|

| By Martin Weiss |

Consider this not-so-fictional scenario …

The next time the goverment runs out of money, it's shut down for longer than ever before, and no one can agree on how to get it back open.

The nation’s borders are mostly “closed for lack of funding,” but actually wide open because thousands of border guards “went home.”1

The 2024 presidential election campaign is fought by two men on trial, one in Congress, the other in a court of law.

And nearly everything you hear about what’s “really” going on is a bunch of B.S.

Just a bad dream? Not really. But if you think Washington’s a mess, check out the messy pile of dirt that Wall Street “pros” have dumped on average investors …

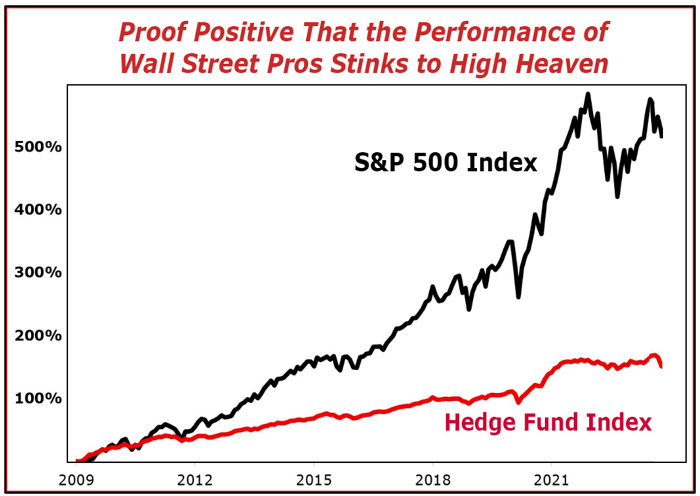

In 2009, when the market was just beginning to recover from the Great Financial Crisis, hedge fund managers were scared.

Before investing, they hemmed, hawed and hedged.

Then, at nearly every step along the way, they continued to underperform due to a combination of paranoia, greed and the rip-off fees they charged investors.

Meanwhile, if you had simply bought an ETF tracking the S&P 500, you could have easily beaten them by a mile.

Not just by 10, 20 or 30 percentage points, but by a whopping 403 percentage points!

That’s right.

Since 2009, the Eureka Hedge Fund Index, which includes 3,350 U.S. hedge funds, is up 163%.

That gave investors an average annual return of only 4.8%, barely enough to keep up with the official inflation rate.

At the same time, the S&P 500 is up 566%, giving investors an average annual return of 9.7% or about 2x the hedge fund performance.

And when you compound that 2x over time, it multiplies. So, after 14 years, the difference is huge — four hundred and three percentage points’ difference!

Now, for the big questions:

If the average hedge funds can’t beat the market, how can you do it?

How do you consistently invest in the best of the best?

How do you avoid the inevitable bear markets?

How do you build a solid barrier of protection against the crowd psychology that overcomes not only the average investor, but also the so-called “pros” on Wall Street?

For the answers, join me and Research Director Gavin Magor next week for a gala demonstration that I think will knock you off your feet.

Here are the details …

Event: Gala Release of the Revolutionary Tech Upgrade to Our Weiss Stock Ratings Model and Bull/Bear Market Timing Model.

When: Tuesday, Oct. 10, 2 p.m. Eastern.

Where: Weiss Ratings Online Conference Center

Who: Martin Weiss (Founder) with Gavin Magor (Research and Ratings Director)

How to attend: Click here to reserve your spot at no cost.

Then check your inbox for confirmation and link. Please do not share the link in social media or with strangers.

We look forward to seeing you on Tuesday the 10th.

And if you want to see the first-ever live demo of our amazing new upgrade in action, it’s critical that you join us promptly at 2 p.m.

Good luck and God bless!

Martin

1 According to Department of Homeland Security’s fact sheet, “Impact Government Shutdown on the DHS Workforce,” over 19,000 U.S. border agents and 25,000 field operations officers working at 300 ports of entry and more than 600 miles of border will be required to continue performing their vital missions without pay. If the shutdown does not end quickly, many may need to seek alternative sources of income to provide for their families.