|

| By Marija Matic |

The big day finally arrived. Dr. Martin Weiss and I introduced a lucrative income opportunity in a VIP presentation on Tuesday.

Don’t worry. There’s still a little time to check it out. I’ll show you how in a moment.

But first, I want to talk about a unique way to collect yields in my corner of the market.

Let’s start with why this opportunity exists in the first place. And the people most in need of it.

I’m talking about all the folks in or nearing their golden years. Those who lived through a nearly decade-long drought in yields after the Financial Crisis and Great Recession triggered a drastic change in monetary policy.

Well, the times are finally changing for yield-seekers. But don’t direct all those thanks to the Fed.

Yes, a loosening of interest rates by the Fed to nearly zero ensured a sustained period of spending, borrowing and strength in equities.

But it also guaranteed a long, rough spell for savers who collected little other than dust in money markets, CDs and bonds.

That is until March 2022, when red hot inflation forced the Fed to begin raising rates at an unprecedented pace.

Today, those traditional deliverers of yields are back to the “norm,” rewarding income seekers with 5%, 6%, 7% and more on their assets.

Don’t blink though. Those might be short-lived.

Data continues to show economic weakness, and pressure on the Fed to cut rates continues to mount. Shoot, banks are even decreasing what they pay customers on their deposits to offset the drop in loans. So, it’s happening as we speak.

Which brings me back to today’s opportunity on a juicy yield-producing strategy.

Introducing the Crypto Income Bridge

Wouldn’t it be nice not to be at the mercy of the Fed or stock market ups and downs? I thought so.

That’s just a smidgeon of what Dr. Martin Weiss and I covered in our just-released presentation here.

We talked about real yields and real numbers.

We explained how yield hunting works in the cryptocurrency world … and ways to reduce risk.

My reason for writing today is to explain how to access the most opportunities and collect the biggest yields on the strongest coins. Consider it a head start on your yield-hunting journey.

I’ll explain this ticket to triple-digit yields — and what the industry calls “bridging” — in straightforward terms.

First, cryptocurrencies are digital coins that exist on strings of code called blockchains. Each blockchain is unique and cannot interact with other blockchains.

It’s similar to how Windows/Android proprietary products can't operate on Mac/Apple software and vice versa.

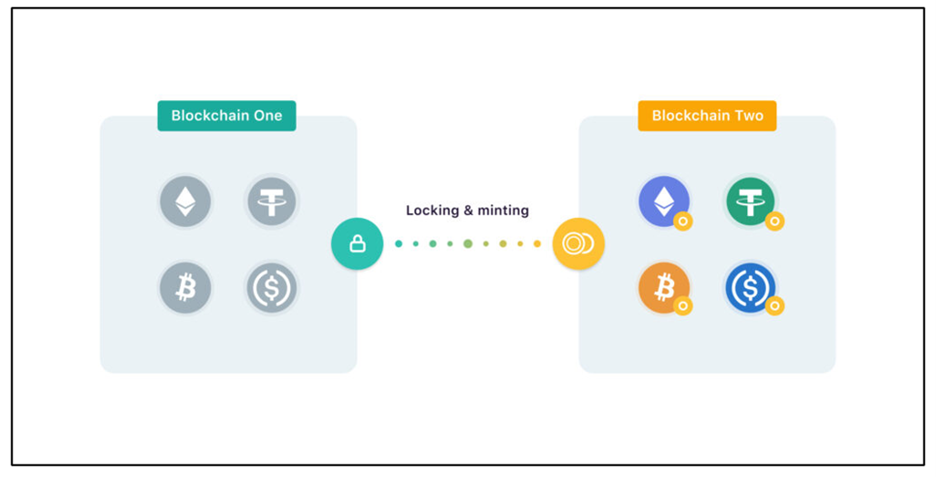

Bridging is the process of converting a crypto asset from its native blockchain into a version that can be recognized and supported on a new blockchain.

A crypto bridge does exactly what its name suggests. It allows movement from here to there.

In this case, we need to cross digital space to move crypto from one blockchain to another. Bridges do that, but there’s a cost — kind of like paying a bridge toll.

But even with the cost, it’s usually worth it because everything is cheaper on the other side of the bridge.

It’s like moving from the city to the suburbs. You can still do most of the things you do in the city, but the cost of living is lower … and there’s less traffic.

Which Bridges You Can Use

Which bridge you use is entirely dependent on what asset you have to start with … and what blockchain you want to move it to.

Here are a few examples of crypto bridges, according to Coincodex:

- Synapse Protocol — The best crypto bridge platform overall.

- Portal Token Bridge — A bridge for both Ethereum Virtual Machine (EVM) and non-EVM blockchains. EVM blockchains adhere to the standards and specifications set by Ethereum’s EVM for smart contracts and decentralized applications, while non-EVMs don’t.

- Allbridge — Solid bridging solution for EVM and non-EVM chain, in particular Solana.

- Arbitrum Bridge — The go-to bridge for transfers between Ethereum and Arbitrum.

- Celer cBridge — Celer’s token bridging solution.

- Stargate — Token bridge with a diverse range of supported platforms.

- Hop Protocol — Bridge specialized for Ethereum layer 2s. Built on top of Ethereum, Layer-2 blockchains help speed up transaction processing while keeping the costs down for layer-1 networks.

- Connext — A bridge for EVM blockchains and layer 2s.

Now, bridging isn’t necessary for yield farming, but it opens up your opportunities and the potential yields you can target.

A bridge can be used to target a pool offering a better yield. A pool refers to crypto that’s held in a smart contract to facilitate transactions. It’s no different than moving your assets from one bank to another because it offers a higher money market rate.

For example, Uniswap (UNI) lets you stake your Ethereum (ETH) on its platform, but it supports several blockchains. You could keep things simple and just stake your Ethereum in a pool that's on the Ethereum network via Uniswap. But those yields are often pretty low.

If I bridge my ETH to the Polygon (MATIC) network, however, and stake that on Uniswap in a pool that's on the Polygon network, I could get a much higher yield. That’s because Polygon needs more liquidity and is willing to pay more for it.

That’s the gist of how bridging works in the world of crypto yield farming.

There’s much more to explore. And the best thing you can do to continue your learning experience is by watching our Superyield Conference.

Just click here to attend and start your journey to capturing high yields in the world of cryptocurrency.

Don’t worry if this sounds like too much. In this presentation, I walk you through opening an actual Superyield position in real time.

Best,

Marija Matić