Find Out the Real Danger of FedNow

|

| By Nilus Mattive |

Nilus here. If you’re sick of waiting for checks to clear, you’ll probably like what my colleague has to say at first … less so by the time he finishes.

I have a guest essay today from Ted Baumann. He’s a celebrated economist and best-selling author. His lifelong commitment is to help people realize financial and personal freedom. His specialty is to find ways to navigate “off the grid.”

So, you can trust what he has to say about the newest government financial transaction platform. I’ll turn it over to him now …

The Problem with FedNow

Have you heard of FedNow?

What is it? What is worth worrying about? What's not worth worrying about?

Those are hot questions in my corner of the off-grid world. I’m here to answer them.

Well, first of all, FedNow is a payment system. It is not an alternative currency. It's not a central bank digital currency. It doesn't run on the blockchain.

It is simply a more efficient way, at least from the perspectives of the bank and the Fed, to move money from one party to another.

Let's say you want to pay your mortgage. You send a payment, and it’s only credited to your mortgage provider three or four days later.

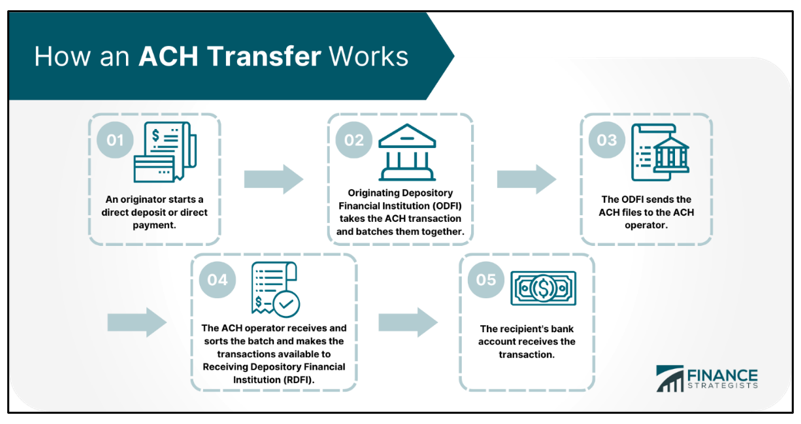

That's a result of what's called the Automated Clearing House system, which is the current standard for making payments.

As you can see, this is too long of a process for modern day finance.

What FedNow intends to do is to make these kinds of payments instantaneous.

To do this, the Fed created a computer platform that allows the central bank to deduct money from your personal bank's reserves and transfer it to the other party's bank reserves instantaneously — so that you don't have to wait for that clearance to happen.

In one sense, this sounds pretty good, right? No more waiting for that mortgage payment to clear. No more mix-ups or BS late fees.

As you can imagine, especially involving a new system created by the Fed, there are some current and potential problems coming down the road.

What FedNow Isn’t

Some skeptics — a group to which I often proudly belong — worry this might be a government cryptocurrency product. It isn't.

It doesn't replace the dollar. Nobody can confiscate your dollars simply because the FedNow system exists.

There's no more threat now to your bank holdings than there was before.

That's because this doesn't run on the blockchain.

Your account balance is not held at the Fed.

Your balances are still held at your bank.

The only thing it's changing is that your money is transferred instantly — 24/7, 365 days a year — from when you pay somebody or when somebody pays you.

Now, what are the dangers of this?

Higher Identification Requirements

Since FedNow transactions happen instantaneously, obviously there has to be an authentication process that involves looking at who you are as the person sending or receiving the money.

Now, the way things work at the moment is that banks do their reconciliations.

When customers of one bank transfer money to customers of other banks, the banks basically clear all those transactions at the end of each business day, hence the Automated Clearing House system.

And really, all of that is done at the bank level. The banks are not necessarily worrying about the individual transaction. They're simply taking a bunch of transactions, and they're settling them at the end of each business day or maybe after 48 hours or 72 hours, whatever the case may be.

You as the individual and the other party who's either receiving money from you or sending money to you is not identified.

FedNow, on the other hand, obviously requires some way to authenticate and identify the person’s identity when an instantaneous transaction takes place, even if it's going through your bank and going through the other party's bank.

If this requirement wasn’t in place, then anybody could log into your bank account and make payments all over the place. And there'd be no way to stop them — because remember, these are instantaneous payments.

Therefore, FedNow will have a higher level of identity requirement in place than normal.

It’s very similar to Zelle or PayPal (PYPL).

That's why these private payment networks send things like a text message to identify who you are or an email message to authenticate and confirm: “Yes, this is me making this transaction.” Because when the transactions are instantaneous, it increases the risk.

So, the parties involved need to provide more secure and sensitive information.

This is where potential problems could come into play.

Database Red Flags

The issue here is that information passing through FedNow will presumably be stored somewhere. That means that that information will now form part of a database.

Even if the intention is not to use that information for anything other than allowing the FedNow system to operate, you can bet your bottom dollar that it will be used for other purposes somewhere down the line.

If there's an opportunity to use data for the purposes of law enforcement or taxation or whatever, you can bet that they will use it.

That information will be used in ways in which it wasn't initially intended.

Now, I personally don't think that this is an immediate threat.

It's really more of a medium-term threat. FedNow is building a platform for a much bigger threat going down the road.

It's being able, for example, to do kind of reverse lifestyle audits.

If you use FedNow constantly, that means that somebody can go in and look at all your transactions and work out very quickly how much money comes in and how much money goes out … to work out whether or not that actually is compatible, for example, with your lifestyle, your career, your earnings and that sort of thing.

That's very intrusive, but that's not an immediate threat right now. It is, however, something that is probably going to be a threat down the road.

How to “Opt Out”

Now, a lot of people have asked, "Can't we find out which banks use FedNow?"

Well, absolutely you can. And while there isn’t really an actual option for “opting out” if you find out your bank does indeed use the system, you can still ask your bank about it. If they do use it, then you can make a decision about whether you’d like to bank with them or not.

At last count, around 57 banks and other types of financial institutions have agreed to use FedNow. That includes most of the major Wall Street banks, including Wells Fargo (WFC) and JPMorgan (JPM).

Here is a very early list from the Fed itself.

That leaves out a lot of banks. In fact, there are around 7,000 banks in the United States, and only 57 of them at this point signed up for FedNow. But we can assume that more will sign up in the future.

My takeaway: If the potential for this invasive new system worries you, call your bank and ask if they’ve signed up for this new FedNow system.

It’s better to catch it now before you find yourself in a database.

Kind regards,

Ted Baumann