Martin Weiss: 3 Shockers. Hitting Hard.

|

| By Martin Weiss |

Anyone who thought all the so-called “great news” of recent weeks was for real needs to wake up and smell the coffee.

After a few short weeks of make-believe euphoria in the market, the lurking storms are back in full force with three shockers hitting at the same time …

Shocker #1. The market rally was built on hot air.

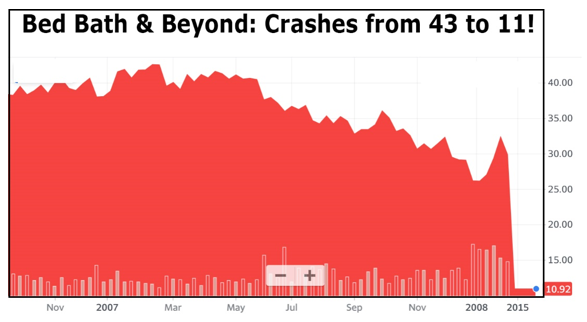

That’s why the wonder child Bed Bath & Beyond (BBBY) has suddenly plunged from 43 in May to below 11 on Friday.

Nearly three-quarters of its value wiped out! Gone!

What about Cineworld? Its shares were crushed by more than 50% on news of bankruptcy.

But it’s not just stocks …

Shocker #2. U.S. existing home sales just sank 5.9% in July to the lowest level in two years.

It wasn’t more than a couple of months ago that anxious homebuyers were mobbing new homes, tripping over each other to bid up the price.

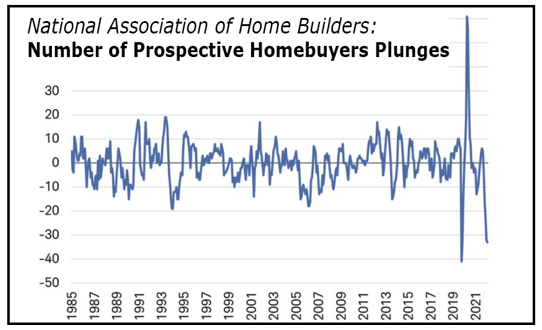

Now, precisely the opposite is happening: Fewer people are showing up for an open house in a half-century!

The National Association of Home Builders adds this supporting factoid: The number of prospective homebuyers has suddenly plunged by 33%.

What about the glowing job numbers that helped spark the latest market rally in the first place?

Bah! That leads me to …

Shocker #3. Among the 528,000 “new jobs” announced for July, it looks like as many as 309,000 could have been bogus, created out of thin air by a defective “birth/death model” used by the Bureau of Labor Statistics.

Meanwhile, a new survey from consultancy PwC shows that …

• 50% of U.S. companies are planning to reduce overall head count.

• Another 46% said they’re dropping or reducing signing bonuses.

• Plus, 44% are rescinding offers.

And all this BEFORE the Fed’s next rate hike?!

I want our members to be ready for this, especially those planning for retirement.

So, this coming Tuesday at 2 p.m., I’ll be giving a special investment tutorial to Weiss Members, and you are invited.

Click here to reserve your seat.

Just bear in mind that TODAY is the last day to do so.

You will learn …

• Precisely how to select, on your own, the 10 extreme, highest-quality investments in the world today.

• Precisely how to get an early signal when the market is turning down for real.

• How to use our ultimate all-weather strategy that could have beat the S&P 500 by 4.9 to one over the years.

That means …

For every $100,000 S&P 500 investors could have made over the years, we’d be talking about $490,000.

And for every million dollars they could have made, we’d be talking about $4.9 million.

Big difference!

To learn how, be sure to claim your free ticket now.

I will promptly send you a confirmation email with instructions for attending.

Good luck and God bless!

Martin