|

| By Kenny Polcari |

I often talk about instances when the algorithms aka algos may kick in, causing the stock market to rage higher or lower on a dime.

That’s because they’re impossible to ignore and mostly to blame when extreme volatility rears its ugly head. Surprisingly, they’re also very simple to understand.

An algorithm is “a set of step-by-step procedures, or a set of rules to follow, to complete a specific task or solve a particular problem.”

In fact, we use algos every day of our lives when we tie our shoes, do laundry or follow a recipe.

On the other hand, depending on who you ask, big banks, hedge funds and institutional investors use algorithms to make some 80% of all trades in U.S. equities, European and Asian markets.

For example, an algorithm may be set to detect when the S&P 500 pushes through the $4,000 mark. After processing real-time, high-speed data feeds and spotting the appropriate price level, the algo instructs your computer to automatically place trade orders based on that criteria.

Algorithms can trigger trades based on any factor a human directs it to — even news events.

You can understand why computer-based trading used by some of the biggest institutions in the world can move mountains of money, especially if they’re using common denominators for ”Buy” or “Sell” triggers.

You may remember when stock markets plunged in March 2020 after the pandemic gained momentum. The erratic, increased trading activity halted market-wide trading several times.

The sheer amount of data that’s generated, analyzed and processed — in addition to the speed at which all of that happens — makes algorithm-based trading the beast that it is today.

Thanks to the explosion of technology, traders using the fastest computers in the world have a distinct advantage over the rest of the investment world.

Although algorithm-based trading began in the 1970s, it really began to take hold in the 1990s as technology gave rise to …

The High-Frequency Trading Revolution

HFT manages small but rapid-fire trade orders sent to the market at high speeds. By the turn of the 21st century, HFT trades had an execution time of several seconds. By 2010, it was down to milliseconds and even microseconds.

Today, the best algos and computer networks can make several trades in just 64 millionths of a second. So, we’re talking about completing hundreds of thousands — or even millions — of trades in a single hour.

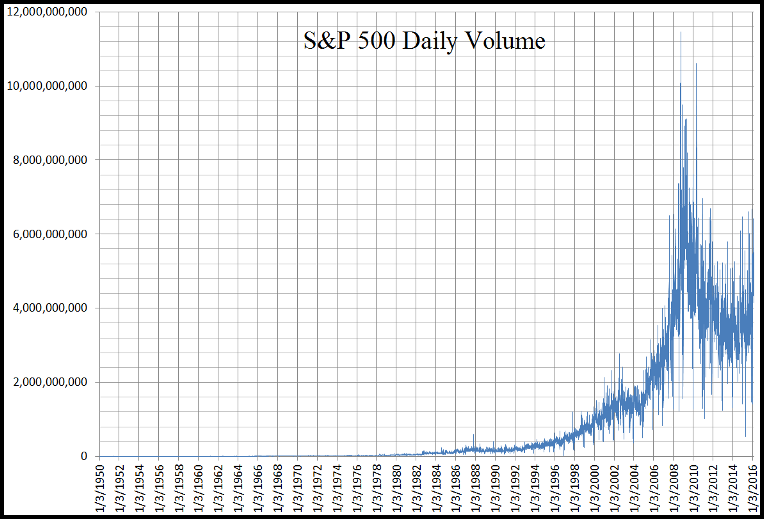

Once the Securities and Exchange Commission authorized electronic exchanges in 1998, it forever changed the way stocks were bought and sold. In fact, that regulation basically solidified HFT a place in Wall Street’s future and sent average number of shares through the roof in 2005, reaching a peak in 2009.

Click here to see full-sized image.

One way high-frequency traders profit is by monitoring and acting on price movements caused by large institutional trades.

For example, when a mutual fund sells a million shares of a stock, the price dips. HFTs buy on the dip, hoping to sell the shares a few minutes later at the normal price. When a pension fund buys 2 million shares, the traders short the stock, hoping to close their position at a profit.

And while regular investors or retail traders can receive important news and make decisions based on it just like everyone else, modern HFT software can analyze new stories seconds after they hit the internet.

As you can imagine — and have probably experienced firsthand — the scope of HFT can be disruptive. It certainly contributed its share of turmoil on the day now known as the 2010 Flash Crash.

You may recall May 6 of that year when the stock market experienced one of its most severe price drops in history: The Dow Jones Industrial Average dropped by almost 9% from the open — the second-largest intraday point swing, by 1,010.14 points, and the biggest one-day point decline of 998.5 points.

The crash was so rapid that the index tumbled 900 points in less than five minutes but recovered the bulk of its losses in the next 15 minutes of trading.

The market lost more than a half-trillion dollars in equity value that day, shaking what little faith nervous investors had in U.S. markets.

Shares of Procter & Gamble (PG), the ultimate defensive blue-chip stock, dropped more than a third in a matter of minutes before recovering almost as quickly, all for no apparent reason.

A few other large U.S. companies, including accounting firm Accenture (ACN), saw their stocks trade as low as a penny a share, only to close not far from where they began the day — nearly $42 a share in the case of Accenture.

Shares of Apple (AAPL) actually rose to $100,000 in a matter of minutes.

By the time the dust settled, a whopping 19.3 billion shares had changed hands, more than twice the average daily U.S. equity market volume this year and the second-biggest trading day ever.

High-frequency trading has increased rapidly since the mid-2000s and now represents about 50% of trading volume in U.S. equity markets and between 24% and 43% in European equity markets.

This all brings us to how you can …

Use HFT & Algo Trading to Your Advantage

Interestingly, while HFT first emerged in traditional financial markets, it has since made its way into the cryptocurrency space and is used to trade on decentralized exchanges.

HFT’s popularity has also resulted in some crypto trading-focused hedge funds employing algorithmic trading to produce large returns, prompting criticism for giving larger organizations an edge in crypto trading.

In any case, HFT — and algorithm-based trading — appears to be here to stay in both traditional assets and cryptocurrency.

As a retail investor, you may feel like you’re constantly battling the algo traders. Since you may never beat ‘em, you might as well join ‘em.

By that I mean investing in one of the most important technologies behind algorithms — AI — a global market expected to grow to well over $1.5 trillion, up from the $327.5 billion mark in 2021.

Some of the leaders in the development of AI technology include companies such as Amazon.com (AMZN), C3.ai (AI), a subsidiary of Alphabet (GOOG) called DeepMind, Meta (FB) and Salesforce (CRM).

The only stock rated above a “D+” by Weiss Ratings is Alphabet, currently holding a “C+” rating. However, I don’t expect this group will stay down for long.

It’s quite clear that this trend is not going anywhere, so the best action plan for savvy investors is to take advantage of it by getting into the companies that are wielding this all-powerful tool. It’s certainly the way of the future — not only in trading, but many other sectors.

That’s it for today. I’ll be back with more for you real soon.

All the best,

Kenny Polcari

P.S. If you haven’t joined my friend and colleague Nilus Mattive’s The Safe Money Report, now is the perfect time to do so. Members of this service are currently sitting on open gains of 37%, 24% and 41%!