|

| By Kenny Polcari |

It was the September surprise heard ‘round the world.

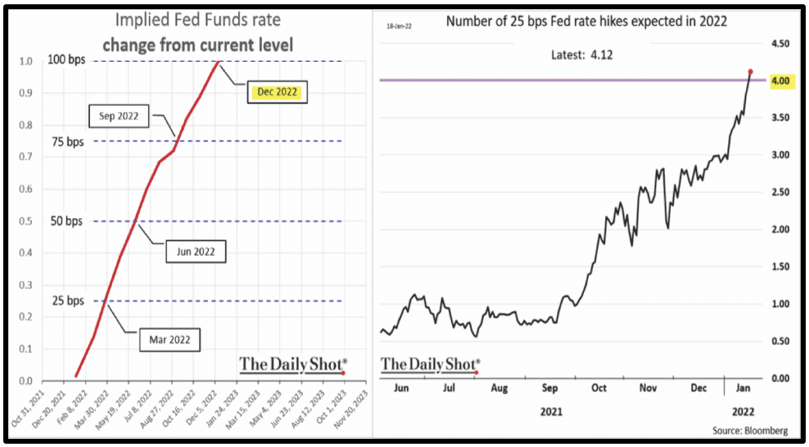

While the Fed did just as expected and raised rates by 75 basis points, Fed Chair Jerome Powell still managed to surprise markets.

How? The Federal Open Market Committee has now raised their neutral terminal rate to 4.6%, up from 4%–4.5%. This means we can expect another 0.75% rate hike on Nov. 2, just days ahead of the midterm elections.

It gets worse.

We can expect another 50-bps hike in December and then a 25-bps in early 2023 to get us to 4.5%–4.75%.

Click here to see full-sized image.

Investors, traders and algos obviously didn’t like that at all, and the stocks which were already trying to stabilize and move up got whacked.

The surprise announcement made it very clear that the Fed will remain aggressive, so anyone expecting a Fed pivot in early 2023 — or even mid- to late-2023 — needs to go back to the drawing board.

A Pivot is NOT Happening

As was expected, the algos went berserk. In-line bids disappeared, leaving a void in prices that caused markets to plunge as waves of sell orders caused the hurricane that JPMorgan Chase (JPM) CEO Jamie Dimon warned us about months ago.

Click here to see full-sized image.

Bottom line: Higher rates will cause investors to re-price risk, period. It all comes down to it being just a math problem.

In fact, those thinking there’d be a soft landing and the idea that investors and stocks “fear” that the Fed’s action might put us into a recession need to rethink that narrative. That includes President Biden, Director of National Economic Council Brian Deese, Press Secretary Karine Jean-Pierre, Fed Chair Jerome Powell, Treasury Secretary Janet Yellen and anyone else who chooses to repeat that narrative.

We Are in a Recession

What we need to understand now is how bad it will be. In order to do that, we need a quick history lesson.

Remember that the Fed’s been stimulating since the Great Financial Crisis of 2007-2009. When that crisis was over, they chose to keep rates artificially low well past the time it was necessary.

While the crisis ended around 2011, everyone was still walking on eggshells and the mere thought of changing monetary policy got you tarred and feathered in the media.

So, they never changed monetary policy. Bernanke, Yellen and now Powell all found ways to justify and keep rates at zero. Then we got hit with a global pandemic that brought the world to a standstill, but they kept going.

When we made it through that, we were told once the Consumer Price Index pierced 2%, that would be the signal to change policy. Well, that happened in April 2021 and the Fed still did nothing. They continued to stimulate well past the time they should have.

Now they’re forced to act.

Powell acknowledged that his actions will cause pain for Americans and the economy by stating, “We have to get inflation behind us. I wish there were a painless way to do that, but there isn’t.”

Click here to see full-sized image.

An A-list of U.S. companies, including JPM, Tesla (TSLA), Meta Platforms (META) and Walmart (WMT), are pre-announcing near-future actions that they’ll have to take, using such words as “restructuring,” “cost-cutting” and “layoffs” in headlines to lay the groundwork.

