|

| By Tony Sagami |

Do NOT underestimate the impact that the SVB Financial Group (SIVB) and New York-based Signature Bank (SBNY) shutdowns will have on the economy.

Whenever you see a cockroach, you can bet more will be found.

|

In 1972, members started writing in, asking about the safety of their savings and loan banks. Back then, there was no data available. Weiss Ratings has decades’ worth of data, PLUS a long history of warning against collapse. Today, S&L banks no longer exist. And while we have fewer institutions today, they are bigger. Many are also at risk of failing 2008-style. While the Silicon Valley Bank debacle is unique in that it largely serviced tech and venture capital outfits, it may not be the last to be taken over by regulators. Click here to look up your own financial institution for FREE. |

Without getting lost in the financial weeds, the thing that worries me the most is the generous latitude financial institutions have when it comes to accounting.

Financial Sleight of Hand

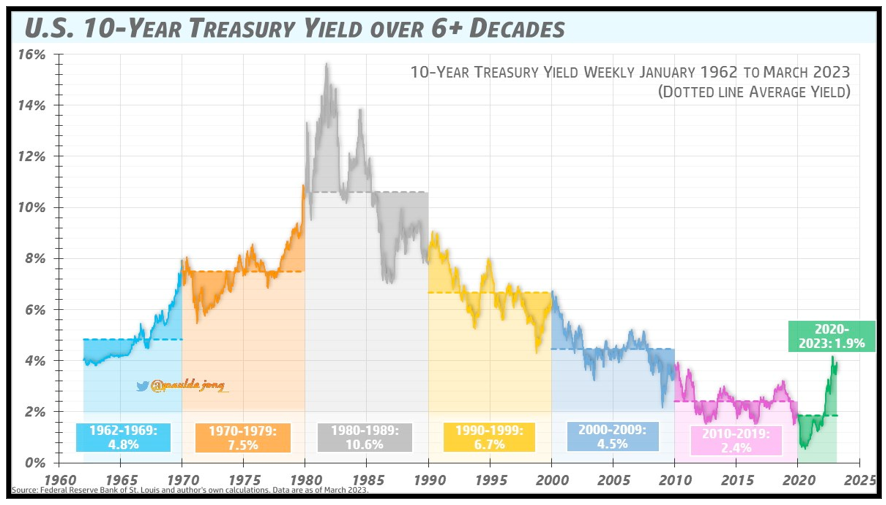

For example, banks are allowed to value U.S. Treasury bonds at acquisition cost, even if they have dropped in value.

Click here to see full-sized image.

That’s like valuing my 2016 Corolla at the $22,000 I paid for it, instead of the $5,000 or $6,000 it’s worth today.

That’s not a problem until you start selling. To meet withdrawals, Silicon Valley Bank had to sell $21 billion of its bond portfolio at a $1.8 billion loss.

However, once a bank coverts unrealized losses into actual losses, the bank must mark similar assets at the new, lower prices. The avalanche of mark-to-market accounting losses is what pushed Silicon Valley Bank over the insolvency edge.

By the way, the same accounting rules are used at many insurance companies.

History Rhymes

One of the catalysts for the Financial Crisis of 2008 was the same accounting nonsense. Banks loaned billions of dollars for mortgages on homes that were painfully falling in price.

Banks and mortgage companies were allowed to value those mortgages at original prices. And like Silicon Valley Bank, they finally had to admit massive losses and restate their balance sheets.

The Federal Reserve’s fight against inflation is behind the current problem. The Fed increased interest rates so rapidly that it created the worst bear market for bonds in the history of the U.S.

Bonds got clobbered in 2022, with the 30-year U.S. Treasury bond losing 39.2%, marking the worst year ever for bonds.

That loss was unprecedented — you have to go all the way back to the Napoleonic War in 1803 for the second-worst year, when long bonds lost 19%.

What’s This Mean for Investors?

What you’re looking at is a liquidity problem. History has shown that whenever there is a big drop in liquidity, there is almost always corresponding downside volatility.

No. 1: Stay the heck away from bank and insurance stocks. If you own any financial stocks, I would dump them. They’re too dangerous right now, and it would have been wise to exit those already.

No. 2: This is a time to purge your portfolio of high volatility assets. Everybody loves upside volatility, but downside volatility is a portfolio killer.

Investors who want to take action to protect their money should click here for four steps to take now to stay safe and grow their wealth.

No. 3: Manage your risk exposure to crypto. Crypto is the king of volatility. Last Friday, the crypto market got clobbered, losing $70 BILLION in market cap in a matter of hours. Bitcoin (BTC) dipped below $20,000.

It recovered pretty quickly over the weekend — remember, crypto markets never close — but big swings are common in crypto. That’s why many people are still steering clear of this young market.

If you’re not yet exposed to crypto at all, and don’t want to be, that’s fine, too. But, if you’re looking to dip your toes in the water, you have a few options, such as Greyscale Bitcoin Trust (GBTC), which gives you exposure to Bitcoin without needing to hold the asset itself, or the ProShares Bitcoin Strategy ETF (BITO), which tracks Bitcoin futures.

Alternatively, if you think Bitcoin is heading lower, you can trade the ProShares Short Bitcoin Strategy ETF (BITI). Like the name implies, BITI goes up in value when the price of Bitcoin falls.

No matter what your plan of action is, I hope you’re able to prepare and protect your portfolio in these wild times.

Best wishes,

Tony