an 83% head start. There’s plenty of gains left for everyone.

In other words, this isn’t just a smart play on the “New American Wanderlust.”

It’s a stock with the power to add real jet fuel to your portfolio for years to come.

Best,

Michael A. Robinson

P.S. As I noted on Tuesday, GE is also one of the major players in a second megatrend I’m following — the New Space Race.

But the name that draws all the attention in this field is SpaceX.

What would you do if I told you I have four companies that are in position to do even better than that towering name?

Better yet, what if I told you that if you attend Tuesday's event, I’ll give you one of them for free — name and ticker?