|

| By Michael A. Robinson |

U.S. firms are throwing money at investors like never before.

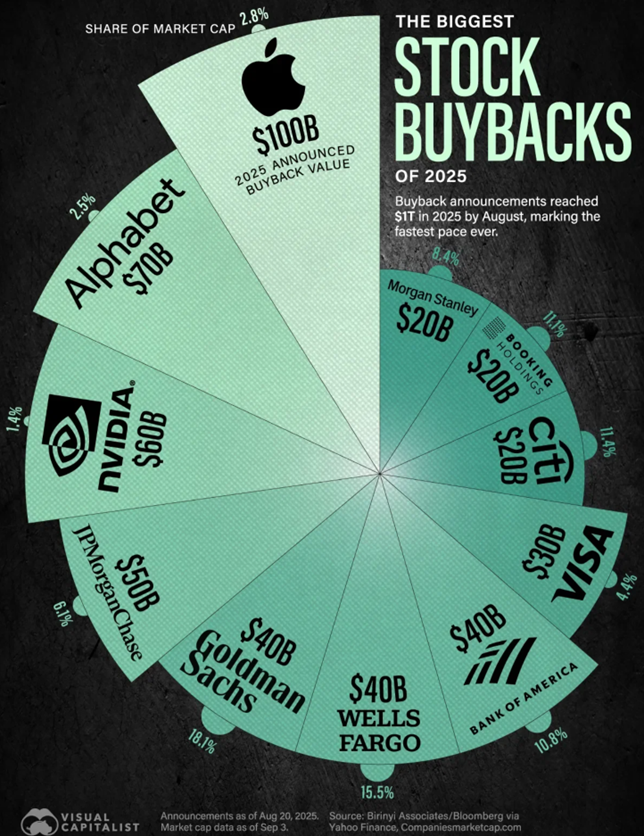

So far this year, companies have announced a staggering $983.6 billion in stock buybacks — the biggest start to a year on record.

By the time 2025 is in the books, Wall Street expects that number to blow past $1.1 trillion.

That’s not pocket change. That’s real money flowing back to shareholders — cutting share counts, boosting per-share profits and fueling a rally that has pushed the S&P 500 and Nasdaq to fresh highs.

Here’s the kicker: Tech firms are leading the charge.

Apple just pledged $100 billion.

Alphabet set aside $70 billion.

And several others in Silicon Valley are lining up behind them.

And that brings me to a way we can ride this trillion-dollar wave for maximum upside.

It’s an investment that has beaten the broad market over the past five years by more than 55%.

Let me show you why there’s still so much upside ahead …

Tech Buybacks as Fuel

Now then, stock repurchases, as they are more formally known, don’t just send a message of confidence.

They also tell us that America’s most cash-rich firms see better odds putting money into their own stock than anywhere else.

And there’s a good reason why tech is leading the pack. They sit on the fattest balance sheets in corporate America.

Their products dominate global markets, their profit margins are among the highest on Earth and their cash flow is enormous.

So, I’m not at all surprised to see that the top 20 firms account for nearly half of all repurchases so far this year — and the bulk of them are in tech.

That makes buybacks one of the strongest short-term drivers for tech stocks we’ve seen in years.

Every dollar they use to retire shares tightens the supply.

That pushes up per-share profits, which in turn draws in more investors.

It’s a cycle that feeds on itself — and right now it’s running full tilt.

Better still, these buybacks aren’t a one-off event. They are being built into long-term capital plans.

Tech leaders see them as a way to reward investors while still keeping billions in reserve for the next wave of innovation.

This is why the buyback boom has become such a powerful tailwind for tech stocks — and why the best is still ahead.

The Big Driver: Earnings Power

Buybacks are a great way to put cash to work.

But the real fuel behind this trillion-dollar wave is something even more powerful: Earnings.

Tech firms aren’t just rich by accident. They mint money at a pace the rest of corporate America can only dream about.

Their software, chips and platforms scale globally with very little added cost.

That’s why their profit margins are the fattest in the market.

And when those profits pile up, Wall Street takes notice.

