|

| By Chris Graebe |

Most people believe — yours truly included — that the Apollo 11 mission and Neil Armstrong’s history-making walk on the moon in 1972 ended the Space Race between the U.S. and then-Soviet Union.

The U.S. may have won bragging rights as the world’s most technologically advanced country by doing so. However, NASA’s 50-plus year gap in moon travel has created a meteoric opportunity for public and private companies in space.

As a startup enthusiast, I’ve also got my eye on a few pre-IPO deals capable of delivering orbital returns on investments. More on that in a bit.

There’s much more at stake than bragging rights in this latest leg of the modern-day race, hoisted back into the spotlight by the first-ever commercial landing on the moon on Feb. 22.

Built by Texas-based Intuitive Machines (LUNR), the uncrewed robot, dubbed Odysseus, took off from its mission operations center in Houston and landed on the moon seven days later.

Odysseus carried six experiments for NASA, which paid $118 million for the ride as part of the U.S.’ mission to eventually send a manned vehicle back to the moon.

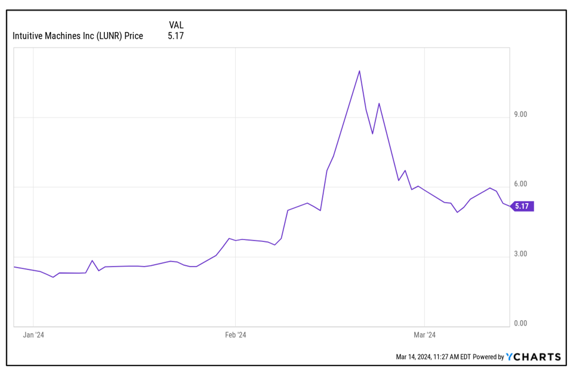

Prior to the mission, LUNR traded under the radar for a mere $2 per share. But those shares took off after its robot touched down, hitting $21.

The boost turned out to be short-lived after Odysseus tipped over and never made it back to Earth. As a result, the stock lost almost three-quarters of its value from a near-$1 billion market valuation down to the current $159 million. Shares trade around $5.47.

Investors shouldn’t consider the mission a failure for Intuitive Machines, however. The company sure doesn’t. It is organizing a second mission later this year … with a third in the planning stages.

Considering LUNR spent much of its pre-mission time relatively unknown, investors just becoming aware of the company may have a great opportunity to buy shares on the cheap for a star with a bright future in the space sector.

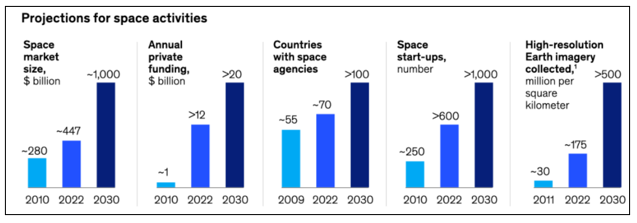

Whether companies “partner” with NASA on future missions or pursue space exploration independently, they’ll all be clamoring for their piece of the potential $1 trillion value the market is expected to reach by 2030.

SpaceX is doing a little bit of both.

Officially known as Space Exploration Technologies Corp., the private company is the brainchild of Elon Musk. Founded in 2002 with the goal of reducing space transportation costs and ultimately developing a sustainable colony on Mars, SpaceX’s more recent foray into sending rich folks into orbit has caught the world’s attention.

By the end of the decade, experts say that SpaceX alone is likely to launch more satellites than the rest of the world has sent into space since Sputnik.

NASA is also partnering with the company, as the U.S. prepares for the Artemis III mission planned for 2026. NASA declared that it will “mark humanity’s first return to the lunar surface in more than 50 years and make history by sending the first humans to explore the region near the lunar South Pole.

That’s if the mission stays on schedule and a private firm doesn’t beat it to the punch.

If you’d like to put your faith and money into previously launched companies in the space scene, consider buying shares of LUNR or Rocket Lab (RKLB).

If you’d rather avoid individual stocks, take a look at this ETF: ARK Space Exploration & Innovation ETF (ARKX). Keep in mind, however, that this ETF is thinly traded, risky and rated poorly by Weiss Ratings.

You have other options, though, thanks to advances in AI, blockchain, 3D printing, materials science, nanotechnology and biotechnology. These technologies have collectively made launch costs cheaper, increased the capabilities of smaller satellites and created new avenues for exploration.

As a result, they’ve greatly impacted the sources of space R&D funding. In the early 2000s, more than 90% came from the government. Today it stands at 50%, with commercial sources now providing 30% of total space R&D funding, according to McKinsey Research.

If this trend continues, commercial funding could surpass government funding within the next 20 years. Private sector funding in space-related companies already topped $10 billion in 2021 — an all-time high and 10-fold increase from the prior decade.

Now, I’m not big on investments in space tourism. Even though it’s gaining traction, traveling to space for fun remains a hobby of the rich and famous, and I suspect it will be costly for some time.

I see the biggest opportunities in the scientific discovery arena.

This is where we’ll see the creation of new products including semiconductors, pharmaceuticals, optical cables, retinal implants or even organs, that will benefit people living on Earth.

Experimentation on in-space manufacturing will likely lead to discoveries that we have not yet imagined. For example, space may be well suited for heavy manufacturing linked to pollution on Earth today because the solar system can support many times more industry than we have on our planet.

Another exploration-worthy corner of space is asteroids and other bodies that contain a plethora of precious metals scarce on this planet.

Just imagine the success the first companies that earn a share of mining rights and ownership of resources in space will achieve — and the profits investors who funded them in their early days will accumulate.

While the right space mining company might not be here just yet, I do have some good news on an Earth mining — or drilling — company.

I just shared the name of my newest crowdfunding target with my Deal Hunter Alliance Members yesterday.

For a very limited time, you can hear all about this private tech/oil hybrid. Click here for the details.

Until next time, my friend!

Happy hunting,

Chris Graebe