According to the Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) jumped by 7% last month … the hottest inflation reading in 40 years.

The BLS collects a mountain of data for hundreds of goods and services by surveying over 23,000 retailers and 50,000 landlords/tenants.

With that much data, you would think the CPI numbers would reflect the current state of inflation.

- WRONG!

The CPI numbers are grossly understating the true rate of inflation.

It is really much, much worse than the government wants us to believe.

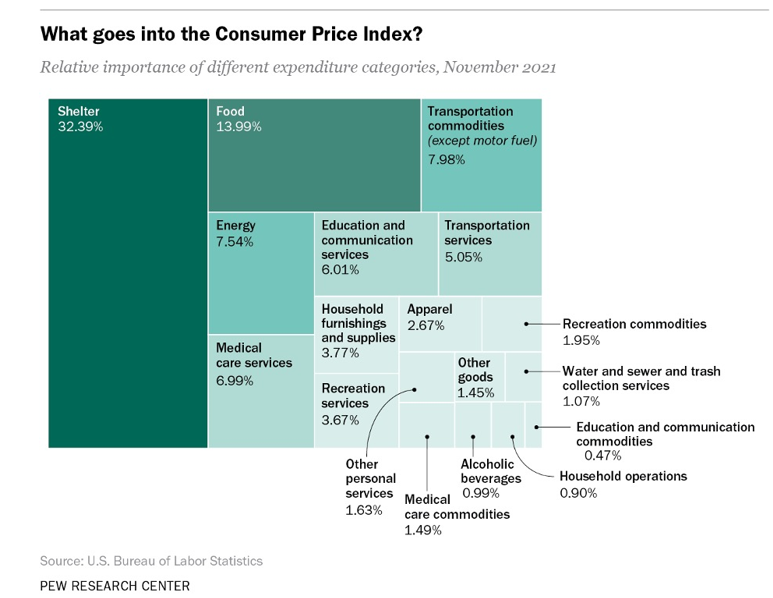

For example, let’s look at shelter. It’s the biggest category, accounting for nearly a third (32.39%) of the CPI index.

Of that, something called “owner’s equivalent rent of primary residence” carries a 22.3% weighting.

Owner’s equivalent rent (OER) is the government’s subjective estimate of how much homeowners would have to pay if they were renting their homes.

Over the past year, OER increased by 3.8%.

Seriously?

And regular rent (traditional landlord/tenant rental property) only increased by 3.3% over the past 12 months.

As the Future Farmers of America (FFA) students at my high school used to yell at basketball referees after making a bad call … bull****.

“American renters saw an 11% increase in median asking rent from January to December of 2021," according to Jonas Bordo of rent tracker Dwellsy.

- The increase for single-family home rentals was even bigger: 26%.

That is why the 3.8% increase the government wants us to believe is baloney. And don’t forget that shelter is almost one-third of the CPI calculation, which means that CPI is really running at 10%-plus.

No wonder the Fed has dropped its “transitory” excuse!

What This Means for Investors

Three decades of falling interest rates and low inflation are over.

Dead. Gone. Kaput.

Don’t fight the last war; the new war is inflation … and you need to adjust your investment strategy accordingly.

The following are three ways investors should consider modifying their approach:

1. Ditch Long Bonds.

When interest rates rise, long maturity bonds get clobbered.

I recommend getting rid of your long-term bonds and swap in short-term, fixed-income instruments like CDs, T-bills, short-term bond funds and money markets.

And in today’s day and age, new yield-seeking strategies are quickly emerging.

Dr. Martin Weiss has recently unveiled a new strategy to potentially make 70 times better yield than you can make in the highest-yielding type of bank deposits in America, with far less risk than many types of common bonds.

If you’d like to learn more about this strategy, click here now.

2. Load Up on Hard Assets.

My old friend Larry Edelson (RIP) called them “real” assets.

He loved natural resource stocks like industrial metals, timber, real estate, energy, farmland and agricultural commodities.

Higher inflation will translate into higher natural resource prices and windfall profits for companies that own them.

The top-rated natural resource mutual funds at Weiss Research include ICON Natural Resource & Infrastructure (ICBAX, Rated “B-”), VanEck Global Resources Fund (GHAIX, Rated “B-”) and BlackRock Natural Resources Trust (MDGRX, Rated “B-”).

3. Climb Aboard the Gold & Silver Inflation Train.

For thousands of years, humans have used gold and silver as a storehouse of wealth … but precious metals have barely budged in the past year. That’s about to change, and I expect gold and silver prices to skyrocket.

You could always buy SPDR Gold Shares ETF (NYSE: GLD, Rated “C+”) or iShares Silver ETF (NYSE: SLV) … but I think you can make double, triple or more by investing in precious metals mining stocks.

Instead of getting angry at the government’s fraudulent inflation numbers, position your portfolio to profit from those lies.

Best wishes,

Tony