|

| By Michael A. Robinson |

Hurricane season gives us proof every year why every homeowner should own a generator.

Here’s the thing. The high winds and torrential downpour from Hurricane Helene caused more than $35 billion in damage, according to Moody’s Analytics.

Milton’s bill will still take some time, as it just made landfall a little over a day ago. But cleanup should also cost in the billions.

More to the point, the high winds and tornadoes snapped trees and downed power lines in several states. This left millions in homes and businesses without power.

Here in California, we’ve been pretty lucky so far this fall. This is the season when high winds can force utilities to cut electric power. After all, just one spark from a downed line can cause an inferno.

So, if you don’t have a backup power source on your property, you’re at the mercy of your local utility company.

With that in mind, today I want to introduce you to the leader in the roughly $17.5 billion market for backup power for homes and businesses.

And I’ll show you why it’s set to double per-share profits in as little as three years …

Now then, you may think that living in California would mean I don’t have to worry about my power going out for days at a time due to inclement weather.

But you would be wrong …

Fires Lead to Outages, Bankruptcy

Here in the Golden State, we’re supposed to remain alert to any impending electricity shutdowns caused by high winds. The idea is to forestall disastrous firestorms.

Take the case of the Santa Rosa Tubbs Fire in 2017 — the most destructive wildfire in California history at the time. Some 5,600 structures were burned and some $1.2 billion in damages occurred before the fire could be contained.

Not only did firefighters have to deal with the origin of the fire, but strong winds also knocked down 10 power lines, causing transformers to explode.

Additionally, these 41 MPH winds contributed greatly to the amount of damage that occurred before first responders were able to get everything under control.

Bay Area utility PG&E and its arcing power lines were blamed for much of the disaster. The company filed for bankruptcy after other fires were sighted as being caused by similar infrastructure issues.

So, it is no wonder why PG&E now takes precautions by issuing planned power outages for days at a time when fire danger is particularly high.

The Clear Leader

Now you know why Generac Holdings (GNRC) is targeting more growth in California in addition to states subject to hurricanes or heavy snow and ice that can knock out power over vast stretches.

Generac has been around for 65 years and is the top selling brand in home backup generators. They dominate the market.

You can find Generac in the homes of 75% of Americans who own generators.

And with the rise of remote and hybrid work, the need for people to have backup power for their homes faces a long runway. Indeed, the room for Generac to explode in this segment of their business is substantial.

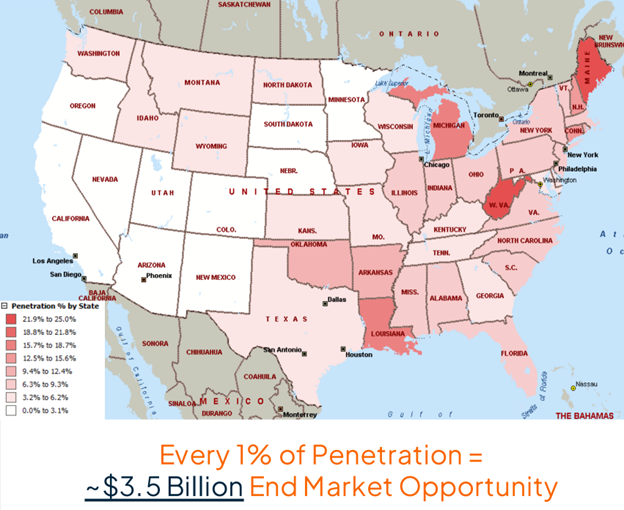

Consider that less than 7% of U.S. households have invested in backup power sources for their homes. If the company bumps that up by even one percentage point, it would add $3.5 billion to its end market opportunity.

While the company makes over half of its money selling residential products like standbys and portables, it also has products in the commercial & industrial sector, as well as grid services offerings.

Generac’s commercial & industrial products include business standby, industrial and mobile generators, light towers, heaters and pumps. It provides solutions across a myriad of industries. Two big ones are telecommunications and data centers.

Backing Up 5G, AI

With the continued rollout of the 5G cellular networks and AI data centers, there is a need for significant improvements in backup power solutions. See, 5G needs three times the number of base stations to support power consumption than earlier mobile generations.

And the standards for telecom infrastructure are high. Telecommunication backup power runs on the “Five 9s” — flowing electricity to relay stations, servers, antennas and the like 99.999% of the time, 24/7.

Data centers also run on the “Five 9s.” Keeping the power on here is critical. A sudden loss in power has the potential to bring an entire data center’s operation to its knees.

Meantime, Generac has a relatively new revenue stream in grid services and energy-as-a-service.

Concerto is an open software platform that helps grid customers get the most out of their operations.

The software enables an efficient balance of supply and demand in real-time to make energy more accessible. Specifically, it gives you the power to bring megawatts online, optimize distributed energy resources and access advanced insights.

Earnings Accelerate

Generac has also moved into the growth market for solar batteries. Its PWRcell Solar+ Battery Storage system can keep an entire home running.

With demand for solar power and the need for backup, this offers years of growth.

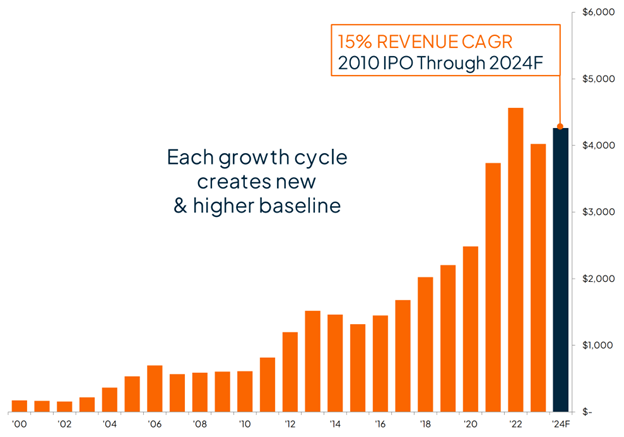

To be sure, the stock was out of favor earlier this year as Wall Street worried about earnings growth after the company invested heavily in building out the franchise.

But in its most recent quarter, the company reported per-share profit growth of 25%. At that rate we’d see a double in less than three years.

In other words, playing the long game here offers plenty of upside.

So, as you can see, this is a company that can electrify both your home and your portfolio.

Best,

Michael A. Robinson

P.S. Of course, you don’t have to wait three years with my colleague’s Instant Income system. I urge you to check it out and see how to collect about $1,000 nearly every week in extra income.