|

| By Jordan Chussler |

Once upon a time in America, retirement meant something very different than it does today.

There were gold watches, jovial farewell parties with coworkers whose shared memories spanned decades and, in many instances, pensions that would comfortably see retirees through their golden years. Then came decades of traveling, golfing, fishing, dining out and invaluable time with loved ones.

However, that was then, and this is now. Data shows that in 2022, Americans are woefully ill-prepared for retirement. And for those who are prepared, ensuring that rising costs and looming recessions don’t implode their streams of income is no simple feat.

The Great Pension Disappearing Act

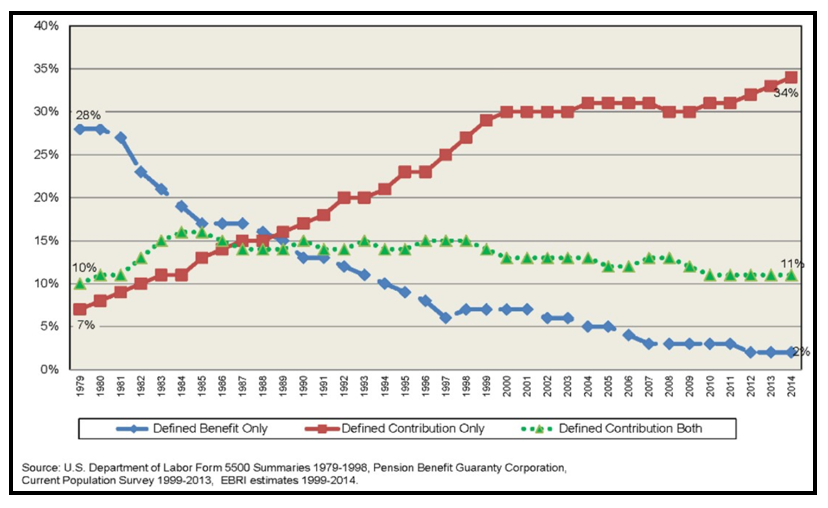

Outside of public service vocations, pensions have largely given way to defined contribution plans (e.g., 401(k) and 403(b) programs), meaning the onus of saving for retirement has been shifted from the employer to the employee.

Traditional pensions — or defined benefit plans — have joined cable television, landlines and Blockbuster Video on the long list of “remember when.”

According to the National Public Pension Coalition, the 401(k) was originally intended to be a supplement to Social Security and defined benefit pensions — a means for workers to save a little extra toward their retirement — but by no means was it intended to become the basis of their retirement income.

However, in the early 1980s, the Reagan administration changed the interpretation of the 401(k) provision to allow it to become more widely adopted and, ultimately, replace companies’ need to provide pension programs for their workers.

The result? In 1970, 45% of Americans who worked in the private sector had a pension plan. By 2014, that figure plummeted to just 2% of private-sector workers.

Social Security

Social Security, as conceived by President Roosevelt in 1935, aimed to permanently address the problem of economic security for the elderly by creating a work-related, contributory system in which workers would provide for their own future economic security through taxes paid while employed. The program isn’t without its criticisms, but it’s endured for 87 years and provided millions of Americans with a bonafide means of post-retirement income.

However, the average Social Security check is just $1,657 per month, despite the maximum benefit being $3,345 per month. This is, to a degree, attributable to more retirees tapping into their accounts at younger ages to address cost of living challenges.

That $1,657 per month for the average recipient equates to receiving $19,884 per annum. For context, the Federal Poverty Level for a one-person household is $13,590, meaning the average retiree just barely outpaces the level of need-based assistance.

Unretirement

Meanwhile, the rate of American unretirement — the act of returning to employment within a year of retiring — is surging. The causes are plenty, including fading COVID-19 fears, soaring inflation, rising wages and an unemployment rate that’s hovering around 50-year lows.

After hitting a 3.5-year low of 2.06% in June 2020, the percentage of retirees reentering the workforce climbed to 3.15% by March 2020. And according to Forbes, nearly two-thirds of recently retired workers would consider returning to their jobs.

So how can average American retirees — 45% of whom rely on Social Security for over 90% of their income — strengthen their money in retirement? Here are three lower risk, income-based approaches …

No. 1: Dividend Aristocrats & Dividend Kings

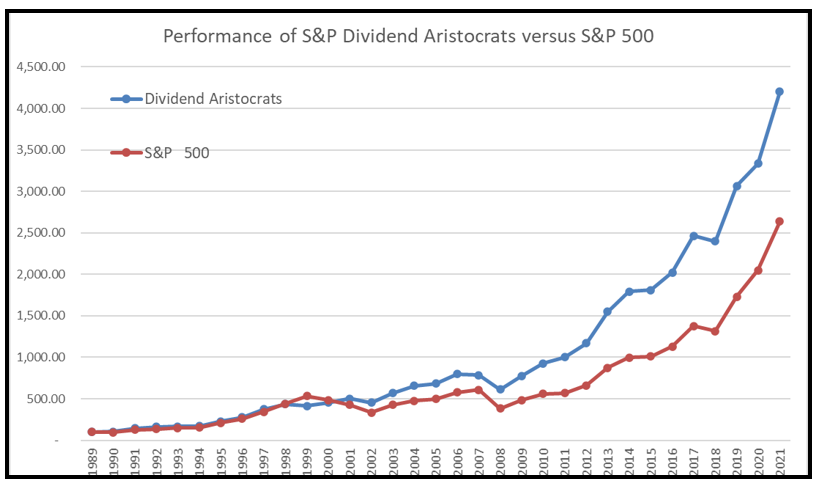

It’s no surprise that shares of companies that pay dividends outperform their counterparts over time. Riskier equities like growth stocks, which often don’t pay dividends, are not safe portfolio allocations for retirees in a late-cycle environment like we’re seeing now.

