One Ticker to Profit from NATO’s New Spending Surge

|

| By Michael A. Robinson |

He’s not on Wall Street …

He’s not in Silicon Valley …

For that matter, he’s not even in the U.S.

But over in Europe, the former Dutch prime minister has become one of the Trump administration’s most powerful allies — and one that savvy investors would do well to study closely …

Because he can connect you to profitable investment opportunities.

Let me explain …

Last month, Mark Rutte — who’s now Secretary General of NATO — went viral for a comment he made during a summit meeting.

Well, it was less a comment than one specific word.

President Trump had likened Israel and Iran to two kids in a schoolyard that had a fight. He even included some profane language in his description.

That’s when Rutte interjected, “Daddy has to sometimes use strong language to get them to stop.”

Whatever you think of his humor, it’s hard to argue with his strategy.

In a single moment, Rutte showed how to get things done with Trump: flattery, timing and theatrics.

Behind that one-liner lies a market-crushing investment idea …

Let’s Make a Deal

Rutte may not be known as a comedian. But he should be known for the deal he recently brokered.

As a result of Rutte’s negotiating skills, NATO members agreed on a landmark pledge:

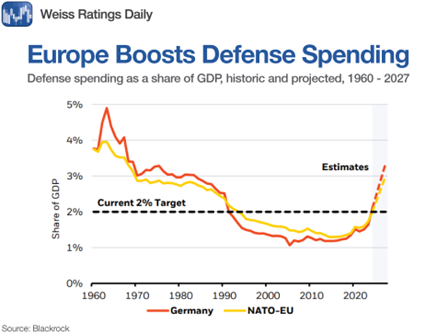

By 2035, member countries will raise spending related to defense and security to 5% of their GDPs.

This 5% will be split into 3.5% for core defense systems and 1.5% for broader security measures like cybersecurity and logistics.

This pledge is important for two main reasons:

- First, it doubles the previous benchmark of spending (which was around 2% of the GDP).

- And second, it balances U.S. pressure for allies to step up.

Trump often expressed frustration that European countries weren’t paying nearly enough to protect their own continent.

But this is a big step in the right direction.

In fact, Rutte described the deal as a “quantum leap” for collective defense. It was also a major diplomatic score at his first NATO summit.

So, over the next decade, defense spending will ramp up — a great sign for the sector as a whole.

Of course, we don’t want to wait 10 years before investing in this industry.

We want to get in now, on the ground floor …

Because that’s when our profit potential is the greatest.

So, how do we do that?

A Europe-Wide Defense Investment

In a case like this, I believe it pays to cover as much of the Europe-centric defense market as we can in one bold move.

That’s why I’m focused on the Select STOXX Europe Aerospace & Defense ETF (EUAD).

Launched last October, it’s an ETF that tracks the Europe Total Market Aerospace & Defense Index (STOXX).

EUAD invests 80% of its assets into Europe-based firms that bring in at least half of their sales revenues from aerospace and defense.

Make no mistake. The stocks inside EUAD have been handpicked for their great operations and profit potential.

That’s why the fund only holds about a dozen stocks, weighted by market cap.

A Roster of Defense Dominators

Simply stated, these are great firms who play dominant roles in Europe’s defense and aviation sectors.

Take a look:

Airbus (EADSY) is a leading global aerospace company that designs, manufactures and sells commercial aircraft, helicopters, military transports, satellites and related systems.

It's one of the two main players in the global commercial aircraft industry, alongside Boeing and is riding a 20-year aviation boom.

Safran (SAFRY), based in Paris, is a major French multinational company that designs and manufactures high-technology products for the aerospace, defense and security sectors.

It's particularly well-known for its aircraft engines and avionics systems, and it's a key supplier to both Airbus and Boeing.

Rolls-Royce (RYCEY) is better known for its luxury cars. But this is a top-tier global supplier to the aerospace and defense sectors.

It has contracts with the U.S. DoD along with such nations as Australia, Great Britain and India.

It also supplies jet engines to Airbus, Boeing and several airlines.

BAE Systems (BAESY) ranks as one of the world's largest defense, security and aerospace leaders.

Based in the United Kingdom, it plays a vital role in supplying military equipment, advanced electronics and cyber solutions to armed forces around the world — particularly in the UK, U.S., Saudi Arabia and Australia.

Rheinmetall AG (RNMBY) is a major German defense and auto tech firm and has a growing global presence.

It is one of Europe’s most important arms makers. It plays a central role in upgrading land forces, producing advanced weaponry, armored vehicles, ammunition and more.

It also makes sensors, fire control systems and anti-drone defense tech.

As you can probably tell from their ticker symbols, these companies trade over the counter here in the U.S.

Some don’t have a lot of trading volume. That isn’t a problem with EUAD, which trades on the licensed (and therefore SEC-regulated) BATS Exchange.

