Martin: The Most Dangerous Times of Modern History

|

| By Martin Weiss |

We live in some of the most dangerous times of modern history.

And yet you can count on your fingers the number of leaders — in the business world or in the political sphere — concerned enough to do something about it.

"So, inflation is the worst in 40 years. So what?" they say.

"So, we've had a bad year in the market. Big deal!"

"The Fed will save us. The government will bail us out. Debts will be forgiven."

But you and I know the truth. We know it's a fantasy world financed by funny money and "mana from heaven."

We also know it could be America's pathway to hell.

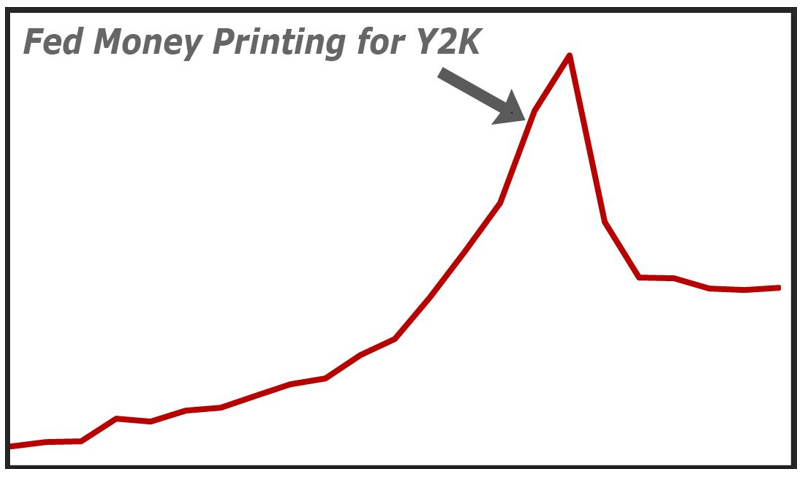

1999

Our story begins in late 1999. It's just before the new millennium, and a strange fear sweeps the nation. It's the Y2K bug, a computer programming glitch that threatens to crash the banking system.

At first, the folks at the Fed think the Y2K scare is a bunch of hogwash. But then, at the last minute, they take a closer look.

And they panic.

"Wow! This is for real," they say. "If we can't fix this fast, it WILL crash the banking system and pretty much everything else. We need to flood the system with liquidity."

And sure enough, for the first time in history, the Fed prints billions of paper dollars to pump liquidity into the banks.

I track a chart that shows precisely how much the Fed is printing.

For years, it's practically flat. But then, it suddenly goes through the roof.

I'm shocked. But what shocks me even more is that there are no protests by Wall Street. No critical editorials in the Journal. No one seems to know.No one cares.

As it turns out, the programmers fix the Y2K bug. The banking system does not crash. And the Fed quietly pulls the money back out of the system.

"Hey! This is way cool," say some young guys at the Fed. "We can actually print money, and no one will give a damn."

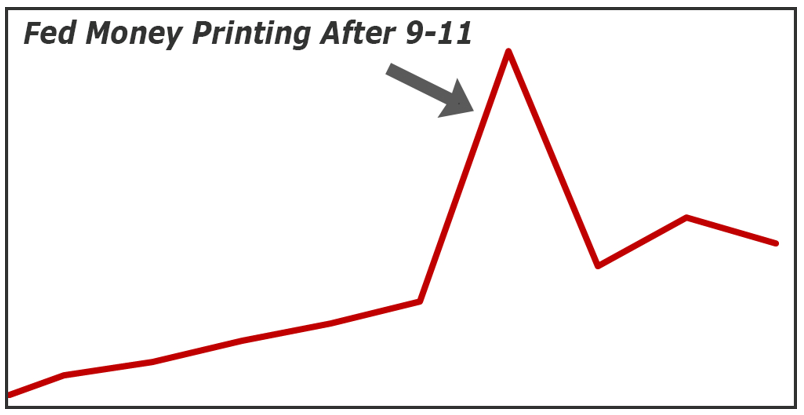

2001

The days go by — eleven days and nine months to be exact. And this time an even greater shock threatens the banking system: 9/11.

The New York Stock Exchange is shut down. Banks are closed.

And behind the scenes, the Fed is in panic mode again, printing money like crazy to flood the system with billions of dollars in liquidity.

Again as soon as things came back to normal, the Fed takes it all back out.

"Wow! This is better than cool," the kids at the Fed say.

"We've got a new weapon. Any time we have an emergency, we just inject this drug into the economic body, make everyone feel good. Then, as soon as the emergency is over, we pull it back out. No one will ever know the difference."

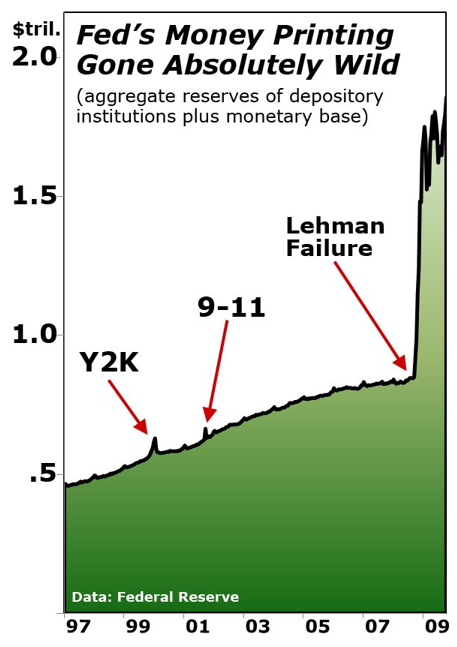

2008

But the next emergency is different, very different.

It's not September 11, 2001! It's September 15, 2008, the day Lehman Brothers fails.

It's not a computer bug with four digits or an air attack by 19 terrorists.

It's ground zero of our financial system, the U.S. market for all kinds of debt instruments and derivatives.

Plus, there are two other critical differences.

This time, the Fed doesn't print billions of dollars. It prints trillions of dollars.

By comparison, the money printing binges for Y2K and Sept. 11 now look like tiny blips on the chart.

And this time, the Fed does not take the money back out.

No! That phase when the Fed just experiments with drugs is over!

Now, the real addiction sets in. Now, the Fed refuses to exit. Now it just continues printing trillions and trillions of dollars. Mega-doses that get bigger and bigger.

2022

Where does that leave us right now?

I'm sad to say that the money addiction is so bad and so widespread, whenever the Fed tries to cut back the dose or even just keep it the same …

The withdrawal pains are immediate.

The economy goes into convulsions.

The stock market plunges.

Fear sweeps the nation.

And the Fed comes under immense pressure to print money at an even faster clip even BEFORE it's able to conquer the inflation. But the Fed has barely begun to tackle inflation.

Put yourself in the shoes of the Fed Chair.

In the past, you might have had some leeway. As long as you stayed within predefined lanes, the economy and the markets could continue to truck along.

No more! Now, you're walking a very narrow tightrope.

If you lean just a bit too far to one side, toward tightening, everything starts to fall apart.

If you pivot back to the other side, rolling the printing presses again, inflation skyrockets.

That's the tightrope we're on today.

It means you need a simple strategy designed to overcome all these threats.

A conservative, low-risk way to beat recession and inflation at the same time.

A simple approach to generating yields that are both high and relatively safe.

How? Watch my presentation now for the details. Tomorrow's the last day.

Good luck and God bless!

Martin