Instead, income-focused investors should be turning to safe-haven, defensive stocks in sectors that perform well during bear markets — recession-resistant sectors like health care, consumer staples and utilities immediately come to mind, as the products and services they offer are inelastic in demand.

Value stocks also perform better in environments in which interest rate hikes occur, like we’re seeing now as the Federal Reserve belatedly attempts to quell runaway inflation.

Shareholders of companies that qualify as Dividend Aristocrats and Dividend Kings have a sense of assurance and stability in what has otherwise been a tumultuous and unpredictable 2022 market.

Dividend Aristocrats include companies that have paid and raised their dividends for at least 25 consecutive years. Dividend Kings have accomplished the feat for at least 50 consecutive years. While doing so, investors in companies who qualify for those lists have experienced bifold profit through share appreciation and dividend distributions.

Examples include well-known names like Procter & Gamble (PG) with65 consecutive years of raising dividends, 3M (NYSE: MMM) with 64 years, Coca-Cola (KO) with 60 years and Stanley Black & Decker (SWK) with 54 years.

No. 2: Fixed-Income Funds

Like dividend-paying stocks, fixed-income funds — or bond funds — are once again in vogue. And for similar reasons, too: 41-year high inflation, a precarious equities market and contracting gross domestic product that suggests a looming recession.

However, while the average dividend-paying stocks’ yield remains well below the historic highs set nearly 50 years ago — the average Dividend Aristocrat yields a mere 2.3% — yields for fixed income funds are above dividend yields for the first time in years.

Their return to popularity makes perfect sense after nearly 15 years of investors disregarding Treasury notes in favor of higher-risk assets. The Fed’s rate hikes — which are historic in their own right — have caused bond yields to rise considerably and, in some cases, potentially outpace inflation itself.

With persistent volatility disrupting the markets this year, fixed-income funds provide steady interest payments that can help offset potential losses from declining shares while softening the blow of hightented consumer inflation, which stands at 8.5%.

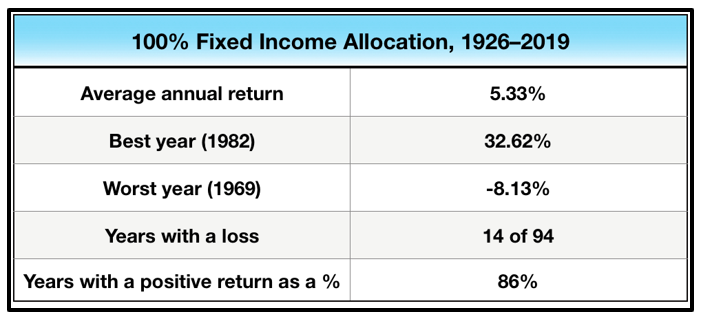

Between 1926–2019, investors with funds set to a 100% allocation of fixed income experienced, on average, a historical return of 5.33%. That respectable 5.33% average return is important, as the probability of having an annual gain with a fixed-income fund is outstanding compared to other investment vehicles.

Over the course of those 94 years, funds with a 100% allocation to fixed income experienced just 14 years with a loss, or 14%, meaning they have a historical track record of producing positive returns 86% of the time.

Those with fixed-income funds in their portfolios can largely avoid — or at the very least, offset — the wild swings we’ve seen this year in the equities market. This is significant for recent retirees, as it enables them to reinforce their fixed income while also preserving their capital.

No. 3: Qualified Longevity Annuity Contract

On Dec. 20, 2019, the Setting Every Community Up for Retirement (SECURE) Act became law. The previous May, it passed in the House of Representatives with an overwhelming, bipartisan margin of 417-3.

Among its numerous provisions — including making retirement plans more accessible for part-time workers and allowing 401(k) programs to offer annuities — was a mandate that pushed back the age at which participants in retirement programs were to begin taking required minimum distributions (RMDs) from 70.5 to 72 years old.

The move from 70.5 to 72 was included because as life expectancy increases, so does the need for retirement savings to last longer. This is precisely why retirees should consider a qualified longevity annuity contract, or QLAC.

QLACs are deferred annuities designed to prevent retirees from outliving their savings. They must be funded from a qualified retirement plan or individual retirement account (IRA), but not a Roth IRA since those retirement accounts do not stipulate that RMDs must be made.

Deferred annuities — in this case, QLACs — allow account holders to defer RMDs until a certain age, with the maximum age permissible set to 85 years old.

Thanks to the SECURE Act, retirees can spend 25% or $135,000 (whichever is less) of their qualified retirement plan or IRA to purchase a QLAC. The main benefit of doing so is that the calculated RMD from the account used to fund the QLAC is lowered by either 25% or $135,000.

For example, upon retirement, if a traditional IRA has a balance of $500,000, and $125,000 (25%) is used to procure a QLAC, the remaining balance of $375,000 is the principal upon which the RMD is based — not the initial $500,000.

Another benefit of a QLAC is that they reduce the tax burden placed on RMDs, since smaller distributions are made after the funds are diverted from the qualified retirement plan or IRA. On the flip side, once distributions are made from the QLAC, because they are purchased with pre-tax retirement funds, they’re factored into retirees’ ordinary income tax rate.

As previously mentioned, QLAC holders can defer income payments until age 85, and the longer into retirement they wait, the higher those payments will be. It is up to the individual to determine the start date for payments based on multiple personal factors, including their current age, health status and financial needs as based upon the remainder of their retirement savings.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily

P.S. Last week, Dr. Martin Weiss held a free tutorial for an all-weather strategy to help investors consistently beat the market. Testing shows this strategy beat the S&P 500 nearly 5-to-1 over the past 19 years. See how it works by clicking here.