How to Profit from Our 147-Zettabyte World

|

| By Michael A. Robinson |

Last month, I appeared on Schwab Network’s “Trading 360.”

During my segment I was asked about a high-profile chip stock called ON Semi (ON).

The company had released its most recent quarterly earnings statement. And it had beaten forecasts on Wall Street.

Still, I cautioned that I was still far from impressed with ON’s future.

Sure, I’ve recommended this Phoenix-based chipmaker before.

But this time, I wasn’t so bullish.

ON had two straight quarters of negative earnings growth. This bodes poorly for making money down the road.

But I wasn’t a total naysayer.

Yes, I discouraged investors from scooping up shares of ON Semi.

But that’s because I see another, better opportunity …

One that has nothing to do with semiconductor chips.

Instead, it’s focused on AI — specifically, the use of AI in a sector that is already valued at more than $62 billion.

In this space, I like one company that is on pace to double its earnings in less than three years.

And that is a conservative forecast.

Let’s dig into it …

More Data Than We Can Fathom

To understand the value this company has, we first need to talk about something that’s an integral part of our daily lives.

I’m referring to data.

Data helps with things like decision-making, marketing, problem-solving, risk identification and goal setting.

It’s become extraordinarily valuable. In fact, many refer to data as “the new gold.”

It can be hard to wrap your mind around how much data there is. But let’s give it a shot:

In late 2022, the early version of ChatGPT, an AI-assisted chatbot, was developed using 175 billion data points.

That’s about the equivalent of one million feet of bookshelf space, or the distance between Baltimore and New York City.

But each day, more than 2.5 quintillion bytes of data are created. That’s the equivalent of 100 million Blu-ray discs.

And more than 90% of data was generated in the last two years alone.

Storage Is Crucial

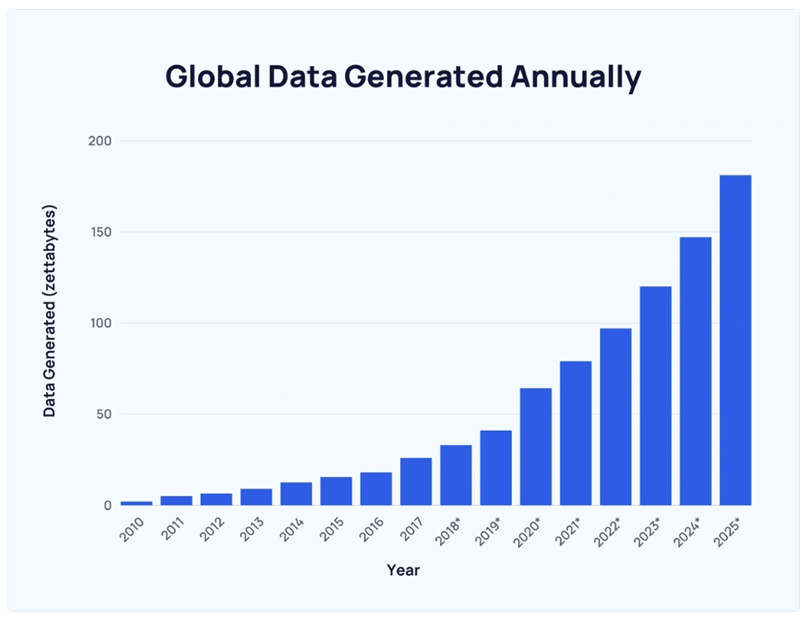

By the end of this year, the global data volume is projected to reach about 147 zettabytes.

For reference, just one zettabyte is equal to one trillion gigabytes.

That figure is set to soar to 181 zettabyes in 2025.

Clearly AI plays a role in the creation of this data.

But this technology also plays a role in processing all this data, which must be done at warp speed.

The thing is, with all this data surfacing, how do we store it all?

The market for data storage is massive. According to GMI Insights, it’s valued at $62.5 billion.

Storing data involves facilities that house a company’s computing equipment. Here, cutting-edge hardware and software process, store and share information.

The largest data center in the world is 10 million square feet, located in China.

The largest data center in America is owned by social media giant Meta Platforms (META) and spans 4.6 million square feet.

As more data is created, demand for data centers will increase.

That’s why I’m focused on a specialty data center supplier whose value is set to rise right alongside this demand …

A Data King

This company provides networking hardware and software for large data centers.

Founded in 2004 in Silicon Valley, this company makes high-speed network equipment. The kind of gear that data centers rely on so they can connect multiple servers with each other and with the internet. All without creating logjams that slow everything down.

You see, it’s not just about storing all this data.

It’s about getting it stored and transferred quickly.

That’s where this company enters the picture.

Its main focus is on ultra-fast switches — small boxes that route traffic to the exact server it needs to go to at lightning speeds.

It may sound simple. But in data centers, switches need to handle so much data so quickly that it takes highly specialized equipment to do it right.

For large data centers, it’s critical that these switches not introduce any delays in the signals they re-route.

And one company has a history of being the fastest on the market.

Its data-center grade switches can route information to the right destination in under 500 nanoseconds. That’s just 500 millionths of a second.

This is a huge opportunity. That’s why I recently presented it in more depth here.

I urge you to check it out. You’ll learn more about this company AND an even larger problem in the data storage world … one that comes with other massive opportunities.

Best,

Michael A. Robinson