|

| By Chris Graebe |

I recently got off a phone call with a founder who seems to be headed toward the Holy Grail of startup life — an exit.

In fact, it looks like this founder could potentially have a competitive bidding war on his hands from two massive tech giants.

Now, his startup is in a red-hot sector. The money continues to flow from private equity and venture capital into a few select sectors — his being one of them.

However, while not his, the sector that is getting the most attention is of course … AI.

Before we hung up on the call, he shared a little nugget with me that I found very interesting. He said that one of the major acquisition banks — these are banks that specialize in helping startups get acquired — is starting to see much more activity than it did throughout all of 2023.

In fact, he claims there was zero deal closed in the first nine months of last year … but four or more were closed in the last 90 days. That's a very good sign.

Here’s what it should mean for the new year …

Cash to Buy

In 2023, there wasn't much movement at all inside the world of private equity. Cash was piled up on the sidelines … waiting to see what the markets did.

But there’s a shift coming …

Managers across the VC spectrum are expected to retrench their fundraising strategies and lower their expectations. This may result in the raising of smaller funds. It should also mean a renewed interest in equity crowdfunding investors as an alternative.

Taps will flow once again, within reason …

Down Rounds and Unicorpses

First, there should be an increase in "down rounds." This means that valuations will decrease across financing, affecting existing investments.

As a result, talent will migrate from struggling companies, or "unicorpses," to the next generation of startups.

Another thing I expect is a boom in acquisitions. There is already a substantial appetite for deals here. However, closing deals or raising funds may be hindered by external factors.

The market may experience a recovery similar to that seen after the Dot-Com Bubble Burst in the early 2000s … much more measured than previous years.

Finally, this year, as the AI arms race continues, I predict that AI acquisitions will be all the buzz.

Back in 2020, I actually invested in one company that has been preparing for this very moment in time. And I wouldn't be surprised at all if it gets acquired in 2024.

So, here’s how we sit in front of this new year …

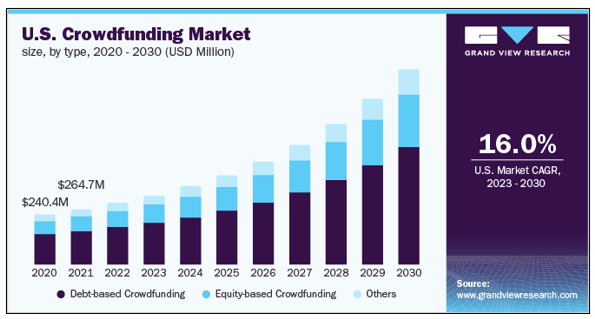

2024 holds promise for the revival of private equity and venture capital. The power balance is shifting though, with equity crowdfunding gaining strength.

In fact, according to Grand View Research, the global crowdfunding market size was valued at $1.67 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 16.7% from 2023 to 2030.

The fundraising environment for VCs may be challenging, leading to discussions of mergers, down rounds and acquisitions.

No matter what deals land, however, I plan to take advantage of the right ones.

That’s all for today. I’ll be back with more soon.

All the best,

Chris Graebe