So, you should expect to hear more in the next couple of weeks, ahead of the next Central Committee meeting that begins the week of Oct. 10.

In short, it was an ugly day for the markets:

• The Dow, which had surged to +300 points prior to the announcement, ended the day down 525 points, for a loss of 1.3%.

• The S&P 500 lost 66 points, or 1.7%.

• The Nasdaq fell 205 points, or 1.8%.

• The Russell lost 25 points, or 1.4%.

• And the Transports gave back 130 points, or around 1%.

However, that certainly wasn’t the case for …

Surging Bond Yields

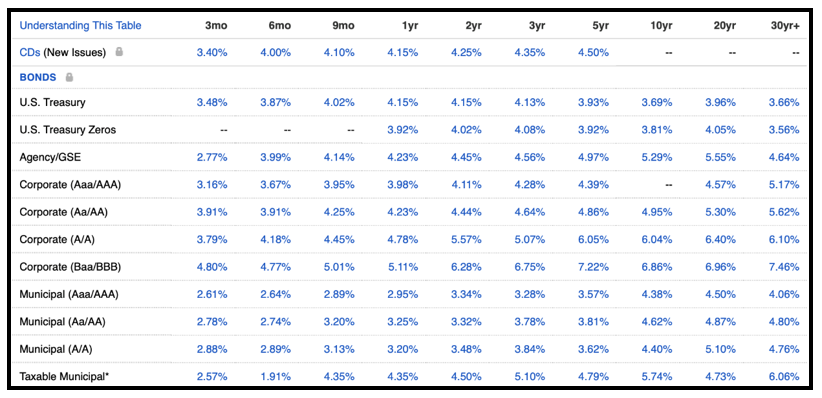

Two-year Treasurys busted up and through 4% and are now yielding 4.15%.

Click here to see full-sized image.

Bond guru Jeff Gundlach told investors that “risk assets (e.g., stocks) are the last place you want to be when the two-year is over 4%,” and that did nothing to help soothe the mood. In fact, I would argue it only helped exacerbate the move lower, but it is what it is.

Valuations are just a math problem, so with rates now expected to go higher, you must expect stocks valuations to come down.

Now that you can get 4.15% on your money for two-year Treasurys, many investors will consider it during this anxious time and that means money will move out of stocks into short-term notes and bills. And if the two-year goes even higher, then expect stocks to go lower. In short, stocks will suffer.

It's like the housing story, mortgage rates go up and prices come down.

Indeed, the latest housing data told us that existing home sales fell by 0.4%, which was a bit better than the estimate, mind you. And housing starts surprised last week. But mortgage rates are now 6.5% and going higher, so the cost-of-carry rises, which means the price of the house has to come down to make it affordable.

On Tuesday, we learned that building permits, which reflect future demand, plunged by 10%, much more than the expected 4% loss and what that tells you is that homebuilders are pulling back on building new homes because mortgage rates are much higher than what buyers are used to. So, 2.5%–4% rates on 30-year mortgages are not happening anytime soon. Get ready for 7% mortgage rates by year-end.

The Answer Is …

You should do what makes you comfortable and helps you sleep peacefully at night. But if you’re a long-term investor, you’d do well to stay focused and ensure your thesis hasn’t changed.

By that I mean if the fundamental story for your stocks remains intact, then take advantage of lower prices, but if the story has changed, then you need to be more dynamic and adjust.

I expect the markets to remain on edge as we move into late September and October. If you recall, Oct. 19 was a day of destruction in 1987, and while we’re not in the same situation as back then, don’t be surprised to see the markets remain anxious as the date approaches.

Lastly, keep in mind that we’re in a seasonally difficult time and a test lower is still very much a reality. Stick with the big, boring names and sectors, including healthcare, consumer staples, utilities and energy and take advantage of the lower prices.

All my best,

Kenny Polcari

P.S. Dr. Martin Weiss and a special guest expert who picked the last bottom are getting ready to show our members how to spot the NEXT bottom. Not only is it coming our way, the list of winners will look VERY different from the last. Get that list and more Wednesday, Sept. 28 at 2 p.m. Eastern. Click here to get your free ticket.