|

| By Chris Graebe |

I often crisscross the country in my ongoing hunt for the best startup deals.

All this effort isn’t just for a few casual conversations.

This is where the real work happens.

Behind the scenes, in the early stages, before the headlines hit.

And as I do this due diligence, I constantly ask one question:

“What’s the signal I might be missing?”

Some of the best investments I’ve ever seen didn’t shout for attention.

Rather, their indicators were quieter. Subtle, strategic signals that most casual investors wouldn’t even notice.

So, I want to break down three “green flags” I like to look for when vetting startups.

Ones that often make the difference between a decent return and a generational one.

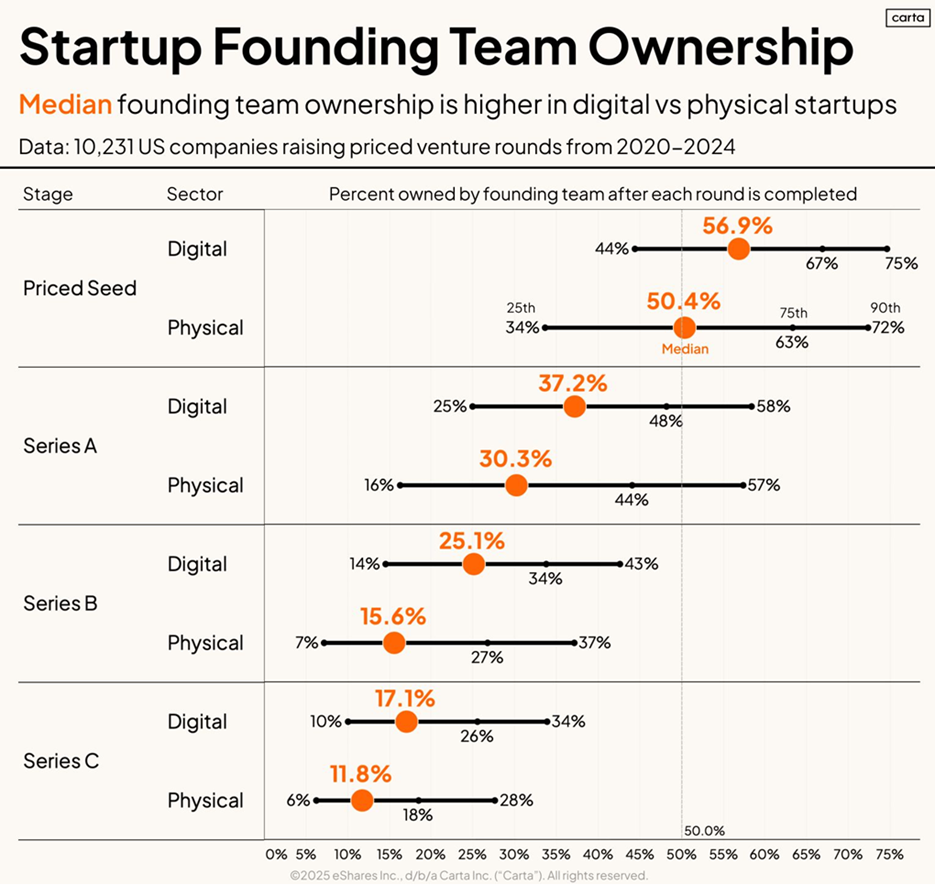

Green Flag 1: The Founder Still Owns a Big Chunk

This is more than just “skin in the game.”

I like to see a founder who still owns 50% or more of the company after raising significant capital ($5 million to $30 million).

That reveals a few key strengths, such as …

- They raised money the smart way, not necessarily the fast way.

- The founder was able to protect their vision from early dilution.

- And they’re still hungry because their financial upside is very real.

Too many early stage companies have cap tables (which show their ownership structure) where the founders already look like minor shareholders.

That’s not a bet I want to make.

If the upside for them isn’t that exciting, they more than likely won’t strive to deliver life-changing returns to investors they attract during their crowdfunding round(s).

Green Flag 2: Quiet Traction, No Flashy Funnels

A startup with 100,000 followers on social media and no revenue?

I’m probably going to pass on that.

A company that’s quietly doing $500,000 or more in annual sales with zero ad spend? Now you’re talking!

Because organic traction — word-of-mouth, inbound growth, product-led referrals, etc. — is a huge green flag.

It signals the company has found a solid product-market fit, enjoyed some efficient growth and earned customer love.

Think of it this way …

If they can scale without paid marketing, imagine what happens when they do start spending.

Green Flag 3: Smart Money, Early & Quiet

Not all capital is equal.

When I see a founder has raised a big chunk of capital from a big batch of small checks, I pay attention.

That signals a group of high-conviction early stage investors is on board.

Especially if those small checks come from funds or syndicates with a history of spotting breakout companies.

To be clear, I don’t look for the big names.

Rather, I want to see the consistent winners.

The ones who got in early on companies like Stripe, Figma or Rippling before anyone knew the name.

If those folks are writing checks early again? That’s a signal worth watching.

The Payoff

This is the kind of lens I use when searching for potential Deal Hunter’s Alliance deals.

In my cross-country scouting, I dig into all three of these signals and more.

I recently went on such a trip. And I found exactly what I was looking for!

A little-known company is about to disrupt one of the most lucrative industries on earth.

Successful deals in this sector offered returns as high as 900% … 19,942%, 53,423% and more.

But as you might suspect, when I decide to let the cat out of the bag on what it is, the deal can fill up fast. In as little as seven hours!

So, make sure you clear your schedule for 2 p.m. Eastern on July 22.

That’s when I will host the Summer 2025 Private Investment Summit, exclusively for Weiss VIP Members.

As a subscriber to Weiss Ratings Daily, you can grab your spot now.

I hope to see you there.

Happy hunting!

Chris Graebe