My AI Prediction Yielded 90% Gains — With More Ahead

|

| By Michael A. Robinson |

If you doubted the advice I gave you a little over a year ago regarding Oracle (ORCL), I can understand why.

After all, Wall Street lost faith in the firm, thinking it was falling behind in the AI arms race.

But I said just the opposite was true — the company was in turnaround mode and would have a big AI payoff.

I was right, and the Street was dead wrong.

But you might not have known it at the time.

Here’s the thing. The stock sold off and went down more than 20% over the next few months.

But it then staged a comeback that is nothing short of amazing for a mega-cap tech leader.

From its recent low on April 21, the stock has roared back by more than 150%.

So, since the time I talked to you about this AI-driven comeback, the stock is now up more than 90%.

Let me show you why there’s still plenty of upside ahead …

Beating Wall Street to the Punch

Months before the Wall Street Journal or Investor’s Business Daily even noticed, I told you Oracle was a hidden AI play.

The financial press was still labeling Oracle an “also-ran” database company. Analysts dismissed it as a laggard in cloud computing.

But I saw something different.

I told you Oracle was reinventing itself. I said the firm’s pivot to cloud infrastructure would become a springboard for AI contracts.

And I told you that its Digital Assistant platform, combined with deep experience in enterprise software, would position it perfectly for the AI Supercycle.

That call turned out to be dead on the money. We had that chat back on Sept. 13, 2024.

I like to think of the stock’s results since then as a great one-year “anniversary gift” to you readers.

See, while the so-called experts were asleep at the switch, Oracle was quietly lining up some of the biggest deals in tech history.

The Big Breakout

Oracle recently dropped a bombshell that stunned Wall Street.

Shares jumped 36% in a single session — the biggest one-day surge in more than three decades.

Trading volume was eight times the average, proof that the smart money got the memo.

Here’s what fueled the moonshot: Oracle said its sales backlog had swelled to $455 billion.

That’s more than four times larger than it was a year ago.

Current CEO Safra Catz said the firm had signed four multibillion-dollar contracts with three different clients — all in a single quarter.

The crown jewel? OpenAI, the company that kicked off the AI arms race with ChatGPT, agreed to buy $300 billion worth of Oracle’s cloud computing power over the next five years.

That one deal alone will consume more electricity than four million homes use in a year.

This is all part of “Stargate,” the $500 billion project to build America’s AI backbone.

And Oracle, led by founder Larry Ellison and incoming CEOs Clay Magouyrk and Mike Sicilia (Catz announced she will move to the Executive Vice Chair of the Board role this week), is playing a central role.

More Than a Database Company

This isn’t the boring database outfit from the 1990s.

Oracle has become a lean, high-powered AI and cloud infrastructure leader.

Remember: Oracle Cloud Infrastructure (OCI) isn’t just another platform.

It’s been built from the ground up to provide the kind of scale and efficiency that AI workloads demand.

That’s why Microsoft, Google and Amazon are now working with Oracle.

It’s no longer a question of whether the firm can compete in the cloud. The question now is how big its AI contracts can get.

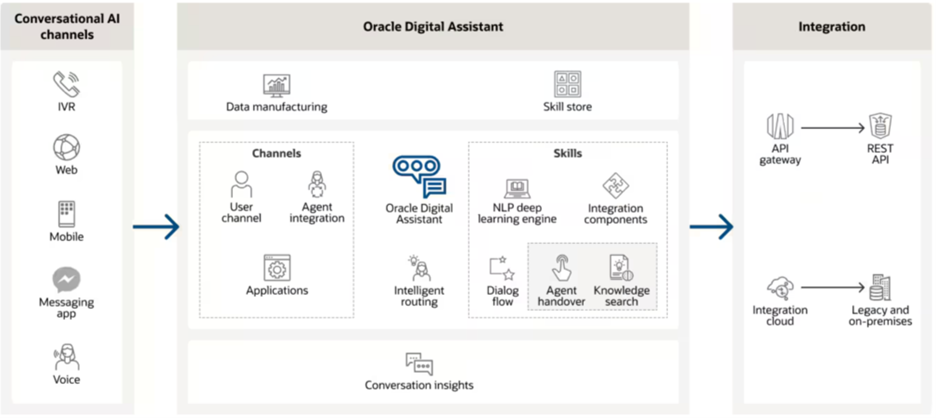

And don’t forget Oracle’s Digital Assistant platform.

This is its end-user play in conversational AI, a field expected to double every three years through the end of the decade.

From Siri and Alexa to bots booking trips and restaurant tables, digital assistants need reliable AI power. Oracle is providing exactly that.

The company’s platform has a few key features.

For example, it patented deep learning algorithms that understand a user’s natural conversation.

It can also derive intent and context … and build memory from user behaviors.

Why the Backlog Matters

But let’s step back for a moment. Why does a $455 billion backlog matter so much?

Because these contracts represent locked-in sales.

They aren’t vague promises or hype.

They’re booked orders that will roll off into sales quarter by quarter, year by year.

In other words, much of Oracle’s future growth is already baked in.

This is crucial for a mega-cap leader.

Unlike smaller firms that rely on uncertain pipelines, the firm can now forecast years of growth with a clear vision.

Investors love that kind of visibility.

It’s why the stock can move 30% in a day — and still have room to run.

The Bottom Line

I told you nearly a year ago to the day that Oracle was no laggard.

I said it was a turnaround story with a massive AI payoff ahead.

Wall Street doubted me. The press ignored it.

Now, after a historic one-day surge and a $455 billion backlog, the truth is clear.

Oracle isn’t just surviving in the AI era — it’s thriving.

This backlog will flow straight to the bottom line. These sales are locked in.

And as they’re recognized over time, Oracle’s earnings power will become even more robust.

That means the rally we’ve already seen — more than 90% since my call — is likely just the beginning.

Because with Oracle at the center of the AI Supercycle, the upside is still enormous.

Stay the course.

Best,

Michael A. Robinson

P.S. Of course, Oracle is only part of the AI Supercycle. Another is the massive build-out in communication and data transfer tech.

For that, we’re already seeing record numbers of satellite launches every year.

Now, a group of small companies are getting in on this boom. Watch the replay of this week’s Weiss Tech Investment Summit to see which ones I recommend you own.