If you have or plan to accumulate a sizable 401(k) nest egg, listen up.

Traditional pension plans that pay a lifetime monthly pension — aka “defined benefit” pensions … usually based on years of service and final salary — have largely disappeared.

|

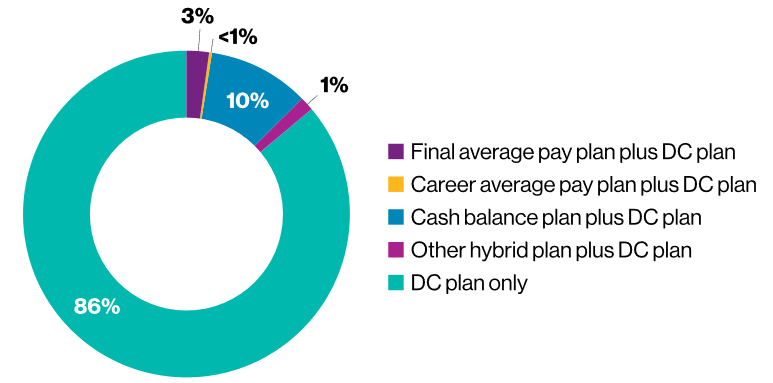

| Offered retirement plan types of Fortune 500 companies in 2019. |

In 1970, 45% of private sector workers in America had a pension plan. By 1980, that figure dropped to 38% of private sector workers.

Today, just 18% of private sector workers are covered by one. And most of those are blue-collar, union jobs.

The reason for that significant drop off?

According to the National Public Pension Coalition:

In the early 1980s … the Reagan administration changed the legal interpretation of the [401(k)] provision and allowed for it to be more widely adopted.

Originally, the 401(k) was intended to be a supplement to Social Security and defined benefit pensions; a way for workers to save a little extra toward their retirement.

Companies, however, began to offer defined contribution 401(k) plans instead of defined benefit pension plans…

[T]he availability of the new 401(k) plan gave them something else to offer.

Subsequently, since the early 1980s, pension plans have largely been replaced with defined contribution plans, the most popular being the 401(k).

• The result is that the onus of saving for retirement has been shifted from the employer to the employee … you!

That’s not a knock on 401(k)s; I’m just telling you that the financial quality of your retirement depends on you and not the company you work for.

If you’re a diligent saver, that’s wonderful because you can accumulate a mountain of money in your 401(k). The only problem with accumulating a mountain of money is that you’ll owe half a mountain in taxes when you withdraw those funds.

But hold on — there are two strategies that can lower how much tax you’ll have to pay when you tap into that 401(k) money.

Tax-Saving Strategy 1:

Convert Your 401(k) to a Roth IRA

There's tons of information online about Roth IRA conversion, so I won’t go into the details.

What I will tell you is that Roth IRAs are such a powerful tax reduction strategy, that even revenue-hungry Congress is talking about abolishing those conversions altogether.

House Democrats have proposed legislation that would eliminate Roth IRA conversions. According to Oregon Senator Ron Wyden, chair of the Senate Finance Committee, “IRAs were designed to provide retirement security to middle-class families, not allow the super wealthy to avoid paying taxes.”

• The good news is that the current proposal doesn’t eliminate Roth IRA conversions until 2032.

I’m not suggesting that you rush out and convert your 401(k) into a Roth IRA tomorrow morning...

What I’m STRONGLY suggesting is that you talk to a tax professional about whether a Roth IRA conversion is appropriate for your personal situation.

Hint: There’s a strong possibility.

Tax-Saving Strategy 2:

Consider a QLAC Annuity

There was an underappreciated retirement rule change in President Trump’s Setting Every Community Up for Retirement Enhancement (SECURE) Act.

The age at which you are REQUIRED to start taking withdrawals — called required minimum distributions (RMDs) — from your retirement account was increased from 70 to 72 years old.

People like Martin Weiss and me … who never plan to retire — face a taxation problem. That is, we are required to withdraw money out of our plans whether we need it or not.

The extra two years — from 70 to 72 — are helpful, but the IRS will still get its grubby fingers on my money eventually.

• Thanks to a little know annuity product called a qualified longevity annuity contract (QLAC), it’s possible to reduce the size of RMDs from your retirement account.

You can put up to $135,000 — or 25% (whichever is less) — of your retirement funds into a QLAC. The benefit is that $135,000 is subtracted from the value of your retirement account and thus lowers the RMD.

For example, someone with $500,000 of retirement savings would calculate an RMD on $365,000 instead of the full $500,000 using a QLAC.

• The benefit is that your RMD is lower every year going forward because of the QLAC.

By the way, if you do a Roth IRA conversion, you won’t need a QLAC because you won’t pay a penny of tax anyway!

Best wishes,

Tony Sagami