|

| By Tony Sagami |

How much Top Ramen did you eat in college?

I got sick of the instant noodles after a while, but at 10 packages, and sometimes 15, for just $1, they were too cheap for a broke college student to pass up.

And in one of my microeconomics courses, I vividly recall the professor teaching us about inferior goods — those for which demand decreases as income increases.

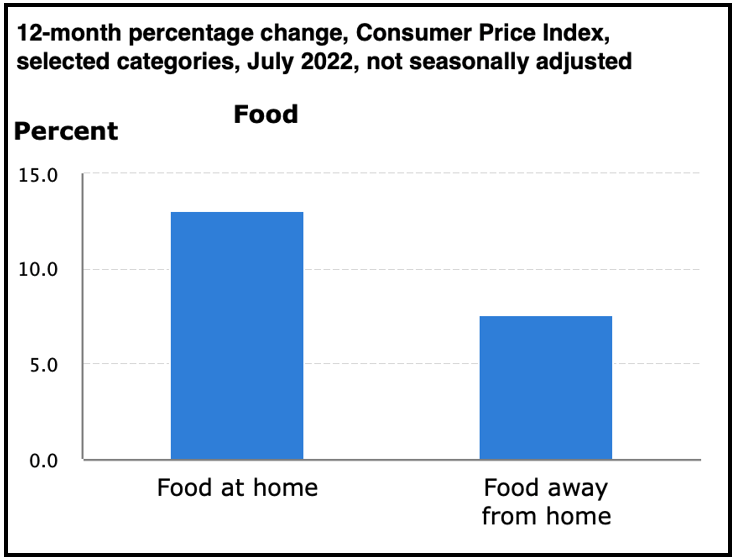

Inflation for food at home reached a staggering 13.1% last month.

With skyrocketing food prices, instant noodles are seeing a resurgence in demand as cash-strapped families are being forced to stretch their meal budgets.

Sales of Nissin Cup Noodles, owned by Premier Food (PRRFY), jumped by 6% YOY in Q2 of this year.

Consumers are making ends meet at the grocery store by buying generic products and clipping coupons.

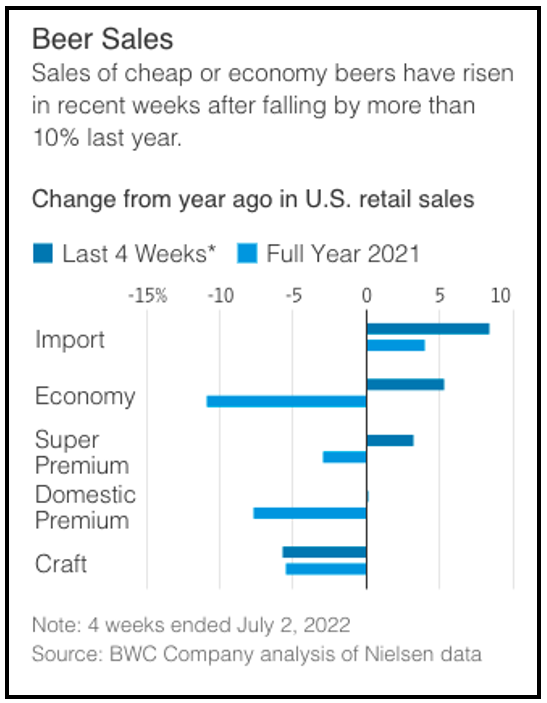

It's not just food, either. Shoppers are trading down to cheap beer brands and discount cigarettes because of inflation.

In the past month, retail sales of economy beer increased by 5.4% over the past year, according to beer-industry consultant Bump Williams Consulting.

Budget beer brands that are enjoying the biggest gains? Busch Light, Icehouse and Milwaukee's Best Ice. Yuck! Talk about college favorites.

Inflation is driving sales of cheap cigarettes, too. Philip Morris Internationl (PM) reports that Marlboro is losing market share while discount cigarettes like Eagle, Pyramid and Montego are rising.

Consumers across demographics are also reducing the number of restaurant meals they eat.

Name the product, and you'll see that Americans are pinching pennies to procure it. According to Morning Consult, seven out of 10 consumers said they're taking steps to save money as a result of rising inflation.

Finding Profit Amid Inflation

Inflation is painful for consumers, but some businesses that can pass along inflationary price increases to their customers without hurting their sales volume do very well. Examples:

- Monopolies: toll roads, airports and pipelines

- Commodities: energy, industrial metals, soft commodities (e.g., wheat, cotton, coffee, sugar) and agricultural producers

- Precious metals: gold and silver — the ultimate inflation hedges

- And my favorite inflation-fighting asset … trees

Yes, trees.

See the Forest for the Trees

Trees may not be the first things that come to mind when you think about investing, but money really does grow on trees when it comes to potential profits.

Trees represent rich opportunities for investors who understand the dynamics of timber as an investment. Timberland is used as an investment primarily by large institutions — like pension and endowment funds — and it's one of most productive investments you've probably never considered.

Uncorrelated to stocks: Trees don't know about quantitative easing, our staggering $18 trillion national debt or bear markets, though they may be acquainted with bears. Trees keep growing year after year and deliver some of their strongest returns when the stock market is struggling.

Throughout the 1970s, a tough decade for investors, timberland never had a losing year. Trees just keep growing, season after season. Consider the following:

- Timberland delivered positive returns in four out of the five most recent major bear markets. In 2008, when the S&P 500 lost 38%, timberland gained 9.5%.

- During the Great Depression, timber was up 233% while the price of stocks fell more than 70%.

Timber beats inflation: Most investors think of gold as a hedge against inflation, but timberland is also an excellent hedge. Over the past century, timber prices have risen at 3.3% above the rate of inflation. During our last inflationary bout from 1973 to 1981, timberland delivered an average of 22% a year.

Flexible and safe: A unique feature of timberland is that it's both a factory and a warehouse. Timber can be grown and then stored on the stump, which gives investors the flexibility of harvesting trees when timber prices are up or postponing harvests when prices are down.

And unlike oil, where new discoveries expand supply, there are no hidden timber deposits waiting to be discovered.

This may surprise you, but timberland is resistant to natural disasters. Fire and other disasters consume, on average, less than 0.5% of forests a year, so the risk is minimal. Even damaged timber retains much of its value. For example, 80% of the scorched trees from the Mount St. Helens eruption were still merchantable.

Time is your friend: Best of all, the longer you leave a tree in the ground, the more valuable it becomes. A North American timber forest grows by about 8% a year, and a 24-year-old southern pine is worth three times as much as a 12-year old tree.

Lastly, timberland is about to become one of the most valuable carbon-capture assets in the world. Every time you hear about carbon capture and storage, remember that trees consume carbon dioxide second best to the world's oceans.

How to Invest in Timberland

It's easy to invest in trees through publicly traded companies like Rayonier (RYN), PotlatchDeltic (PCH) and Weyerhaeuser (WY).

All three own huge tracts of timberland, and all of them pay dividends big enough to keep you off a Top Ramen diet.

WY pays a dividend yielding 2.03%, RYN yields 3.1% and PCH yields 3.67%.

If you'd like my tailored picks to help beat inflation, join members of my service, Disruptors & Dominators who are currently sitting on open gains of over 58%, 36% and 27%.

Best wishes,

Tony