From Ancient Wine Service to a $376B Industry

|

| By Michael A. Robinson |

Katakolon, Greece — Let’s start today’s tech investing chat with a little pop quiz.

Who built the first robot?

If you guessed George Devol, you’re right — sort of.

In the 1950s, he created Unimate, the first programmable bot for industry.

It’s the same kind that went on to transform auto making and launch the age of robots I’ve been writing about since the early ‘80s.

Or maybe you’re thinking of Leonardo da Vinci.

More than 450 years earlier, he sketched out a mechanical knight that could stand, sit and move its arms.

But the real answer takes us even further back. We’re talking the third century BCE.

It was Philo of Byzantium, the ancient Greek genius, who built what we now regard as the world’s first “robot.”

I learned this on a recent tour my wife and I took of the Museum of Ancient Greek Technology here in this lovely port town on the Ionian Sea.

Our visit got me thinking yet again about this unstoppable trend that’s on its way to being worth more than $300 billion in less than a decade.

Today, I will reveal a great tech leader that has beaten the broad market’s returns over the past five months by 63% with plenty of upside ahead.

Related story: The Earnings Double I Found While Traveling With AI

Now then, I ended up here with my wife Tracy as a side trip from our cruise from Italy along the shores of Greece and then on to Croatia.

At Katakolon, we were excited to go the tech museum to see what the ancients had made.

We were impressed with the whole thing. But we were really blown away with Philo’s bot.

The human-shaped automaton would actually pour wine mixed with water into a guest’s cup. The system’s hidden pipes and air valves would respond to the weight of the cup.

Fast forward to 1954, when Devol’s patent for a “Programmed Article Transfer” device gave the world its first programmable robotic arm.

The design featured six degrees of freedom that allowed the arm to perform repetitive tasks on its own.

By storing step-by-step commands on a magnetic drum, it could repeat complex motions with precision.

Make no mistake, while Philo’s early Greek design was impressive, Devol’s 1961 patent for the device became the bedrock of the robotics sector we see today.

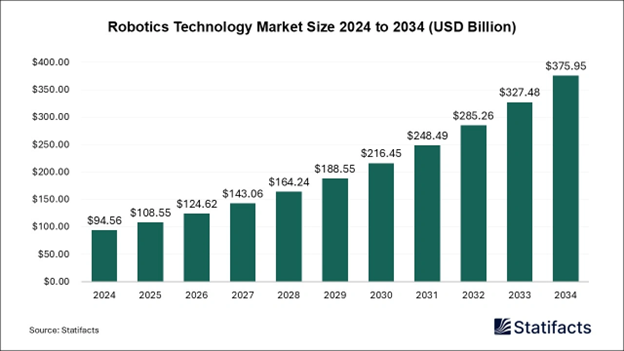

It’s a market forecast to grow from $109 billion by the end of this year to $376 billion by 2034.

Robots and AI are helping make products better, fix problems before they happen and keep the supply chain running more smoothly.

Another key frontier of robotics is self-driving cars and trucks, also known as AVs.

AI is helping create new car features that can spot dangers, predict when maintenance is needed and find the best routes to drive.

By 2034, AVs are expected to grow into a $4.5 trillion market.

Those are big targets for a smart play on this rapidly expanding sector.

Enter the Robo Global Robotics and Automation Index ETF (ROBO).

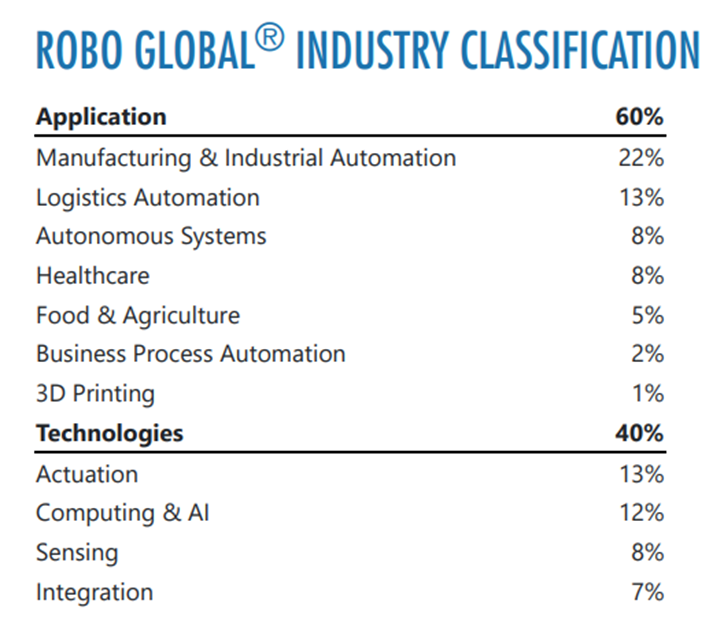

ROBO is a fund that holds stocks in leaders across the global value chain.

This includes firms that make things like sensors, AI and navigation systems, and others that use them to build robots and machines for work and home.

With over $1 billion in assets under management, the ETF also features companies in fields like food, 3D printing and a wide range of sensors.

Top holdings are a who’s who in the sector.

We’re talking everyone from Teradyne (TER) to Symbotic (SYM) and Intuitive Surgical (ISRG).

The overall list of firms breaks down to roughly 50% large-cap, 35% mid-cap and the rest are smaller players.

Here are some of the top holdings …

- Autodesk (ADSK). The firm stands to profit as the software power behind 4D printing.

This tech allows objects to self-assemble via heat or light.

And it’s leading a market growing 40% a year toward $32 billion.

