|

| By Martin Weiss |

Biden and McCarthy are still locked in battle.

So is every reckless spender and every ruthless budget-cutter in Washington.

But they’ve done absolutely nothing to prevent the looming debt default, now less than three weeks away.

Politicians and economists warn the consequence could be recession.

But they grossly underestimate the true impact of an outright default by this once-great nation.

Not just a decline in the economy. Not just a crash in the markets. But also …

A major trigger event for the end of America.

How big is the risk?

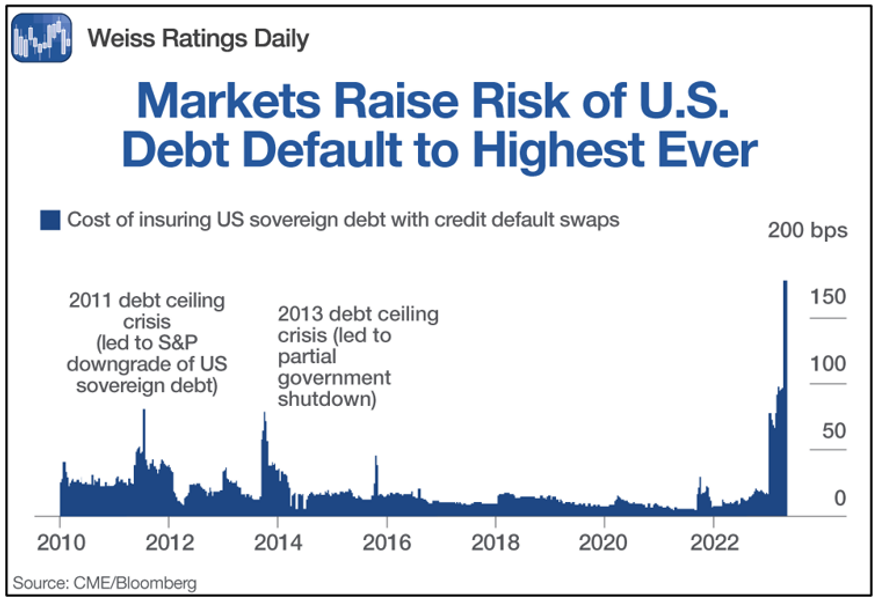

For an answer, consider this chart:

Click here to see full-sized image.

It tracks the cost of insuring U.S. Treasury securities, and it tells a shocking story that began 12 years ago …

The day is Aug. 5, 2011, the place, New York City.

The fiscal crisis in Washington is so bad, Standard & Poor’s decides to announce the first-ever downgrade of U.S. sovereign debt.

The cost of insuring U.S. Treasurys surges to nearly 80 basis points, the highest in history at that time.

On Oct. 1, 2013, it happens again.

The government announces a partial shutdown and the cost of insuring Treasurys surges back to approximately the same peak level as it did in 2011.

But now fast-forward to the present, May 15, 2023, and look at the chart today!

With a great default looming, the cost of insuring Treasurys has now surged to more than double those prior peaks.

The market is now sending the unambiguous message that …

The risk of a U.S. debt default is the highest it’s ever been since the founding of our Republic.

Even during the Civil War, the danger was not nearly as great as it is today.

In Washington, both sides seem to agree it must not happen.

What they don’t tell you is that, in order to prevent it from happening, they will have little choice but to default on most of their other promises …

Their promise to save big banks from failure.

Their promise to stop inflation from wiping away our savings.

And their promises to millions of Americans relying on Social Security or veterans’ benefits.

The primary source of systemic risks today is, ironically, the same source of systemic support that the banking system has increasingly relied on over the decades:

The U.S. government.

That’s right.

The same government that everyone has relied upon for rescues and bailouts is now the greatest source of risk and danger.

The government itself is the primary cause of the big vulnerabilities we face today.

What can you do to defend yourself?

I know of few safe havens where you can both escape the dangers and earn high yields.

For one of the best, watch our just-released conference.

In it, I reveal how I’m earning 18.2% APY on my savings and why nothing will ever be the same!

I will also show you how I’m earning yields that are:

• 2x higher than the highest-yielding bonds.

• 11x higher than stock dividends yields, and

• 56x higher than bank money market rates.

All with little or no market volatility!

Warning: This entire opportunity ends in just a few days.

So, be sure to watch now.

Good luck and God bless!

Martin