|

| By Martin Weiss |

We stand at a turning point in history like none other, a time for deep thought and quick action.

Consider the last time inflation raged out of control in America — when Paul Volcker was Chairman of the Federal Reserve.

In one fell swoop, he raised the discount rate by a full percentage point.

He slapped banks with strict reserve requirements.

And most shockingly, he made a dramatic change in the Fed’s entire approach to money: Instead of controlling the price of money (interest rates), he decided to focus on controlling the supply of money.

He decided to let interest rates fluctuate freely, driven almost entirely by the natural market forces of supply and demand.

That day was Oct. 6, 1979. And on that day, the Fed Funds rate was 11.61%.

Six months later, on April 3, 1980, it was 19.96%, the highest in U.S. history at that time.

But it still was NOT enough to tame inflation.

The economy sank in the first half of 1980. So, the Fed allowed rates to fall back somewhat. And inflation began to return.

So, Volcker went to battle AGAIN!

Care to guess how high he let the Fed funds rate go on this second round?

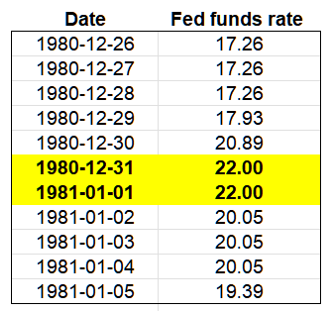

Some people say it peaked at 20%.

But they’re wrong.

The truth, buried in an obscure Federal Reserve spreadsheet, is that on Dec. 31, 1980, the Fed funds rate reached a peak of 22.00%.

THAT’S what it took to break the back of inflation and pave the way for two decades of growth.

THAT’S what it took to launch decades of price stability.

And THAT’s also what it would take — if not more — to achieve a similar result today.

But right now, regardless of any “tough talk” at Jackson Hole this weekend … and regardless of any incremental rate hikes in the works …

Powell is doing little more than spitting against the wind.

Again, just look at the stark facts:

At U.S. banks, the average one-year CD rate is a piddly 0.63%.

The Fed funds rate is a meager 2.33%.

And even if you lock up your money for 30 years, the most you can make on a Treasury bond is 3.32%.

That’s crazy.

The Consumer Price Index has surged 8.5% in the past year. So, even your so-called “good” yields are wiped out by inflation!

Several times over.

And the folks at the Fed still dare say they’re “fighting inflation”?!

Does Fed Chair Powell have power — or even the guts — to wage an inflation war that might make a difference, that would make Volcker proud?

Is it even possible?

Before you answer, listen carefully to my …

Tale of Three Bubbles

In the last four decades, things have changed.

A lot!

Set aside the fact that our country is fighting a domestic political war, a domestic cultural war and a global economic war.

Set aside the fact that Russia has almost destroyed half of Ukraine or that China may be on the verge of attacking Taiwan.

Focus instead on the three giant financial bubbles that have emerged since 1980.

The Government Debt Bubble

Many Americans don’t just take debt for granted.

They abuse it.

And they’re continually cajoled by authorities to abuse it still more.

People who default on their credit cards are soon besieged with new credit card offers.

People who fail to pay their debts are rewarded with debt forgiveness.

And those who work hard to pay every penny — or worse, avoid debt to begin with? They’re either ignored or even shut out of credit markets. So …

Who’s the worst debt offender of all?

None other than the U.S. government itself.

The U.S. government now owes $30.5 trillion to the public and much more if you include money it owes to the Federal Reserve.

Back in late 1979, when Volcker was waging war against inflation, the government owed only $863 billion.

Even if you take into account the growth of the economy, the numbers today are horrendous.

Back in 1979, for every dollar of GDP, the government had just 32 cents in debt. That was reasonable.

Now, for every dollar of GDP, it has $1.27 in debt. That’s downright dangerous.

Or think of it this way:

In the Volcker days, whenever the government’s cost to service its debt rose by one percentage point, the bill was an extra $8.5 billion per year.

Now, in Powell’s time, with each percentage point increase, they pay an extra $305.7 billion per year.

That’s 36 times more!

A sordid truth no one in the White House wants to talk about … and no one at the Fed wants to even think about!

