|

| By Martin Weiss |

Is your home in danger?

Before you answer that question, consider the facts Weiss Ratings has just shared with dozens of reporters on a nationwide online press conference.

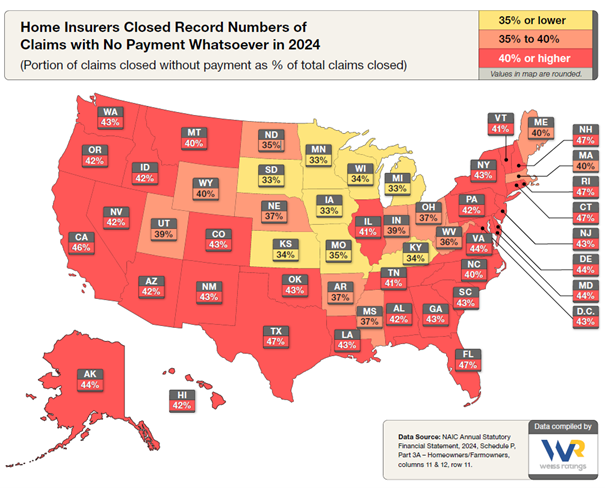

In more than two-thirds of the states across the nation, home insurance companies are closing nearly half of all damage claims with no payment whatsoever to homeowners.

That’s not based on guesswork. It’s the result of a comprehensive study by our Weiss Ratings team based on millions of pieces of indisputable official data on thousands of companies.

You pay exorbitant home insurance premiums. Your home is damaged in a storm. You file a claim. And to your great surprise, you receive a notice “DENIED!”

No payment. Not a single penny! If this happened 10 percent of the time, we might understand. Even 20 percent would be understandable, especially considering that it was pretty close to the norm years ago.

But denying almost half of all claims?! What the heck is really going on here?

If you want the truth, don’t ask insurance executives. When reporters went to them with our report, most lied through their teeth, always blaming people like you.

They say, “You made an error” or “You didn’t meet your deductible” or “You filed a deliberately fraudulent claim.”

Unfortunately, among many insurance executives that’s the image they often have of their own loyal customers. They see customers like us as “a bunch of cheats trying to grab bigger payouts.”

In most cases, the facts prove it’s exactly the opposite, and the most outrageous example is Florida.

After crunching the official data, we discovered that, in 2024, home insurance companies operating in the state flatly denied 47% of claims closed.

And that doesn’t even include claims that were slashed to the bone with no explanation.

In March of 2023, the Washington Post reviewed internal files showing that dozens of Hurricane Ian damage reports by on-site adjusters were subsequently slashed 45% to 97% by “desk reviewers,” typically under the auspices of the insurers.

In one case, a field estimate of nearly $500,000 was reduced to about $13,000.

Two months later, the Miami Herald revealed a smoking gun — side-by-side records showing how the damage estimates of a Venice, Florida homeowner’s damages were cut from $37,258 estimated on site to $2,524 after the desk review.

Adding equally strong telltale data to the record, in September of 2024, CBS’ 60 Minutes interviewed licensed adjusters who said carriers altered their reports to decrease payouts.

One whistleblower adjuster, Jordan Lee, went even further, reporting that, out of 46 Hurricane Ian claims he submitted, 44 were cut back. Only two survived intact.

How did Florida homeowners react? They went to court. They filed lawsuits. And they did so at a rate that was 12 times higher than the average for the rest of the country.

What’s especially surprising is that they did all this despite new Florida laws passed the year before that made it much more difficult for customers to sue their insurance company.

Care to see how often insurance companies operating in your state closed claims without paying a penny?

Take a close look at this map we created for you.

As you can plainly see, this is not about Republicans versus Democrats. It has nothing to do with red states or blue states. Almost the entire country, except some of the northern Midwest states, are in the same soup.

So, clearly Florida residents are not the only ones getting slammed by this crisis of claims denials.

When it comes to filing lawsuits, though, Florida does stand out.

Among Florida homeowners whose claims were closed with zero payment, 12.9% sued their insurance company. That’s crazy high. In fact, it’s 12 times higher than the national average outside of Florida.

But Florida is not the only state where insurers abuse their own customers, blame their own customers and then get legislatures to pass laws to protect them from their own customers’ ire.

In the end, it only makes things worse for both sides.

It’s about time they learn the lesson from insurers who do right for their customers, rarely denying legitimate claims and rarely getting sued.

What to Do

First, if you own your property outright with no mortgage, consider the possibility of self-insuring.

To help protect against risk, just be sure to save all, or nearly all, the money you’d otherwise pay in for insurance premiums.

Even better, set the money aside in a separate account invested in lowest-risk securities and earning good interest.

Second, if you feel you can’t afford the risk of self-insurance, your best defense is to check your company’s recent history of denials before buying or renewing your home insurance policy.

To our knowledge, we’re the only research organization providing the needed information. Just go to this page on our website and look up your company right there.

Third, the particular state where you decide to buy a home can also make a big difference, and Florida stands out as unusually hostile when it comes to property insurance.

Which states are among the least problematic? The frequency of homeowner lawsuits filed against insurance companies can be a reliable indicator, and you can compare the lawsuit activity of nearly all states with this map.

Good luck and God bless!

Martin D. Weiss, PhD

Weiss Ratings Founder

Do you find these facts shocking? Want to dig in deeper? Then, I suggest you check out our recent press release here.