|

| By Kenny Polcari |

I am not a big fan of moving the goal posts — further or closer — but the Federal Reserve apparently is very fond of the practice.

You know what I’m talking about: You set a goal; maybe it is an amount of money you want to save over the next three months or you want to set a personal record on your next round of golf.

Let us say in either situation, you unfortunately fall short of your goal. Instead of saving harder or taking a putting lesson or two, you simply come up with excuses or just lower the bar. And like magic, you’ve achieved exactly what you wanted.

It is not very rewarding, but it sure looks good to friends and family when you share the news.

Now, moving the goal posts in those instances is innocent enough. But in just a bit, I will tell you why you should never move them in investing.

First, back to the Fed’s latest ploy after a batch of higher-than-expected numbers came out.

I imagine the monetary board fooled some folks after pulling a new term out of its hat. They referred to it as “supercore inflation,” something I have never heard in the 42 years I have been in the business.

Turns out that it is a great way to turn a negative into a positive. Here is how it works: Unlike core inflation, supercore inflation does not have a fixed definition. It is a term that expresses prices excluding sectors economists feel distort the broader inflation figure.

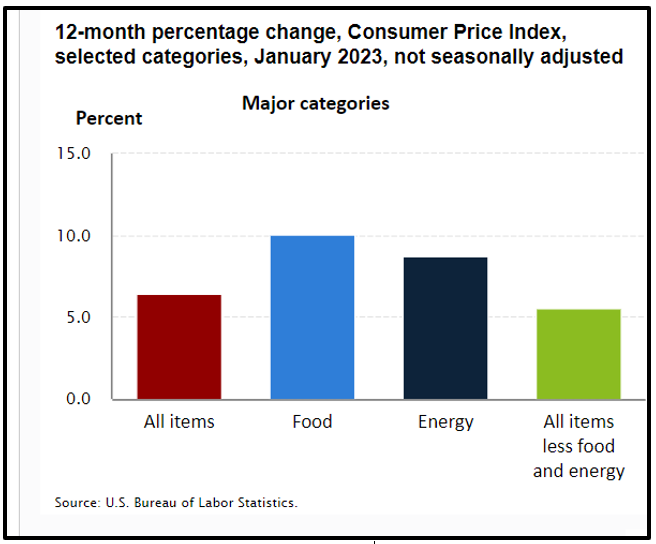

While core inflation removes food and energy inflation from the equation, supercore inflation takes it one step further by removing other segments — like housing — that economists believe could distort how broader inflation is truly impacting Americans.

And when you strip out food, energy and housing, the supercore rate only rose by 0.3%, not the 6.2% year-over-year increase we saw in the regular core inflation figure. Sounds good until you go to the supermarket, see your electric bill or try to buy a home.

Click here to view full-sized image.

I do not ask why the Fed came up with the tweak; instead, I ask why not?

It makes investors and the government happy, so everyone is happy … But I am not falling for it, and neither should you.

Instead, this whole scenario about moving the goal posts got me thinking about instances when it can cause big problems in investing — like when it comes time to sell a position. That’s why it is important to have …

A Sound Exit Plan

Now, I am not referring to your long-term holdings, those megatrend stocks that weather storms better and rebound quicker than many others. The ones I talk about all the time.

Here, I am referring to short or intermediate positions that require fairly regular monitoring and an exit plan.

Knowing when you will sell should always be measured by how much you are willing to lose, not how much you stand to gain. That is important to remember right off the bat because, interestingly, risk has been shown not to enter our heads until after money has been lost.

Deciding when to sell a stock is very much a personal choice. If I asked you what percentage of growth you wanted to pursue each year, you would need to think about what loss you could stomach before answering. That usually goes hand in hand with your stage of life.

You may be graduating from college … or married and sending your children to college. Maybe you are a few years from retirement or hanging out at your beach house after hanging up your working shoes.

Remember, higher reward always comes with higher risk. If you want to make 30%, you had better be able to absorb at least that much of a loss. On the other hand, shooting for a more conservative 12% will keep risk more in check.

It does not matter what you use for an exit strategy; just do it, and don’t move the goal posts.

For example, you can set a stop loss under a stock that automatically triggers a sell after falling 20%, 30% or more below its high. Or you can base an exit point on when a stock moves below a trendline like the 50-day moving average.

There are many other options for doing so, but discipline is key.

And the best way to stay true is to reserve your emotions for Valentine’s Day. Do not fall in love with any positions. Just turn and walk away when the numbers dictate that it’s time.

Although I am a clear proponent of managing risk, it is important to understand that after you sell, the position can always rebound and go back above the sell point.

Oh, I know — it’s annoying. But it happens. Forget about it and learn to keep your eyes on the prize. Looking back does no good.

All the best,

Kenny Polcari

P.S. America could default on its debt as soon as July, triggering the worst economic earthquake in history. What can investors do? The best option is a strategy is one that works regardless of volatility. Over the past five years, one little-known strategy produced 535 real winning trades, averaging 16% gains in just four days. Join Dr. Martin Weiss for an urgent video briefing where he reveals how to put this strategy to work starting immediately.