But the main reason I prefer the ETF over its individual holdings is because it’s …

A Rare Opportunity

I also really like the fact that this is a pretty new fund.

That gives us a rare opportunity to get in early — before Wall Street wakes up to the great long-term value here.

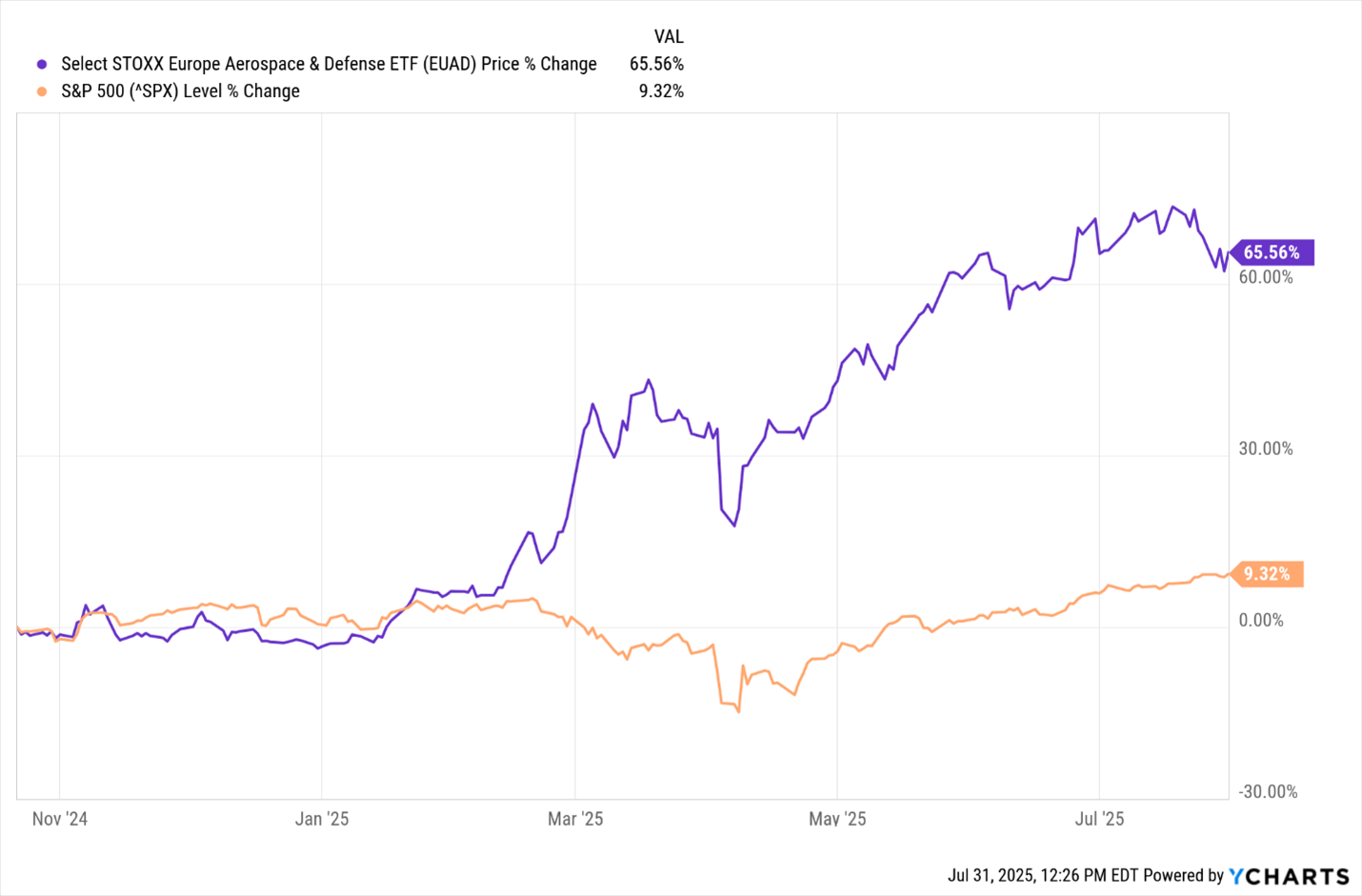

EUAD is already crushing the market.

Since it launched, it’s up 65.6% in less than a year.

Meanwhile the S&P 500 is only up 9.3%:

But don’t worry. I still see plenty more upside.

After all, this is a whole new paradigm that will require years of spending to get NATO to its new defense goals.

In other words, this is a great investment for our favorite time horizon … the long haul.

Best,

Michael A. Robinson

P.S. Europe may be a hotspot for defense investing right now, but America is having its own tech boom.

I recently put together a report on “The #1 ‘America First’ Stock.”

It’s a leader in an industry Forbes calls “a $24 trillion opportunity for investors.”