|

| By Chris Graebe |

Many innovative companies trade on the Nasdaq because they sell game-changing technology OR because they use technology to make their products and services even more compelling for end users.

One company that’s been able to do both is grocery delivery service Instacart, which just officially filed for its initial public offering.

It plans to debut on the Nasdaq under the symbol CART, although there is no word yet about the potential stock price, number of shares that will be made available or its launch date.

Now, as you know, my specialty is finding startups and other pre-IPO companies that are worth having on your radar.

So today, I’d like to take you through Instacart’s journey from big idea in 2012 to $10 billion company today … and see if it’s worth keeping an eye on.

That’s because Instacart’s IPO is the first venture-backed IPO in the U.S. in almost two years. That tells me it’s set to have a big impact on early investors and attract a new wave of investors once the stock goes public.

Profitability Is King

Instacart’s filing revealed that the company’s core business has turned profitable, a crucial factor that could attract IPO investors.

This San Francisco-based company reported net income of $242 million for the six-month period ending June 30, compared to a loss of $74 million during the same period the previous year.

Profitability has been consistent, with Instacart achieving five straight quarters of positive financial performance, which is impressive in this current environment.

It’s also very interesting to see a company of Instacart’s size and years in the market finally turn the corner and see these long-anticipated profitability numbers.

One of the biggest factors for Instacart reaching these numbers is by successfully diversifying its revenue streams, with advertising and other revenue surging by 24% to $406 million.

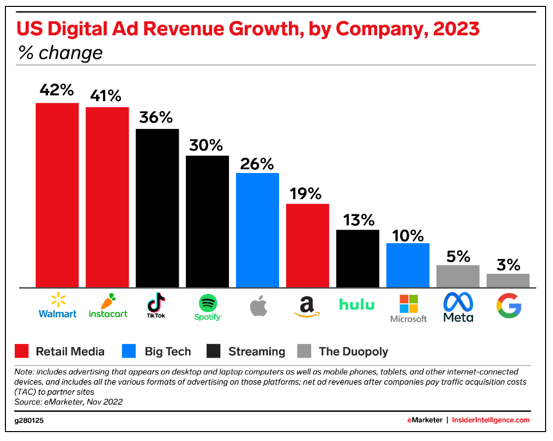

These numbers could get higher, too, with expected 2023 digital ad revenue growth only a hair behind of Walmart (WMT).

This diversification strategy has allowed Instacart to capitalize on additional monetization opportunities beyond its core delivery business.

Instacart also experienced a significant boost in its delivery business during the COVID-19 pandemic as consumers sought to avoid public places. However, as lockdown restrictions eased and market volatility ensued, growth slowed down, leading to a revision of Instacart’s valuation.

In December 2022, the company slashed its internal valuation to $10 billion, a significant decrease from its previous valuation of $39 billion.

Yikes ... that can be a scary time for startups and the early stage investors!

Why IPO Now?

Instacart’s decision to go public comes at a time when the IPO market has been relatively subdued. However, recent developments, such as Arm Holdings’ IPO filing, indicate a potential revival of the IPO market.

The IPOs of Instacart and other high-profile companies like Klaviyo are expected to test investor appetite for new stocks. The fact that Instacart has achieved profitability could be a crucial factor in attracting IPO investors who prefer companies with a track record of financial success.

With Goldman Sachs (GS) and JPMorgan (JPM) as the lead underwriters, the IPO is expected to take place in September. That time frame aligns with a wave of high-profile companies testing the IPO market.

Instacart’s successful IPO could potentially revitalize the U.S. IPO market, which has witnessed limited activity in recent years. Analysts predict that a healthy IPO market will emerge in 2024, leading to an increased number of companies initiating the IPO process.

Should You Pick Up Instacart Shares?

Instacart’s decision to go public marks a significant milestone in its growth trajectory.

The company’s profitability, revenue growth, strategic focus on artificial intelligence and potential for an omnichannel experience position it as a compelling investment opportunity.

The IPO will not only impact early investors, but it will also provide an opportunity for new investors to capitalize on the company’s prospects.

As Instacart embarks on this new chapter, all eyes will be on the grocery delivery giant to see how it navigates the public market and continues to shape the future of the rapidly-evolving grocery industry.

For pure speculators, this could be an opportunity to get at nearly the ground level. As for me, I prefer to invest in companies like this at the basement level — pre-IPO.

If you’d like to invest in these kinds of companies alongside me, consider taking my Deal Hunters Alliance service for a test drive today. You can do that right here.

Happy hunting,

Chris Graebe