Last year, big tech grew per-share profits as a group by roughly 37%.

By contrast, non-Magnificent 7 firms in the S&P 500 had earnings growth of just under 7%.

Here’s the beauty of it: Those earnings not only fund buybacks but also give these companies room to keep investing in the next big thing.

AI, cloud computing and cybersecurity aren’t just buzzwords. They’re high-growth arenas where tech is plowing billions.

That’s how the top 10 tech firms now command a combined market cap of nearly $18 trillion — roughly the size of our frenemy China’s GDP.

Think of it this way. Buybacks are the short-term spark. But consistent earnings growth is the big driver that keeps the engine running quarter after quarter.

Put them together and you’ve got a one-two punch that makes tech one of the most attractive spots in the entire market.

The Twofer Play: IGM

By now, you can see the setup.

Tech’s buybacks are breaking records …

Earnings growth keeps outpacing the market …

And we need a simple, effective way to grab our share.

That’s where the iShares Expanded Tech Sector ETF (IGM) comes in.

This one fund gives us exposure to nearly 290 companies across the tech universe.

Inside you’ll find the giants — Apple, Microsoft, Nvidia, Alphabet and Meta.

But you’ll also get smaller, fast-growing firms in software, cloud, chips and digital media.

Take a look:

- Ubiquiti (UI) has a market cap of just $35 billion. The wireless leader has announced a $500 million buyback while also boosting its dividend.

- KLA (KLAC), a chip supply firm, just added $5 billion in buyback capacity. That a big number for a company with a market cap of roughly $120 billion.

- Arista Networks (ANET) is a play on AI data centers and has a $180 billion market cap. It just rolled out a $1.5 billion buyback program.

Think of it as a basket of the best ideas in tech.

If one company stumbles, dozens of others are driving ahead. That’s why it works so well in markets where change happens fast.

That’s the beauty of IGM. It doesn’t bet on just one stock or one trend.

Instead, it captures the full force of tech’s earnings power and buyback machine.

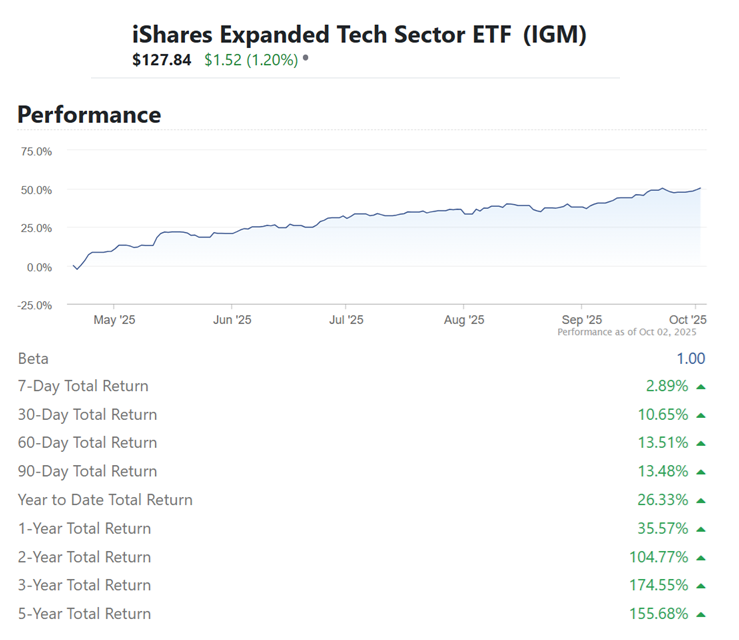

And the results speak for themselves.

