Negative Investor Sentiment Is a Buying Opportunity

|

| By Tony Sagami |

The stock market is off to a rocky start this year … but one group of investors is not only unconcerned, but they’re also buying stocks like there’s no tomorrow.

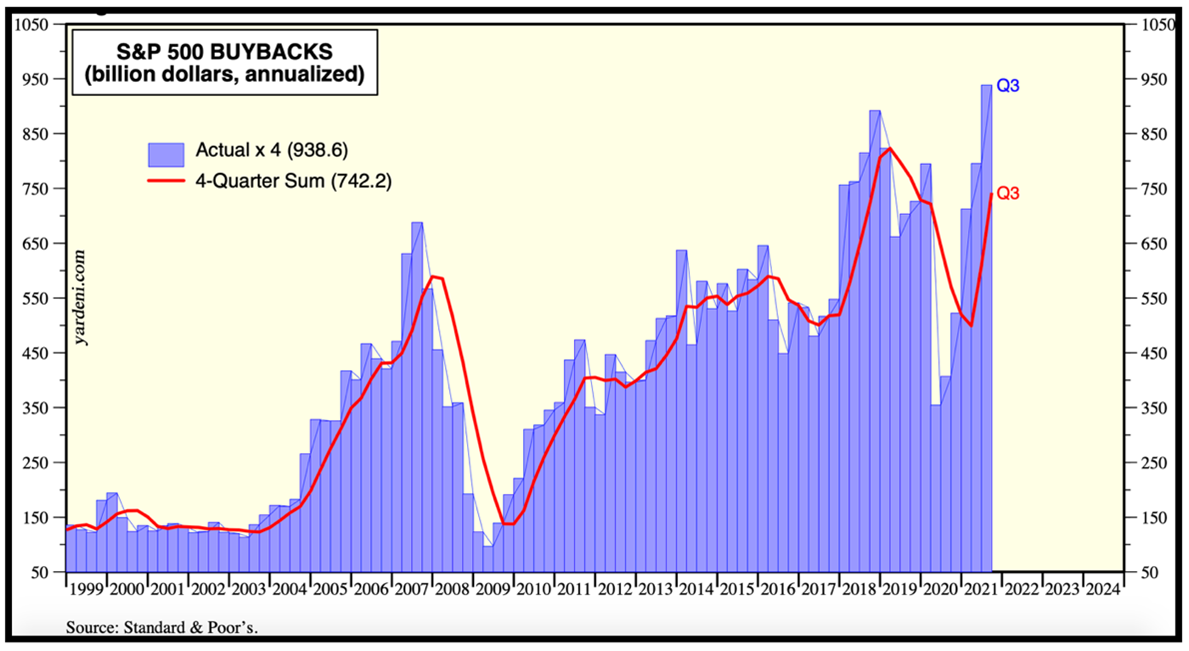

I’m talking about American corporations that are buying back their own shares at a furious, record pace.

Last year, American companies spent a record $870 billion on stock buybacks, which crushed the previous all-time record set in 2018 — when companies took advantage of new tax laws, allowing tax-free repatriation of funds from overseas.

That buyback pace is accelerating.

In the fourth quarter of last year, the 500 companies that make up the S&P 500 firms bought back an estimated $265 billion of stock, another all-time high for 90 days.

So far this year, 10 companies — led by Apple (AAPL), Meta Platforms (FB) and Alphabet (GOOGL) — spent $86 billion to buy back their own stock so far this year.

That’s 30% more than last year.

Lots of other companies are jumping on the buyback trains, including:

- Cisco Systems (CSCO): $15 billion

- Walmart (WMT): $10 billion

- Exxon Mobil (XOM): $10 billion

- Twitter (TWTR): $4 billion

These buybacks are not only good for those companies’ shareholders, but they’re also good for the overall stock market.

Why?

Buybacks are an important support feature for the stock market because they reduce the number of outstanding shares and help goose earnings per share (EPS).

Think of it like a smaller pizza with the same amount of cheese! A company that reduces its share count is now less expensive per dollar of earnings than it was prior to the repurchase … even if there is no change in earnings.

401(k) & IRA Influx

Corporate insiders aren’t the only ones buying billions of dollars’ worth of stock these days.

Another big source is 401(k) and IRA dollars.

I’m talking about target date mutual funds, a wildly popular retirement savings vehicle.

- Target date funds — aka “life-cycle” funds — automatically allocate a diversified mix of equities, bonds and cash that rebalances as you get closer to retirement.

You pick a fund that matches your preferred retirement year, and your money is put into an appropriate mix of different assets based on your timeline.

- In 2021, Americans threw $24 billion into target date funds, bringing the total to over $3 trillion.

That’s a lot of moolah!

That’s not the only thing getting stuffed with big bucks. In Dr. Martin Weiss’ Weekend Windfalls service, subscribers are seeing consistent, weekly payouts when they need them most. If you’d like more information, click here now.

Target date funds are one type of passively managed products, including index funds like the S&P 500 or Russell 2000.

Passively managed funds don’t care about valuations or how long a bull market has lasted — when $$$ comes in, they blindly buy stocks no matter valuation or economic news of the day.