But they’re vividly aware that higher interest rates could gut the federal budget.

Over the next 30 years, interest on the debt alone is projected to cost around $66 trillion, becoming the government’s single largest spending “program.”

Imagine what that number will look like with much higher interest rates!

Does Powell have the guts to forever be blamed for that kind of disaster?

The Stock Valuation Bubble

If Powell thinks the ire of future generations is scary, what about the immediate fury of investors for busting a stock valuation bubble?

How do we know it’s a bubble?

Well, the Warren Buffett Indicator, comparing market cap to GDP, says so with no ifs, ands or buts.

We like to measure the Buffett Indicator with the broadest total stock market index — the Wilshire 5000 Index.

In late 1979, when Volcker launched his first big battle against inflation, it was clearly NOT overvalued.

For every dollar of GDP, the Wilshire 5000 had a market cap of just 39 cents.

Today, as Powell tries to get his battle against inflation off the ground, for each dollar of GDP, the Wilshire 5000 is valued at $1.67.

In other words …

Back in Volcker’s day, the stock market was valued at less than four-tenths the economy. Now it’s valued at nearly 1.7 times the size of the economy.

Relative to GDP, that means the stock market is valued 4.3x higher than it was last time inflation was a major threat.

Big difference! But if you think that’s extreme, take a look at …

The Fed’s Own Giant Bubble

When Volcker was Fed Chair, there was virtually no such thing as Fed money printing …

No such thing as a Fed balance sheet …

And certainly nothing remotely close to the bloated balance sheet it has today.

In fact, the Fed’s balance sheet was so tiny in Volcker’s day, they didn’t even keep track of the amount.

Today, the balance sheet is stuffed with nearly $9 trillion in notes, bonds and other debt instruments, mostly paying low, fixed yields.

What happens to those notes, bonds and other balance sheet assets when the Fed jacks up market interest rates?

The same thing that happens to any investor’s notes and bonds when rates surge: Their market value plunges.

That’s right.

Every time Powell raises rates, he shoots himself in the foot. He guts the value of the Fed’s own portfolio.

My Message to Powell

In early 2009, shortly after the Fed first began printing money with wild abandon, I met former Fed Chair Paul Volcker at a conference in Washington and we chatted privately for a short while.

I asked him what he thought about the Fed’s money printing.

He made a strenuous effort not to overtly criticize his successors, but he did volunteer to say this:

“Mr. Weiss, in all my wildest dreams, I never would have believed our government would do anything remotely similar to what they’re doing now.”

Today, my questions to Fed Chair Powell would be very different …

Are you ready to doom the federal government to massive interest costs?

Do you really want to risk sending Wall Street to hell in a handbasket?

Are you willing to gut the Fed’s own balance sheet?

If so, I believe you might eventually be able to win the war against inflation.

If not, don’t tell us you’re serious about fighting it.

Don’t even waste your breath.

An Investor’s Only Escape

Albert Einstein once reportedly said the most powerful financial force in the universe is compound interest.

I humbly disagree.

The most powerful financial force in the universe is actually compound INFLATION.

Inflation that has metastasized and is spreading uncontrollably!

Inflation that destroys the retirement of millions of hard-working people!

Inflation that no government has ever been able to purge from the economic body without shock therapy!

Inflation that is now PUBLIC ENEMY NUMBER ONE in America!

My solution for investors is very simple:

Not just compound interest.

Not just typical stock market returns.

But the potential to generate massive compound returns by owning the ten most powerful investments in the world today.

To learn more, watch my tutorial.

In it, I lift the veil on a portfolio model that could have outperformed Warren Buffett’s Berkshire Hathaway by 5.3 times.

Instead of turning $10,000 into $59,533, that would mean turning those same $10,000 into $273,496.

In my tutorial, you will learn …

• Precisely how investors could have beat Buffett 5.3 to one.

• How to select the highest-quality investments in the world today.

• Six easy steps to build a firewall around your portfolio.

• Two early warning signals of major market declines.

• 23 large-cap stocks with the best Weiss Ratings.

And those are just SOME of the highlights.

To watch now, go here.

Good luck and God bless!

Martin