Editor’s note: We often discuss gold’s incredible rally —which just hit $3,600 yesterday! — and why it could continue.

But our macro crypto expert discovered how you can use gold itself as the indicator for ANOTHER major asset.

And with just a day left before Dr. Martin Weiss’ emergency summit goes offline, we are rushing you this info.

We’ll let Bob Czeschin explain how this golden indicator works … and what it’s signaling right now …

|

| By Bob Czeschin |

Gold just powered up beyond the high-water mark it made back when Trump’s tariffs first set alarm bells clanging across global markets.

This time, however, the primary propellant for surging prices was a bit different.

Instead, it was the Federal Reserve’s dovish pivot …

As Chairman Powell wilted under presidential opposition to his “higher-for-longer” interest rate policies.

This prompted Fed officials to quietly back away from their Flexible Average Inflation Targeting (FAIT) framework.

That’s Fedspeak for tolerating 2% inflation.

Going forward, 3% will likely be the new 2%.

The investment markets took this as a green light for a quarter- to half-point rate cut and responded immediately.

Gold vaulted to new all-time highs above $3,600.

That could set off a different major breakout …

You see, in 2019, macro crypto analyst Juan Villaverde made a pioneering discovery …

That gold prices contain an embedded layer of meaning no one had previously noticed:

Major lows in gold tend to precede major lows in Bitcoin — by about 24 weeks. Same for major highs.

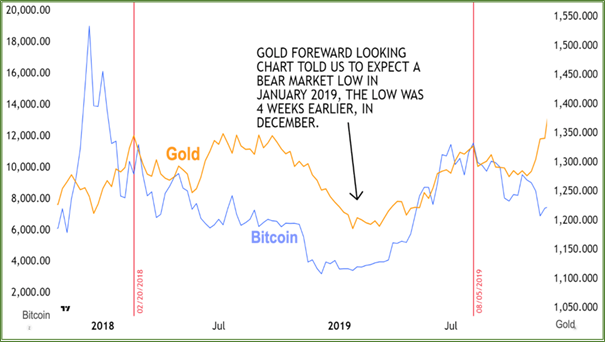

What Juan Observed in 2019

Observe how …

- Gold’s August 2018 low telegraphed Bitcoin’s cycle low in December 2018 — about four months later.

- Gold’s September 2017 top forecast a February 2018 high for Bitcoin (marked by the first red vertical line). Bitcoin’s actual high occurred a bit early — in December 2017, although most altcoins topped in January 2018. Not a perfect correlation, but remarkably close.

- Even more impressive is the second vertical line, which marks a gold forecast high for Bitcoin in early August 2019. As you can see, this prediction was right on the money. Bitcoin topped the first week of August, sliding into a multi-week correction thereafter.

Time and again, gold prices — shifted forward in time — anticipated the general timing of Bitcoin’s highs and lows.

Not down-to-the-day exact. But astonishingly close.

OK, so what is gold saying now?

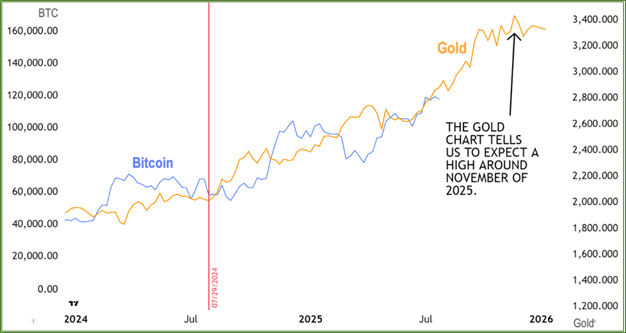

The red vertical line (July 29, 2024) marks a low in gold prices.

That signaled Bitcoin’s months-long period of range-bound trading would end shortly.

Sure enough, it did.

In early August, Bitcoin began its epic run to breach $100,000 for the first time.

So far, so good.

The arrow above points to gold’s other key inflection point — which corresponds to its post-Trump tariff all-time high.

After that, gold retreated to around $3,120 and remained stuck in a sideways range for more than 100 days.

However, this is the fourth year of crypto’s roughly four-year cycle.

So, it’s only natural to worry Bitcoin’s November high (that gold’s pointing to) might also mark the final top of this remarkable crypto bull market.

Indeed, whether this is the case likely depends on how gold finally exits its recent trading range.

A break to the downside would confirm April 2025 as a major top.

In this scenario, Bitcoin tops out in November 2025, falling into a deep long correction, marking the end of crypto’s bull market.

For investors, this suggests battening down the hatches post- November, to get ready for crypto winter.

Conversely, a continued breakout to new highs above these levels means April 2025 was not gold’s final top after all.

In this scenario, Bitcoin merely enters a normal correction following its November high. And then soars to even higher highs — in a longer, larger mania phase extending into 2026.

Well, gold has now hit a new all-time high. Which was certainly great to see. But it was only just above $3,600.

Accordingly, it may still be a bit early to drink a toast to the crypto bull market extending into 2026.

For that, I’d like to see a more decisive move up.

Which hasn’t quite happened yet.

But no matter what happens with gold (and therefore Bitcoin), there’s another class of cryptos you need to have on your radar.

Just last week, Dr. Martin Weiss laid out all the reasons you’ll want to own them.

But you only have one day left to see those reasons … and find out which ones to own.

After that, we’ll be forced to take Dr. Weiss’ video down.

Best,

Bob Czeschin