|

“Gas prices at the pump are up. We’re working to bring them down, but they’re up.” — President Joe Biden, Feb. 4, 2022 |

|

I was pretty cool in high school.

At least I thought I was.

I was class president, captain of the basketball team, dated the prettiest girl in school … and drove a bright red 1968 Camaro SS with a 396-cubic inch engine.

But when the OPEC oil embargo arrived in 1973, my eight miles per gallon Camaro spent more time parked in my father’s barn than driving on the highway.

That car was fast (and pretty), but boy did it guzzle gas.

The price of gas jumped from 29 cents to 55 cents a gallon in 1973, and I couldn’t afford to drive it more than a couple times a week.

I even rode a bicycle to school so I could pay for the Saturday night joyrides around the strip.

A lot of Americans are feeling a similar transportation pinch these days.

- The price for a barrel of oil hit $90, pushing gasoline prices to a seven-year high.

The national average for a gallon of gas is around $3.50 a gallon, but the premium gas needed to power some cars — like gas-guzzling SUVs — is over $5 a gallon in some cities.

Ouch!

To alleviate those high prices, the White House tapped our Strategic Petroleum Reserves (SPR) in December.

Unfortunately, that didn’t have the intended affect and now our reserves are dangerously low by historical standards.

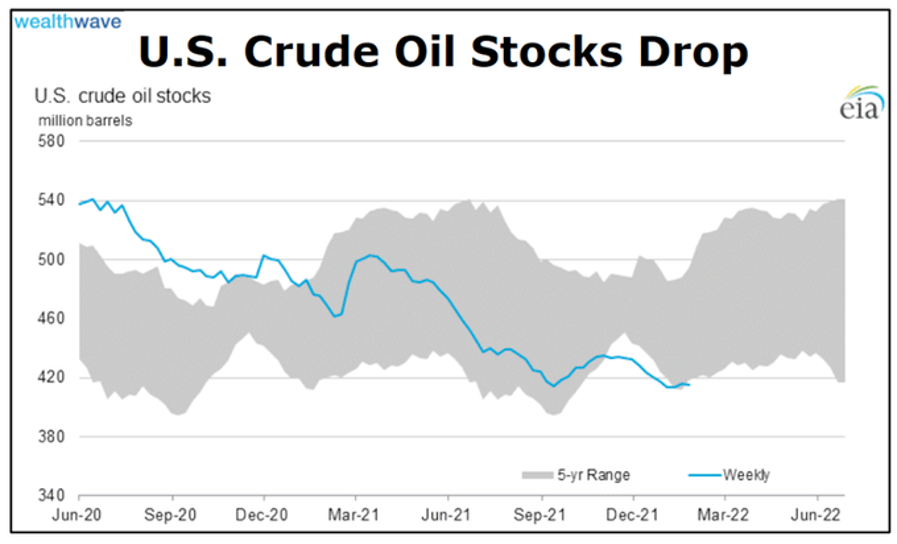

U.S. crude oil stockpiles are currently 9% BELOW the five-year average range.

Morgan Stanley (MS) estimates that global crude oil inventories shrunk by 690 million barrels in 2021 and are also now at a five-year low.

If oil prices are jumping while the White House is emptying the Strategic Petroleum Reserves ...

- What's going to happen when the White House is forced to refill the SPRs?

Instead of complaining about the high cost of gas, you become an energy investor and profit from those rising prices.

Energy stocks have been the best performing sector for the last two weeks in a row and are headed even higher.

Last week, my Stock Options Hotline subscribers banked a 340% gain on Exxon Mobil (XOM) call options that they owned for just two weeks.

Better yet, I expect a repeat of that type of triple-digit gains.

Options aren’t for everyone, and they involve a high degree of risk.

If you’re more of an exchange-traded fund (ETF) or individual stock investor, I strongly recommend that you take a look at my friend Sean Brodrick’s Wealth Megatrends service.

He has absolutely nailed the energy boom and made his subscribers a bundle.

In October, Sean recommended the iShares U.S. Energy ETF (IYE), which is up by 26% since then. That’s compared to a 3% gain in the S&P 500 over the same time frame.

If I followed Sean’s advice in the ‘70s, I would have had plenty of money to fill up that gas-guzzling Camaro SS of mine.

Best wishes,

Tony Sagami