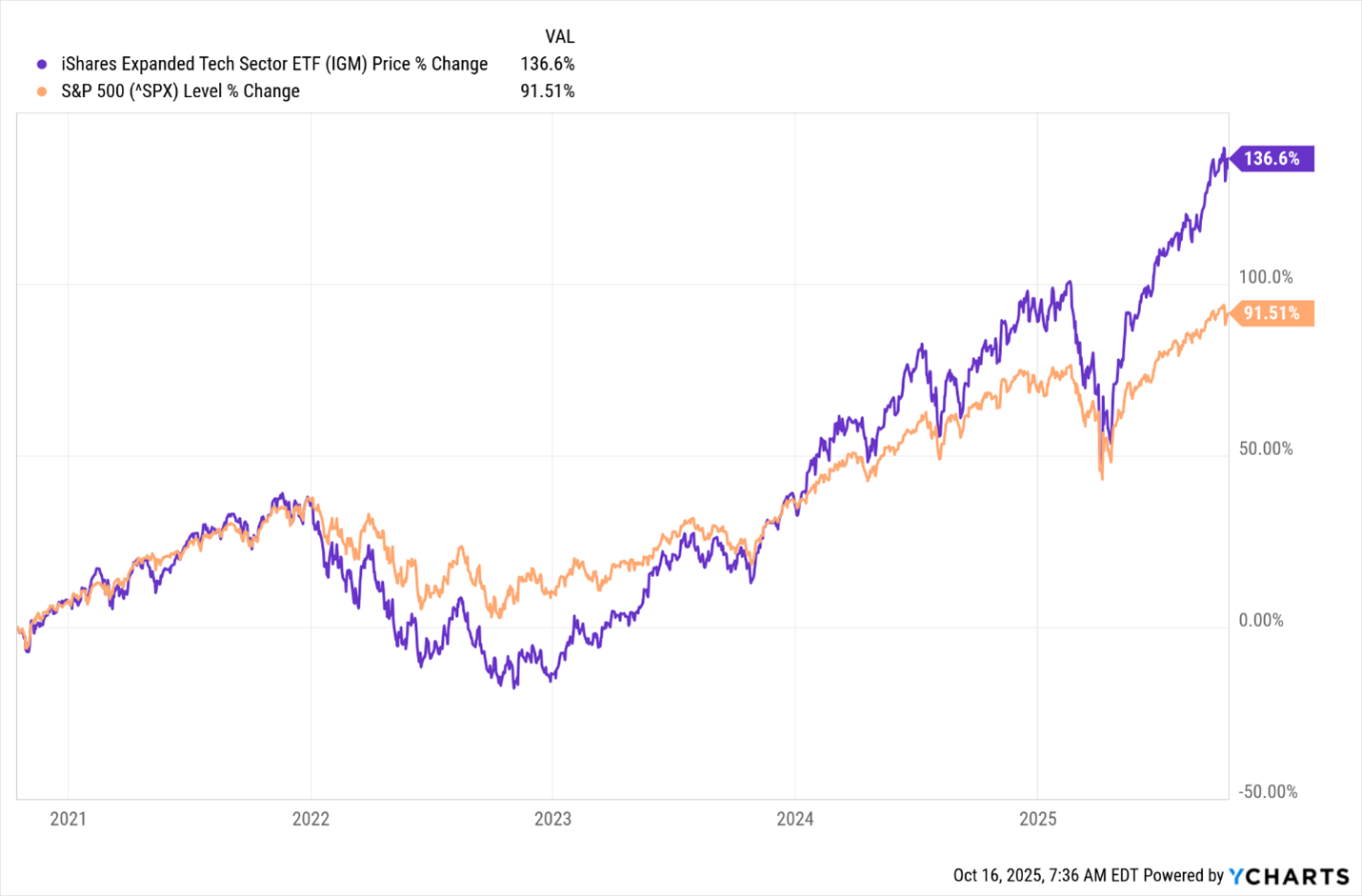

Over the past five years, the S&P 500 has gained about 92% — a very strong showing by any measure.

But IGM surged 137% over that same period. That means it beat the benchmark by 48%.

It doesn’t take many winners like this to really juice your portfolio and set you up for what we all want — financial independence.

And that makes it one of the simplest, smartest ways to ride this trillion-dollar wave for years to come.

Best,

Michael A. Robinson

P.S. Of course, individual tech stocks leading the charge will have even more outsized performance … if you can invest in the right ones.

Fortunately, with the 7 terabytes of data at our disposal, Weiss Ratings just put out a report on the stocks set to lead “AI’s Second Wind.”

Watch to the end to see how to get this always-updated report.