|

| By Tony Sagami |

During the eight years I lived in Texas, the summers were so brutally hot, I ran my air conditioner all day and all night.

Heat waves put so much extra strain on the independent Texas electrical grid that brownouts and power outages have become common.

In fact, earlier this month, the state asked residents to reduce use of major appliances in anticipation of increased demand during the latest heat wave. And in May, a heat wave was so bad it knocked six Texas power plants offline.

It's not just heat waves causing demand strains, either. In 2021, the failures of the state's power grid resulted in the deaths of 246 Texans during a February winter storm.

The biggest issue with the state's power grid is that it's independent of the rest of the nation's, meaning it avoids federal regulation … but also meaning that Texas cannot borrow energy from other states when its power infrastructure fails, as it's often prone to do.

And despite having some of the best onshore wind power potential, the state heavily relies on fossil fuels for nearly all of its electric power production.

With an aging, disconnected grid and a reluctance to embrace renewable energy, Texas has its fair share of issues with meeting electricity demand. Now, it has another …

Soaring Electrical Demand for Electric Vehicles

The situation is so dire that the Electric Reliability Council of Texas is pleading with residents to conserve energy, including NOT charging their EVs vehicles during heat waves.

I have nothing against EVs, but our politicians are getting ahead of themselves with their push for them. Even if you can afford a new EV, like Secretary of Transportation Pete Buttegieg is urging, you're going to face a different set of problems.

EVs are the future, but they're simply not ready to replace internal combustion vehicles. Here are a few key reasons why …

- Shortage of Charging Stations: Around 80% of EV charging occurs at home. But for that other 20%, there simply aren't enough charging stations in the U.S. (yet), especially in rural America.

- Slow Charging Times: The typical charging time for an electric car is around eight hours, which is why most EV owners charge their vehicles overnight at home.

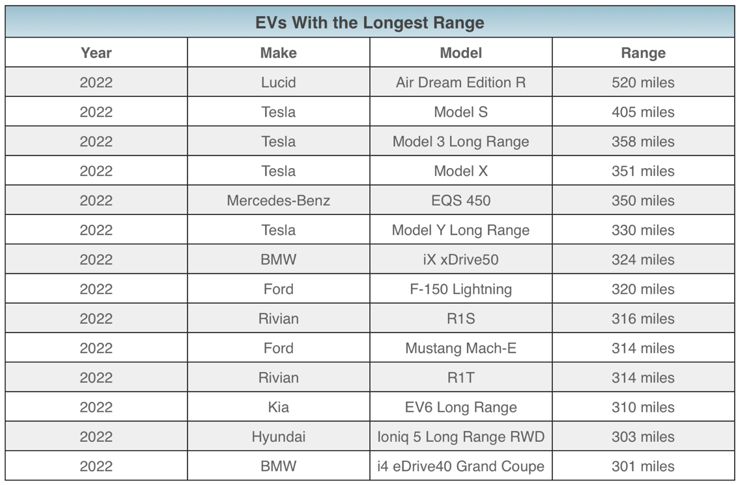

- Limited Driving Range: Range and efficiency are improving at a rapid clip. Look no further than Aptera's industry-best drag coefficient and 1,000-mile range. But most electric cars currently on the market have a range of about 250 miles. And only a 14 mass-produced EVs have better than a 300-mile range:

- Shortage of Service Centers: Good luck finding a repair shop for your EV.

- EVs Are Expensive: Electric cars can be as expensive as higher-end ICE vehicles, which middle- and low-income Americans generally can't afford.

- Electricity Isn't Free: Owners still need to pay for the electricity powering their EVs. That said, it's a LOT cheaper than filling up an ICE vehicle with gasoline. According to the U.S. Department of Energy, if electricity costs 10.7 cents per kilowatt-hour, that translates to $6 each time an EV with a 200-mile range is fully charged. But it's still not free.

How to Invest in the Looming EV Revolution

That doesn't mean you can't make money from the EV food chain. In fact, members of my service, Distruptors & Dominators, own both Tesla (TSLA) and Albemarle (ALB), the largest lithium producer in the world.

Tesla just reported a gangbuster of a quarter, delivering slightly higher revenues than expected. However, it blew the doors off of profit expectations with $2.27 per share of profit, smashing the consensus estimate of $1.82 per share and 56% more than the $1.45 it earned last year.

Best of all, Tesla expects to hit record production levels, with 1.4 million units this year, and grow that by 50% a year going forward.

Bottom line: While electric cars aren't ready for national prime time yet, there's massive opportunity for EV stocks.

I'm sure savvy investors like you would much rather see that opportunity fuel their portfolios than make a purchase that'll soon have their bank accounts running on empty.

Best wishes,

Tony