|

| By Mike Larson |

Did you see yesterday's inflation news? Holy moly!

The Consumer Price Index (CPI) soared 8.5% from a year ago in March, up sharply from 7.9% in February and the biggest annual rise in 41 years!

For context, here are some events from 1981 — the last time inflation was this high:

- Walter Cronkite signed off from "CBS Evening News" for the last time.

- NASA launched the very first space shuttle mission.

- John Hinckley Jr. shot President Ronald Reagan.

It's been that long.

Back to yesterday's CPI data …

On the month, the CPI jumped 1.2%, which was its biggest monthly rise since 2005.

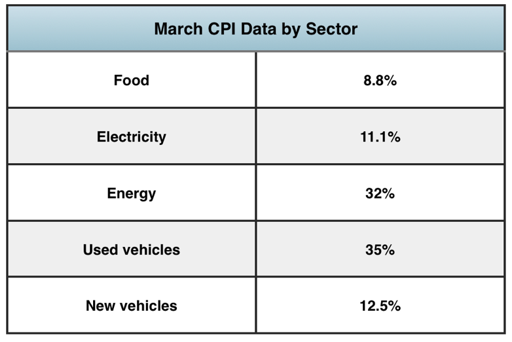

And combing through the data, it was hard to find much to like:

It doesn't end there. Apparel? Up 6.8%. Transportation services? Up 7.7%. Shelter costs rose 5% ... but much more in the real world, considering house prices just soared more than 19% year over year.

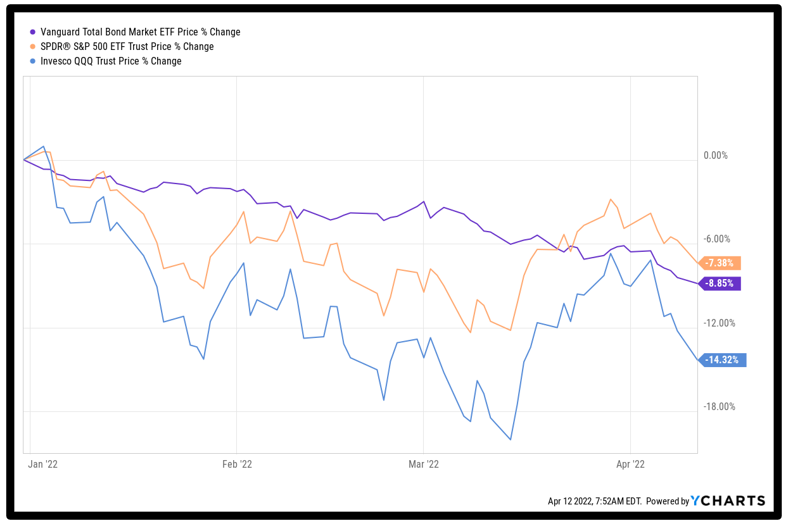

The market was braced for ugly figures, of course. So, we got a bit of a relief rally after the data hit. But this has truly been a dismal year for bond investors.

The iShares 20+ Year Treasury Bond ETF (TLT) has shed more than 16% of its value so far in 2022. Since bond yields move in the opposite direction of bond prices, the yield on the 10-year Treasury note is exploding.

It has surged more than 1.6 percentage points — or 160 basis points — just since last spring. At around 2.7%, it's the highest in 38 months.

And it's not just Treasurys that are getting trashed. Investment-grade and high-yield corporate bonds are plunging in value, too.

All told, the benchmark $298 billion Vanguard Total Bond Market Index Fund ETF Shares (BND) lost almost 9% year to date through Tuesday, more than the 7% loss on the SPDR S&P 500 ETF Trust (SPY).

The first quarter alone was the worst for the aggregate bond index since 1980!

Falling bond prices and rising interest have been particularly bad news for over- owned, overvalued (and in many cases, unprofitable) tech stocks.

That's because rising discount rates drive down the value of earnings that won't be earned until further into the future — a process that hurts stock prices in the present.

The Invesco QQQ Trust (QQQ), for example, has shed 14% year to date.

So, what are investors to do in the face of soaring rates, surging inflation and greater volatility?

Dodge the carnage in Treasurys and find sources of income elsewhere.

That includes things like:

- Business development companies (BDCs), which are legally obligated to distribute 90% of their profits to shareholders.

- Real estate investment trusts (REITs).

- Energy master limited partnerships (EMLPs).

- And other high-yielding names that spin off yields double, triple or even quadruple the yield of the S&P 500!

Selling options for income is another solid strategy to consider. And, of course, you'll find my favorite names and strategies in Safe Money Report.

Investors also need to be sure to own a higher than usual allocation to precious metals and mining shares, as well as stocks levered to other surging commodities like energy.

Most of all, make sure to keep following the guidance here and in my Safe Money Report.

Inflation is trying to rob you blind ... but there are plenty of strategic ways for investors to protect their wealth with whatever hand they're dealt.

Until next time,

Mike Larson