Martin: Bitcoin Naysayers Failing Miserably

Bitcoin (BTC) naysayers are back to their old tricks.

But they’re failing miserably.

Warren Buffett, the Oracle of Omaha, recently declared:

|

“If you told me you owned all of the Bitcoin in the world and offered it to me for $25, I wouldn’t take it.”

OK. But here’s the thing: If you had invested $100 in Bitcoin when it first traded publicly, you’d have close to $50 million today.

If you had invested those same $100 in Warren Buffett’s Berkshire Hathaway (BRKA), you’d have only $700 to show for it.

A good profit? Perhaps.

But with Bitcoin, you could have made not just double or triple that profit … not just 10 or even 100 times more, but 83,000 times more.

Meanwhile, Jamie Dimon, the CEO of JPMorgan Chase (JPM), the nation’s largest bank, says …

|

“Bitcoin itself is a hyped-up fraud.”

Trouble is, Dimon seems to prefer putting his money in the biggest failure since the Great Financial Crisis.

He presided over JPMorgan’s purchase of First Republic Bank, an institution that wiped out its shareholders. And despite the so-called “rescue” by Dimon, they didn’t get a single penny of their money back.

Fed Chairs Ben Bernanke, Janet Yellen and Jerome Powell have also been among the naysayers.

But even as they fussed and cussed about Bitcoin …

They’ve done absolutely everything in their legal power — or even beyond their legal power — to weaken, cripple and maybe even destroy the traditional banking system.

How? First by helping wipe out any semblance of a decent yield for the 110 million Americans with a bank account.

According to the FDIC, the average checking account in America yields 0.06%. Less than one-tenth of a percentage point.

What about savings accounts? According to Bankrate.com, it’s not much better — just one-half of a percentage point.

But compared to the average bank savings account, you can now get up to 8x better yields in a completely liquid, equally safe (or even safer) Treasury-only money market fund.

And in the world of crypto, which Bitcoin’s creators pioneered, you can get as much as 50x better yield. Plus ...

Banks aren’t just ripping us off. They’re also creating the climate for a banking disaster.

You see, most people still don’t realize how much yield they’re missing out on by parking their savings in a bank.

Either that, or they haven’t quite figured out yet how to get better yields safely.

But once they do, watch out. Money could start pouring out of the U.S. banking system …

First in a trickle that everyone ignores …

Then, in a flood of withdrawals that wreaks havoc on the weakest banks, and ultimately…

If nothing is done to fix the problem, ultimately that threatens the banking system as we know it today.

When do I predict money outflows from the U.S. banking system will begin?

Well, I don’t have to make that prediction because they already have begun.

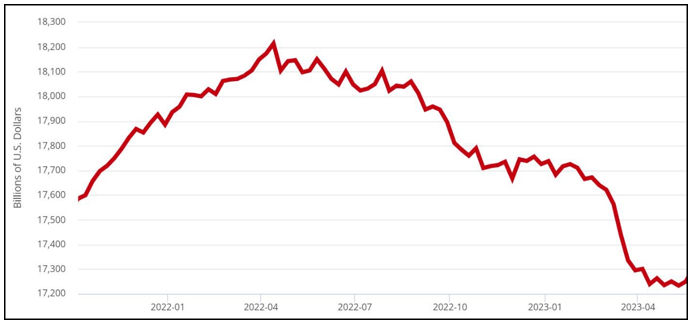

First Big Outflows of U.S. Bank Deposit Since 1930s

Click here to see full-sized image.

For the first time since the national banking crisis in the early 1930s, we’ve witnessed a major outflow of funds from U.S. banks.

In fact, the Fed’s own data reveals that American consumers and businesses have pulled nearly $1 trillion out of their bank accounts.

I’m nearly 77 years old, and I can tell you flatly that I’ve never seen anything like this before in my lifetime.

Who are the culprits?

It’s the likes of Bernanke, Yellen and Powell (cheered on by the likes of Buffett and Dimon).

Why? Because they’re the ones who have presided over the most audacious, most destructive abuse of government power in the history of banking.

They’re the ones who went hog wild printing $8 trillion in unbacked paper dollars.

They’re the ones who pushed interest rates down to zero for multiple years.

And they’re the ones who have thrown the entire banking system out of whack.

To escape this rip-off and potential disaster, there are three steps you can take right now:

Step 1. Check the Weiss Safety Rating of your institution.

For our latest rating on your bank, go to this page.

For our latest rating on your credit union, use this page.

Then, in the search bar at the top of the page, type in your bank name.

(Just be aware that there may be more than one with a similar name. To help identify yours, check the city where it’s located.)

A Weiss Safety Rating of C+, C or C- is a yellow flag — not an immediate danger, but a signal of higher risk in any recession or financial crisis.

A Weiss Safety Rating of D+ or lower is a red flag.

Step 2. For better yield, consider a money market mutual fund. And for better yield with better safety, take a look at money market funds that invest exclusively in short-term U.S. Treasury securities or equivalent.

They’re actually safer than bank deposits because there’s no limit on the government guarantee. And still, they’re paying a lot more than most banks.

Step 3. Evenbetter yields are available in the world of crypto staking, which is now growing like never before.

Staking on the Ethereum (ETH) network, for example, has grown from practically nothing three years ago to about $50.4 billion today.

Stand by for more information on these higher-yield opportunities. And if you haven’t done so already, be sure to check out our Weiss Crypto Daily.

Good luck and God bless!

Martin