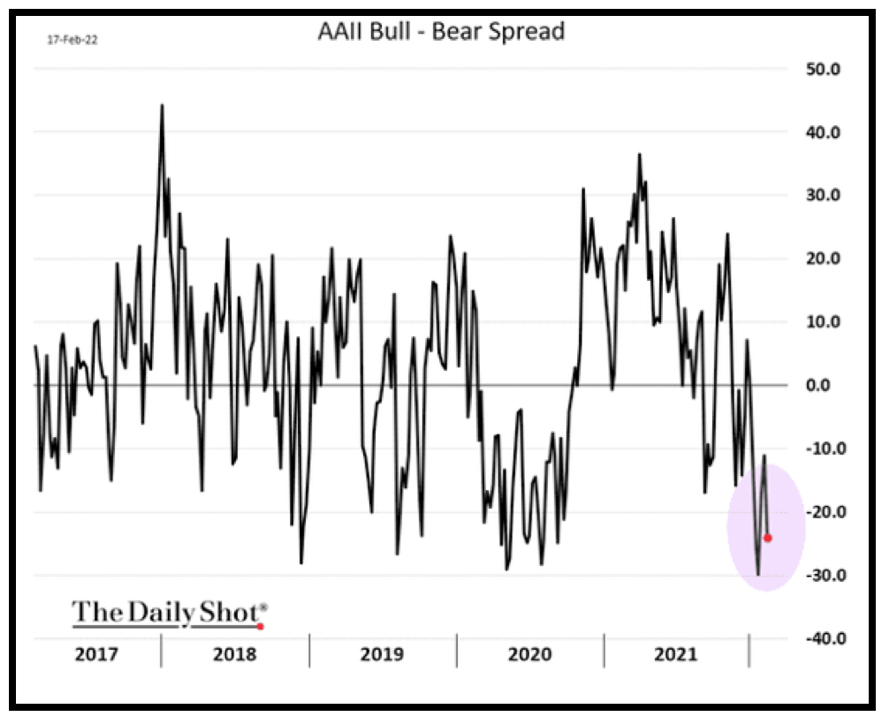

The last reason I don’t expect a full-blown bear market is that investor sentiment is extremely negative.

Simply put, investors are scared.

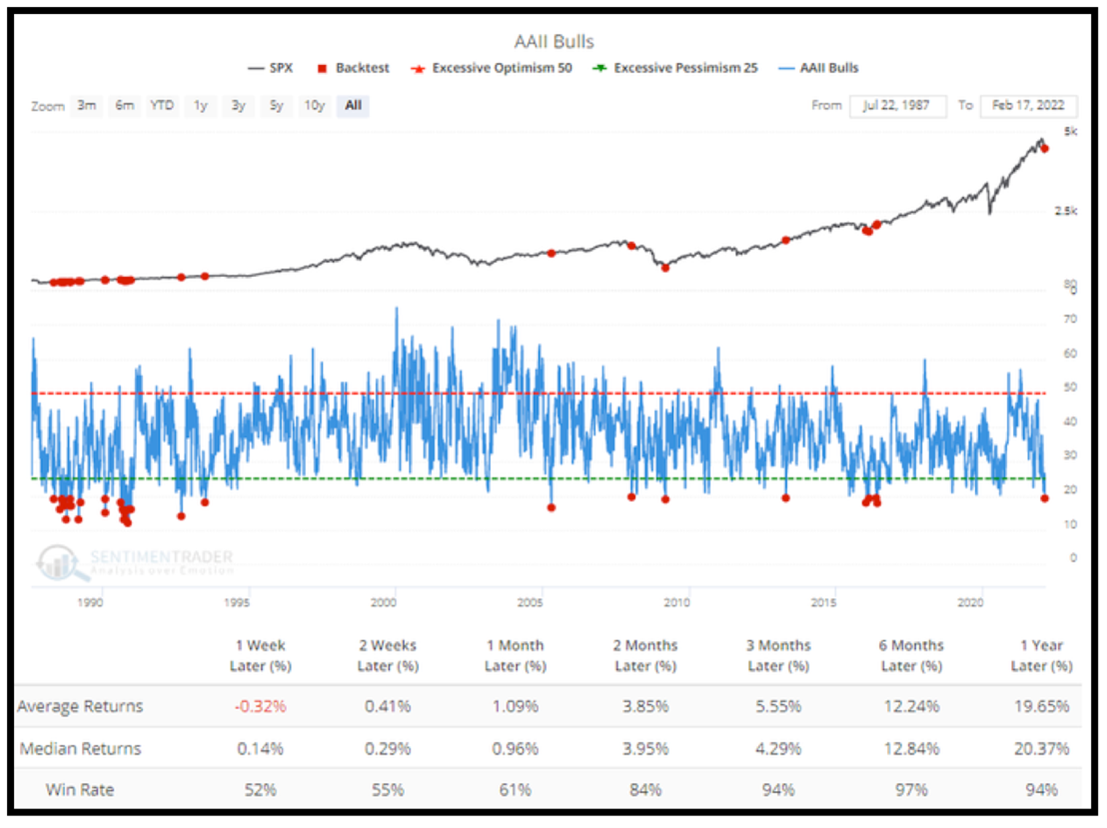

The American Association of Independent Investors (AAII) sentiment survey shows less than 20% of investors are bullish, an extremely negative outlook and one that has historically been an excellent buying opportunity.

There have been 31 weeks when fewer than 20% of AAII respondents were bullish … and after 29 or 94% of them, the S&P 500 was up higher by an average of 4.3% over the next three months.

All these factors certainly don’t guarantee that the stock market is going to explode higher ... but it tells me that the downside is limited.

Bottom line: Now is the time to be a buyer, not a seller.

Best wishes,

Tony