There’s no easy way to say this…

Inflation is here to stay. Even the Fed has been forced to admit inflation is running “hotter than expected” and will continue for months to come.

And still, they’re grossly understating just how severe this inflationary crisis truly is.

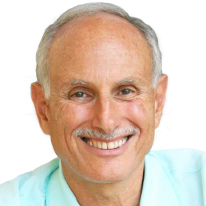

Measures taking into account the entire economy — not just the basket of goods that the government bundles into the Consumer Price Index (CPI) — show inflation is actually 13% and poised to climb higher.

|

No big surprise, right?

You’re probably already seeing and feeling this every day.

Not to mention the bare shelves, shipping shortages and labor crisis, all of which will ratchet inflation even higher.

“No big deal,” says the White House and the Fed.

But it IS a big deal! Surging inflation has severe consequences for income investors, retirees or anyone living on a fixed income.

Especially in a world that’s absolutely starved for anything close to a decent yield!

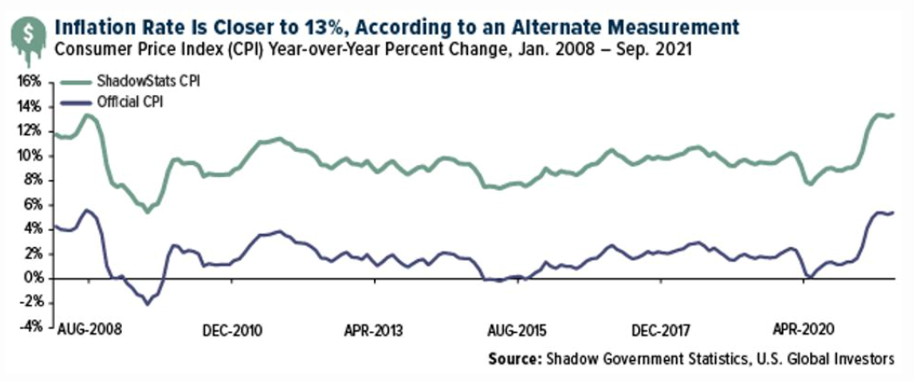

Take a look at this chart.

|

This shows the actual yield that you can now make on U.S. Treasury notes — AFTER subtracting inflation.

It has been falling virtually nonstop for years. But now it’s far below zero due to the extremely rare, almost unthinkable, combination of low interest rates AND surging inflation.

Plus, there are two more aggravating factors that make it even worse for investors and retirees…

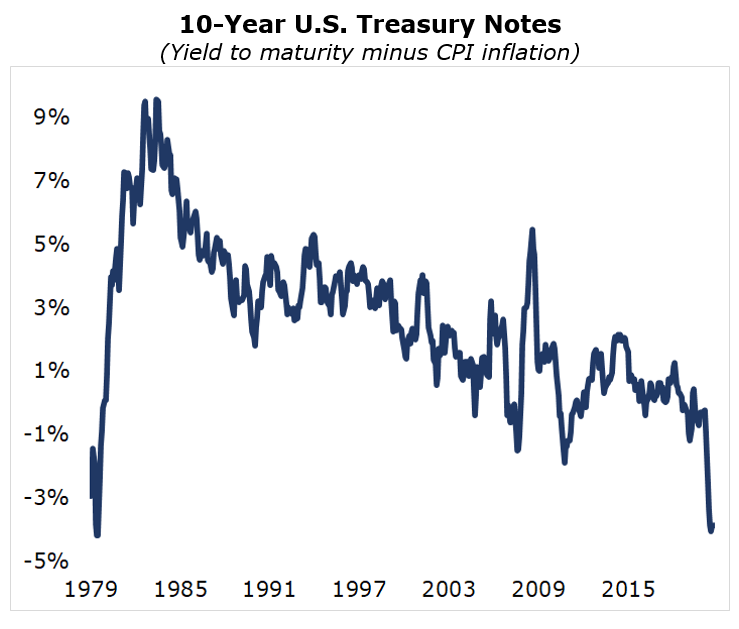

Aggravating Factor No. 1: Actual U.S. inflation is much higher. As you may know, the official inflation numbers reported by the U.S. Labor Department are greatly understated.

And according to Shadow Government Statistics, it could even be a lot worse than most people realize — more than 13%.

Check out their chart…

|

Aggravating Factor No. 2: Grave risks to your principal. As soon as investors wake up to these dire realities, it’s highly likely they’ll start dumping their Treasury notes and bonds, driving prices into a tailspin.

So, not only do you lose money to inflation today ... you risk losing even more when a bond price collapse guts your principal.

Clearly…

It’s An Income Emergency

There’s no other way to put it.

Our team has heard from countless worried readers...

They’re worried their savings and investments won’t last. They’re now more scared than ever that inflation is going to erode their hard-earned wealth and threaten their retirement.

Personally, when I first saw the writing on the wall, I was worried, too. I lived in the 1970s, so I know just how devastating high inflation can be.

That’s why months ago, when we realized inflation was anything but transitory, my team and I set out to uncover the best way to safeguard and grow our money in this market.

What we discovered left me speechless, and…

Tomorrow, during the SUPERYIELD CONFERENCE, I’m going to share our findings with you.

I’m going to reveal how you can start to immediately collect some of the highest yields in history with little or no market volatility:

• 4 times more than you can make on high-yield bonds!

• 15 times more than you can make with stock dividends!

• 67 times more than the yield on five-year jumbo CDs!

With virtually no market price risk. Without default risk. Without lock-up periods.

Instead of nearly zero returns, you can get high, double-digit annual percentage yields (APY) that are virtually out of this world.

Instead of big risks like defaults, bond market collapses and stock market crashes, you get to deposit money in instruments that are subject to little or no market price changes.

Instead of locking up your money, you get the freedom to withdraw it at any time without penalties.

Other income investors and retirees are stuck in a world of near-zero interest rates on their savings and potentially near-fatal risk with every “high-yield” alternative they can find.

Tomorrow’s Superyield Conference gives you the chance to kiss that world goodbye ... and enter an entirely new world that now offers some of the least risky high yields of all time.

All demonstrated on screen

in real time with my money.

I won’t just be discussing this opportunity...

I’ll be showing you in real time how it works, with real-money demonstrations of how I’m earning yields of 19.5%.

You’ll see why I’ll soon be depositing $1 million of my own money into this new vehicle income … and I’ll show you how you can get started too.

Many thousands of yield-starved investors have already secured their seat to this free online conference, and it’s shaping up to be one of our most important events ever.

Registration closes tonight at midnight, so if you still haven’t secured your seat, go ahead and do that now.

I’ll begin promptly at 2 p.m. tomorrow (Tuesday).

I hope to see you there.

Good luck and God bless!

Martin