Uses include self-folding furniture, shielding for NASA spacecraft and adaptive medical implants that can adapt later to the body.

- John Deere (DE) is all over the $150 billion precision ag market.

It counts Starlink as a partner, bringing satellite WiFi to 60% of North American farms.

The firm plans to connect 1.5 million machines by 2026.

That could help the firm continue to drive its 36% average annual profit growth over the past three years.

- Celestica (CLS) provides key infrastructure for AI data centers and 5G networks.

Those are markets forecast to be worth a combined $1.2 trillion. And it caters to industrial, smart energy and aerospace clients.

Over the past three years, it has grown per-share profits by roughly 38%. Earnings are forecast to rise roughly 60% for the full year.

- Rockwell Automation (ROK) is a standout capitalizing on America's $141 billion factory building boom.

It provides industrial control systems, software and services to a wide range of sectors.

Their advanced tech helps clients connect machines, collect and analyze data, not to mention make decisions that drive smart manufacturing.

And while robots are as old in some ways as the ancient Greeks, the investment thesis here is pretty modern.

After all, in recent years, the field has become an unstoppable trend with the sector doubling over the past decade.

Now then, as you might imagine, the stock sold off with the rest of the market earlier this year during the Tariff Tantrums.

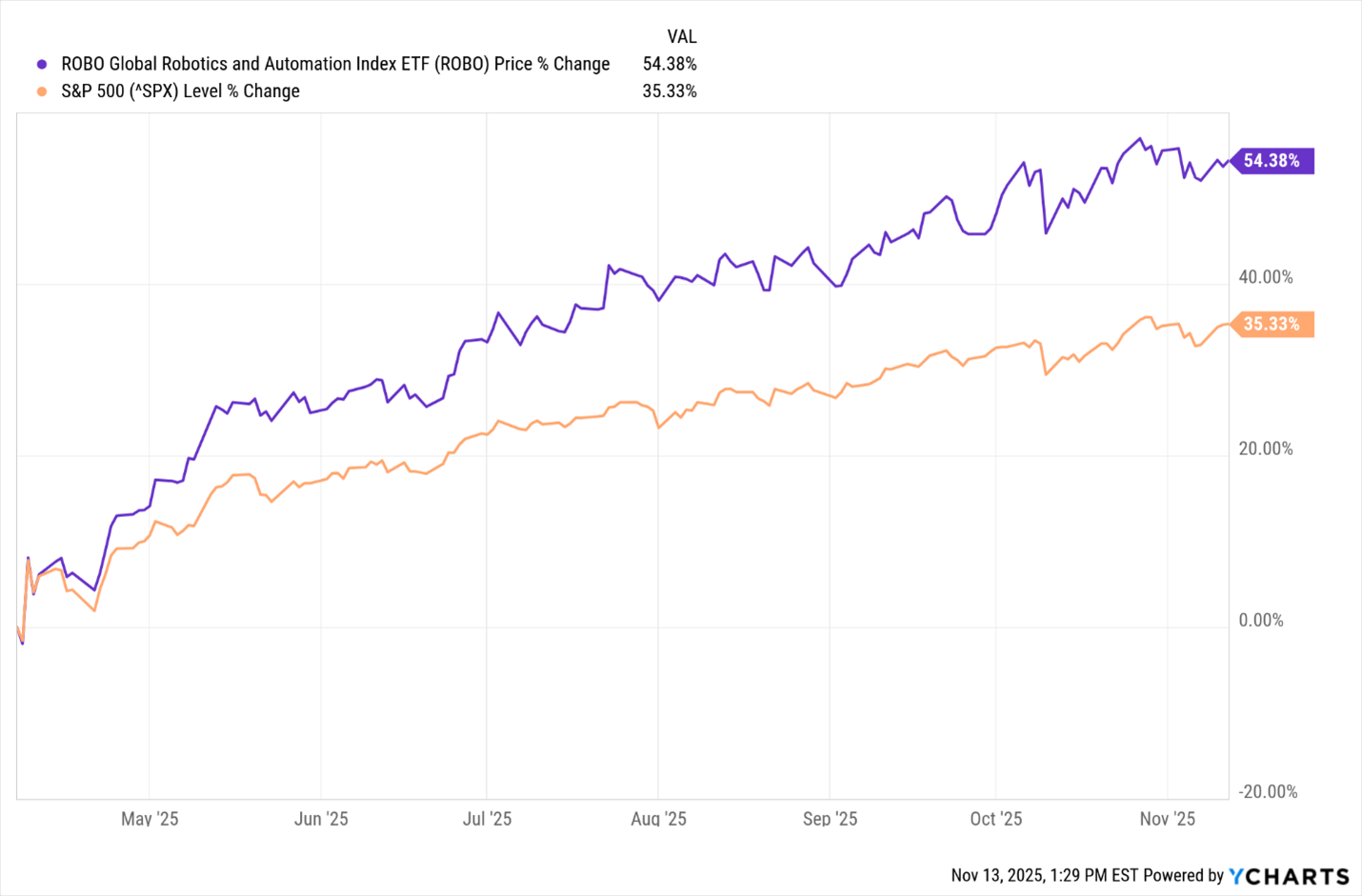

But since the rebound that began last April 7, ROBO is up more than 54%, compared with 35% for the S&P 500.

That means the ETF beat the benchmark by 54% over that time frame.

And as we continue to adopt robots across the board, this is an investment you can hold for the long haul.

Best,

Michael A. Robinson

P.S. The estimate above for how big the robotics industry could be is conservative.

In fact, rather than $376 billion, I think we’ll see it grow into the trillions much quicker.

And there’s one $7 stock that’s behind Nvidia’s push into the field.