|

| By Michael A. Robinson |

A billionaire and an Oscar winner walk into a bar.

No, wait. That’s not right. Let me try that again …

A billionaire and an Oscar winner make a documentary about investing. And it turns into a major hit.

Seriously, that’s really what happened.

In 2023, documentarian Errol Morris and investment-fund manager David Booth released “Tune Out the Noise,” a film centered around investment strategies — in particular, one known as passive investing.

This approach may work for the average investor. But as I’ll explain, it’s a recipe for returns that are, well, average.

To capture market-crushing, life-changing returns, you need to find stocks that obliterate the market. It’s that simple.

And today, I’ll reveal an obliterator that’s set to quadruple its earnings in less than three years — and could potentially quadruple your investment dollars, too.

Lights, Camera, Invest

As I mentioned, the film “Tune Out the Noise” was a triumph. And that’s not the easiest to achieve when your plot focuses on financial investing.

The movie follows a young investor named Alex who tries to navigate the world of stock trading. Along the way, he learns the importance of tuning out external noise, including market volatility, to make sound and informed investment decisions.

The result is a focus on passive investing, a strategy that aims to generate returns by holding investments for long durations, rather than frequently buying and selling.

Basically, you track a broad index (the S&P 500, for example), invest your money and forget about it. You’re not actively making moves within the market — hence the term “passive investing.”

I view this as a low-risk way to invest. But keep in mind that low risk often comes with low rewards. And that’s what you get with passive investing — middle-of-the-pack results.

We’re in it to win it, though. That means making investments that surpass the average investor and hopefully earning life-changing returns.

To do that, we need to find stocks riding unstoppable trends. And that means finding companies with eye-popping growth — like this one …

Data Dynamo

Palantir Technologies (PLTR) is a data analytics company based in Palo Alto, California.

It was founded in 2003 by four entrepreneurs including Peter Thiel, cofounder of PayPal and the first outside investor in Facebook.

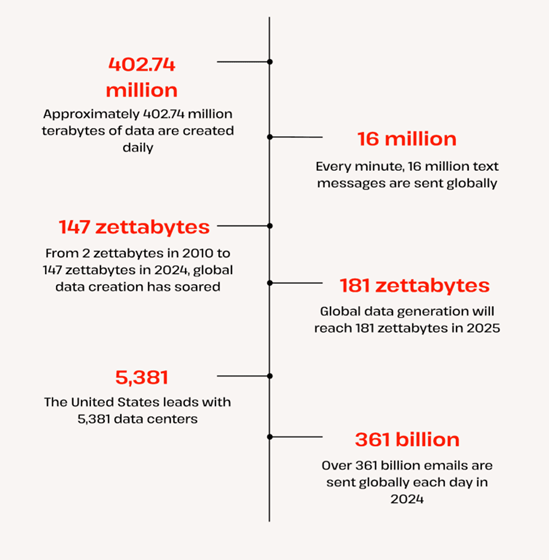

Palantir is known for its software that helps organizations make sense of large amounts of complex data. And with more than 180 zettabytes of data in the world — one zettabyte is equal to one trillion gigabytes — there’s a huge need for this company’s services.

Perhaps that’s why Palantir has split its main offerings into four primary projects:

- Palantir Gotham — This is an intelligence and defense tool used by militaries and counterterrorism analysts.

- Palantir Foundry — This is used for data integration and analysis by corporate clients.

- Palantir Apollo — This platform is used to facilitate continuous integration and delivery of software.

- Palantir AIP — This platform empowers organizations to leverage AI and create AI-driven applications and solutions. (More on Palantir’s AI capabilities in a moment.)

Palantir has amassed quite the variety of customers, including those in industries like healthcare, finance and law enforcement.

Notable customers include Morgan Stanley, Merck, Airbus and Fiat Chrysler.

But overwhelmingly, this company’s biggest customer is the U.S. government …

A Long-Standing Relationship

Palantir and the U.S. government have a long-standing relationship. Actually, the United States Intelligence Community and the U.S. Department of Defense are among the company’s customers.

In fact, its software-as-a-service is one of five offerings authorized for Mission Critical National Security Systems at an IL5 level (basically, this means the government trusts Palantir’s software to store and process some of our nation’s most sensitive data).

Not only does Palantir support the government on the civilian side, but it also does so on the military side.

In late 2024, Palantir won contracts with the U.S. Army worth up to $619 million, including an extension of the Army’s Vantage program, which involves software that helps the military branch across every data domain — from readiness and logistics to recruiting and force management.

And earlier this month, Palantir was in line to win a U.S. Army contract that could deliver annual recurring revenues approaching $100 million.

Palantir’s Use of AI

Palantir’s relationship with our government is impressive. And that’s partially due to the company’s use of AI.

For starters, its Foundry and Gotham platforms use AI to automate the process of integrating and harmonizing data from different sources.

AI-powered algorithms identify and link data points, even when the data is unstructured or incomplete. This is critical for turning chaotic, fragmented data into cohesive datasets.

Furthermore, Palantir uses machine learning algorithms to build predictive models. These models are trained on historical data to forecast future events.

In healthcare, for example, the company’s tools can predict patient outcomes, helping doctors and hospitals plan for potential surges in demand.

When it comes to aggregating and analyzing data, Palantir’s AI is particularly helpful. It can recognize hidden patterns and detect anomalies.

Machine learning models can be trained to identify deviations from normal behaviors, which can be crucial for early detection of fraud, cybersecurity threats and supply chain disruptions.

Finally, Palantir uses natural language processing to process and analyze unstructured data, such as text documents, emails and social media posts.

With Gotham, NLP algorithms can analyze large volumes of documents to identify relevant information and even flag potentially dangerous content.

An Earnings Powerhouse

Earlier, I mentioned finding companies with eye-popping growth. Palantir certainly fits that criterion.

Over the past three years, this company has grown earnings by an average of 83%. At that rate, they’d double every 10 months. And they could potentially double again in just about three years.

Remember, when earnings grow, stock prices usually do, too. In other words, this is an opportunity to invest in a company and potentially see your money quadruple in just about three years.

This is the kind of stock you need in your portfolio to help you earn the market-crushing returns that lead to true wealth.

As you can see, it doesn’t take much effort — just knowing the right stocks can do the trick.

Best,

Michael A. Robinson

P.S. If you think Palantir’s grip on such a large hoard of data is impressive, you’ll love what Dr. Martin Weiss just revealed.

This week, the founder of Weiss Ratings launched a brand-new AI stock-picking system that analyzes nearly 8 million different data points on every stock we rate.

As you can imagine, that can give you a huge advantage. See for yourself here.