How Nvidia’s Reckoning Could Mean Big Wins for You

|

| By Chris Graebe |

ChatGPT played one of, if not the biggest role in AI’s explosive growth in 2023.

And I expect even bigger investment opportunities on the AI front this year — only one of last year’s sweethearts, Nvidia (NVDA), won’t be making the biggest noise.

Here’s how I believe this next chapter in the AI story will play out … and why.

We all witnessed the unprecedented attention this latest and greatest content-producing tool attracted from consumers, tech companies and investors. So, it’s pretty safe to assume that we’ll see a similar, if not faster, rate of innovation this year.

After all, AI is in very early stages of development — a mere baby as technology goes. And ChatGPT is child’s play in this potential world changer.

If all the accelerated behind-the-scenes work being done by engineers is any indication, the best and most “personal- and business-altering AI apps” are yet to come.

That’s all well and good. But as often happens in technological development, we’ve gotten ahead of ourselves … put the cart before the horse.

As chips advanced over the past decade and costs plummeted, it allowed more and more companies and governments to start collecting lots of data. The more, the better.

But data just floating in the cloud taking up space doesn’t serve any purpose. Processing and analyzing it makes it meaningful, and all of that thinking requires a lot of computer power.

While AI is very capable of processing enormous amounts in far less time than human researchers, the complex models it runs also require a lot of horsepower to bring data and apps to life.

Unfortunately, we’re ahead of the game with AI design and development, but we’ve fallen behind the proverbial 8-ball with deployment.

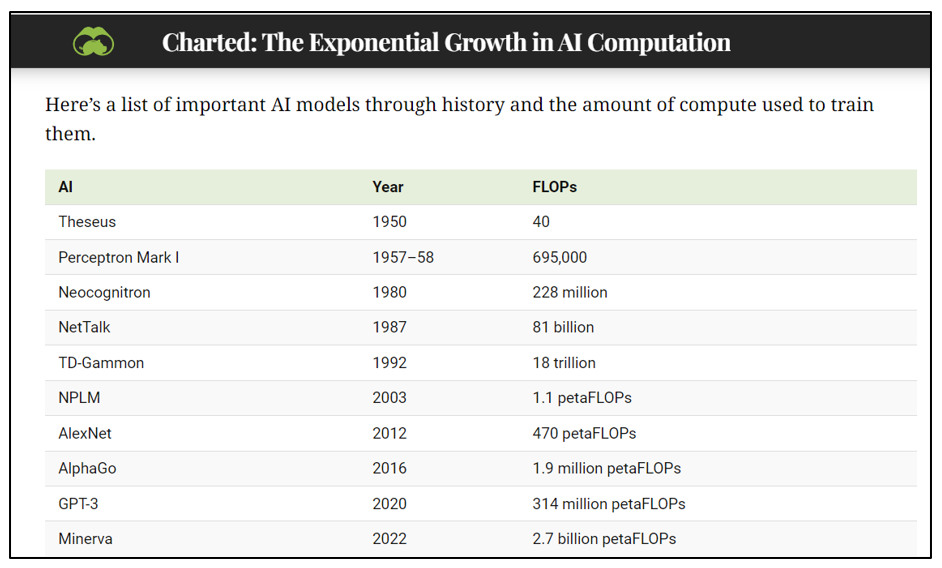

The exponential growth we’ve become accustomed to in computer power isn’t keeping up with the requirements of complex AI models. It’s hard to fathom the heavy lifting required as you can see from the below chart.

For example, the computation used to train Minerva in 2022 — an AI which can solve complex math problems — is nearly 6 million times the amount used to train AlexNet 10 years ago.

The thing is, that’s not a problem we’re trying to prevent down the road … it’s already here. And kudos to Nvidia for keeping the problem in check until now.

With 85% to 90% market share in the AI hardware arena, it produces the one type of chip necessary for AI workloads: the GPU.

But while the $1.5 trillion company’s contributions to the AI revolution have kept pace with innovation, it can’t keep up with demand.

Not even its most powerful GPU with triple the memory capacity of its current product will help alleviate the shortage of high-quality, high-performance chips.

Life After Nvidia’s Dominance

This has opened the door for a new crop of beneficiaries — companies and investors — from this next AI wave.

Nvidia is struggling to keep up with current demand for high-powered chips, which requires the company to quadruple its annual output almost immediately to support customers.

The company is reaching out to industry peers for help. But it’s obvious that the anticipated market growth in GPUs and AI chips presents many investment opportunities outside the Nvidia circle.

UBS analysts expect the market for GPUs and AI chips to post an annual growth rate of 60% from $16 billion in 2022 to $165 billion in 2027.

So, if you missed the Nvidia boat, by all means don’t chase it. Competitors — after ceding much of the early generative AI boom to Nvidia — are chomping at the bit for their share of the AI pie.

All last year, competitors watched the chipmaker add hundreds of billions in market cap and become AI’s sweetheart. Startups scrambled to rent time on its H100 chips, VCs bought thousands of them and Nvidia CEO Jensen Huang turned from a relatively unknown to a tech icon in short order.

You’ve got tech giants like Alphabet (GOOGL), Amazon.com (AMZN) and Microsoft (MSFT) designing their own AI chips and training models on them.

Rival chipmakers like Advanced Micro Devices (AMD) and Intel (INTC) are producing AI-optimized chips themselves. And amid a supply crunch, startups are even willing to try alternatives.

In the GPU market specifically, the industry is teeming with Nvidia competitors such as Qualcomm (QCOM), Broadcom (AVGO), Texas Instruments (TXN), Microchip Technology (MCHP) and NXP Semiconductors (NXPI). They all have, or will, challenge Nvidia’s dominance and diversify the AI landscape.

But instead of directly investing in any of them, I have a better solution. In fact, to see who the real winners are, I recommend you check out my new presentation on what could happen during an imminent “Nvidia Crash”.

All the best,

Chris Graebe