Americans, stuck at home during the COVID-19 pandemic with nowhere to go, drove an astounding 470 million fewer miles in 2020 than they did in 2019. But the price of gas and other fossil fuels have rebounded and are now surging to multi-year highs.

Motorists are once again hitting the road … and thank goodness I only drive a couple hundred miles a month.

• The national average for the price of gas hit $3.42 last week, a seven-year high.

Prices vary widely depending on where you live: California ($4.45), Hawaii ($4.13) and Nevada ($3.90) have the most expensive gas, while Texas ($2.92), Oklahoma ($2.94) and Arkansas ($2.97) have the lowest.

So, where’s this rapid price increase stemming from? Demand.

A barrel of oil is trading for more than $80 a barrel and appears to be headed much higher. But oil isn’t the only fuel source soaring in price; natural gas and coal prices, on a percentage basis, have jumped even more than oil.

|

| Source: BP |

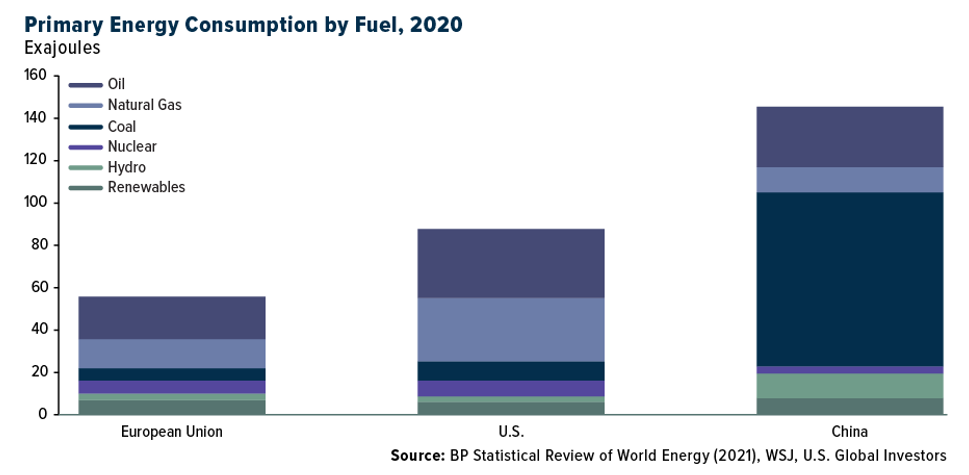

Coal use has been falling in the U.S. and European Union, but in China, it is the largest source of electricity by a WIDE margin. According to the International Energy Agency (IEA), coal generates 40% of the world’s electricity and 46% of global carbon emissions.

The IEA estimates there are 140 GW of new coal-fired electric power plants currently under construction. Plus, the world leaders of the G20 who just met in Scotland failed to agree to stop the use of coal in their own countries.

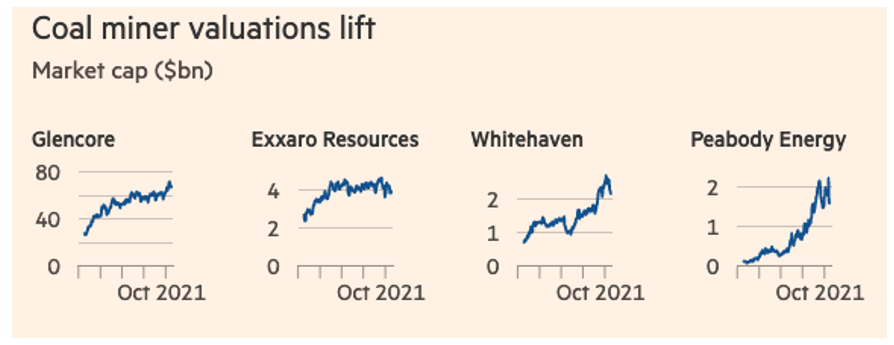

Whether you love or hate it, coal isn’t going away anytime soon, and coal mining stocks have been on fire.

|

| Source: Financial Times |

For example, the stock price of Peabody Energy (NYSE: BTU) has skyrocketed over 700% in the last 12 months.

And even after jumping 700%, Peabody Energy is only trading at two times forward earnings.

• Yup, only two times forward earnings!

In addition to Peabody Energy, you should also take a look at Alpha Metallurgical Resources (NYSE: AMR), Arch Resources (NYSE: ARCH), CONSOL Energy (NYSE: CEIX), Ramaco Resources (Nasdaq: METC) and SunCoke Energy (NYSE: SXC).

Exchange-traded fund (ETF) investors, however, are out of luck. The last coal-focused ETF — the Van Eck Vectors Coal ETF (NYSE: KOL) — closed in December 2020. The ETF only had $35 million in assets, which shows how out of favor coal was with investors, big and small alike.

Earlier this year, Blackrock announced that its actively managed funds would not invest in companies that derive more than 25% of revenues from coal operations and the New York State Common Retirement Fund, a pension plan, pledged to reduce portfolio holdings with greenhouse gases emissions to zero by 2040.

Yes, coal is dirty. But coal is not going away anytime soon … and the demand for it is growing, not shrinking. That is good news for investors of coal producers.

As always, be sure to conduct your own due diligence before making any investments.

Best wishes,

Tony Sagami

P.S. I have a special report to share with you. Our friends at Long Live Your Wealth have shared this timely information, and I encourage you to check it out now by clicking here.