|

| By Michael A. Robinson |

My older daughter, Jordan, is a poster child for what I’m calling the “New American Wanderlust.”

Here’s the thing. Millions of us are yearning to travel throughout the U.S. and abroad.

And for good reason.

Simply stated, after years of Covid shutdowns, many of us are itching to see the world.

Last month, Jordan flew out to meet a friend and spend two weeks on the coast of France, where she was working remotely and is now in Germany for a few more days.

That follows a five-week trip just a few months ago to Cape Town, South Africa, where her laptop allowed her to blend adventure with her job as a real-estate project analyst.

Then again, she is one of what Forbes estimates will soon be 32.6 million Americans working remotely, meaning she can plug in from anywhere that has decent Wi-Fi.

Analysts say this new paradigm is set to play a major role in what Statista says is the $1.7 trillion global travel sector.

In a moment I will reveal a great way to play the air travel boom. It’s a storied leader that literally powers much of the global aerospace sector.

But first, allow me to set the stage for you …

Travel Boom Just Started

According to another Forbes study that surveyed travelers, American interest in travel isn’t waning.

Quite the opposite …it’s growing by leaps and bounds with 92% of travelers saying they expect to travel at least as much in 2024 as they did in 2023.

More to the point, 40% said they expect to travel more this year.

And one of the most interesting aspects is that it isn’t just retiring Boomers or Gen Xers in their prime earning years who’ve put their travel plans in high gear.

It’s Gen Z and Millennials. Of the latter two demographics, those born between 1981 and 1997, more than 70% that have credit cards have cards with travel benefits.

I believe it shows the Covid-19 lockdowns have a much longer and more complicated tail than many suspected.

After being isolated for so long, it could be that we want more than ever to get beyond our glowing screens. Folks simply crave new connections and experiences.

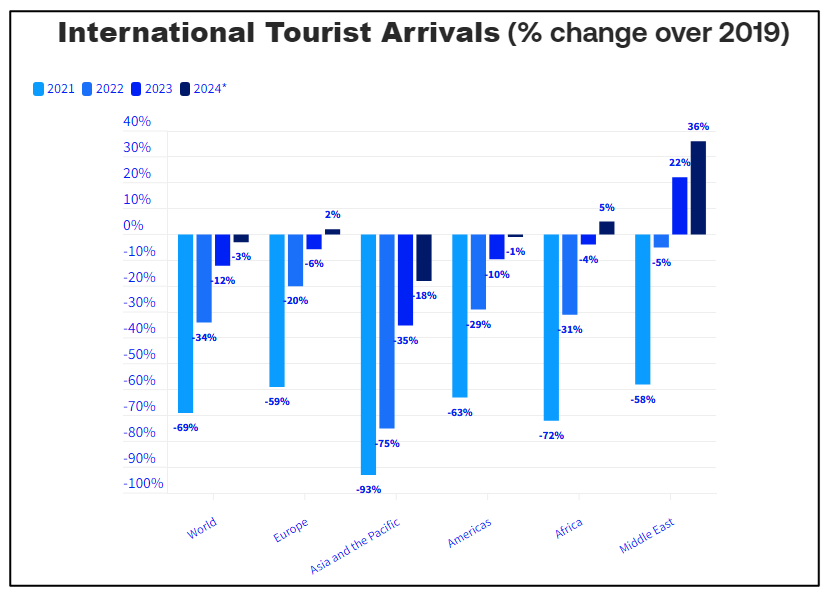

Passenger travel is already surpassing pre-Covid-19 levels in many places.

What’s more, it doesn’t seem like inflation is slowing travelers down, according to Forbes.

More than 70% of those surveyed expect to spend more than $2,000 on travel this year. And nearly half expect to spend a minimum of $4,000.

What’s more, Americans’ wanderlust continues to grow.

The U.S. Travel Association reported that, in January, 93% of Americans had travel plans in the next six months. And inflation was even higher then.

And on the supply side — the aircraft makers — are projecting a similar boom. While Boeing (BA) has its issues delivering planes, its forecasts are usually rock solid.

The firm sees the aviation boom lasting until at least 2041. Its chief rival Airbus is equally optimistic.

At that end point, new airplane deliveries will increase by 80% compared to 2019’s pre-pandemic forecasts. We’re talking a total market value of $7.2 trillion.

And I’ve found a great backend play to take advantage by capturing a big slice of the global market.

The Giant to Precede

the Wright Brothers

The stock that can capitalize on all these travel trends? Ironically, it’s from a company that was around before Orville and Wilbur Wright even got their bird off the ground in Kitty Hawk.

GE Aerospace (GE) might have just begun trading under this universally known acronym, but it has been in aviation as far back as flight began.

You may recall that in 2021, the former conglomerate General Electric announced that it was splitting into three public companies after more than a century as one entity.

The goal was to focus its broad coverage on three strategic areas: aerospace, energy and healthcare.

GE HealthCare Technologies (GEHC) stock launched in January 2023. And last month GE Vernova (GEV) and GE Aerospace launched.

These three sectors are keys to the company’s overall success in the decades ahead and a huge move for current CEO Larry Culp.

The goal is to make each division leaner, more innovative and more focused.

Now then, for today’s chat, I’m focusing strictly on GE, the aerospace juggernaut.

And the fact is, GE is likely carrying the legendary ticker symbol because it represents the greatest growth opportunity for the larger organization now … and for decades to come.

Currently, GE on its own and through strategic partnerships around the globe, has a 55% market share of the world’s commercial jet engines, according to Statista.

What’s more, GE is also one of the chief engine makers for U.S. defense companies. Its engines power everything from state-of-the-art fighter jets to helicopters to a new division, AiRXOS, that’s looking into drones and autonomous flight and traffic management.

To celebrate the official split, GE launched a 1,000-drone air show on April 1 over its Hudson County, NJ offices — aided by AiRXOS flight management, the drones spelled out the company’s iconic logo.

Add it all up and you can see why this is such a great stock. It’s a bona fide profit machine.

In the most recent quarter per-share profits jumped 204%. If we cut that back by 80%, we’d still see earnings growth of 40% a year.

At that rate, per-share profit would double in less than two years.

In other words, this isn’t just a smart play on the New American Wanderlust.

It’s a winner that can add jet fuel to your portfolio over the long haul.

Best,

Michael A. Robinson

P.S. This new Aerospace-focused GE is slowly bringing back its dividend too. Though, it will need plenty of hikes before it’s worth your while on that front.

If you are looking for yields, I have some good news. We are planning a big event. In fact, it’s a “SUPERYIELD Conference” on Tuesday, June 11, at 2 p.m. Eastern. Grab your seat here.